It’s essential for a bookkeeper, accountant, or business owner who is managing their own finances to understand how to use accounting tools such as QuickBooks Online (QBO).

This article is a step-by-step guide on how to reconcile credit cards in QuickBooks online so that you can ensure your credit card statements match the activity inside the platform. It also explores why an expense management software that integrates with QBO is essential for businesses today.

What is Quickbooks Credit Card Reconciliation?

QuickBooks credit card reconciliation is the process of matching the transactions in your QuickBooks credit card account to the transactions in your credit card statement. This ensures that your QuickBooks records are accurate and up-to-date.

The process helps you identify any discrepancies that may have occurred and ensures that your financial records are accurate and up-to-date.

How to Reconcile Credit Cards in Quickbooks Online?

Reconciling card expenses in QuickBooks Online is a straightforward process that allows you to cross-verify your financial records and ensure accurate financial reporting. Here are the steps you’ll need to follow:

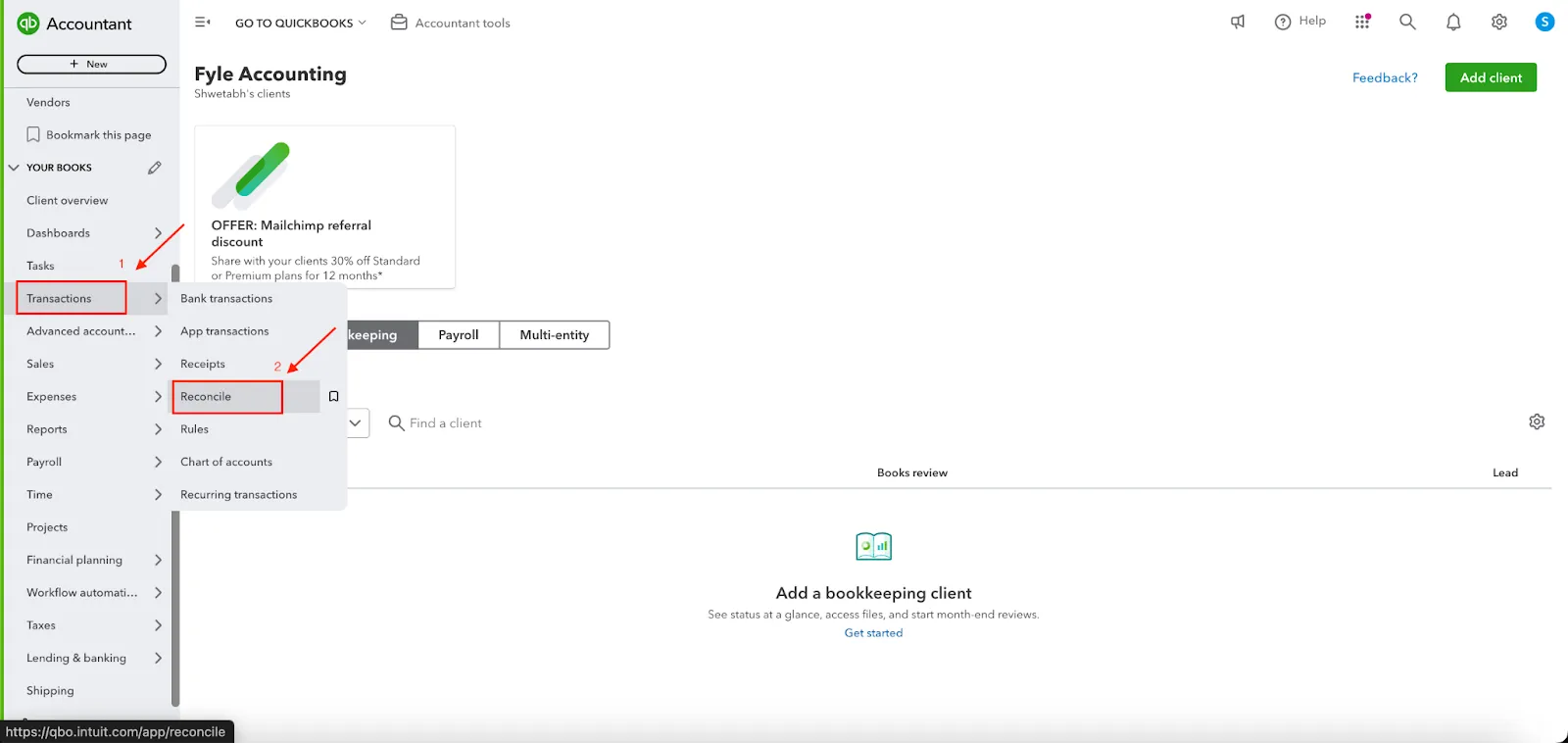

Step 1: Access the Reconcile Window

Log in to your QBO account, go to the "Transactions" tab on the left menu, and select "Reconcile."

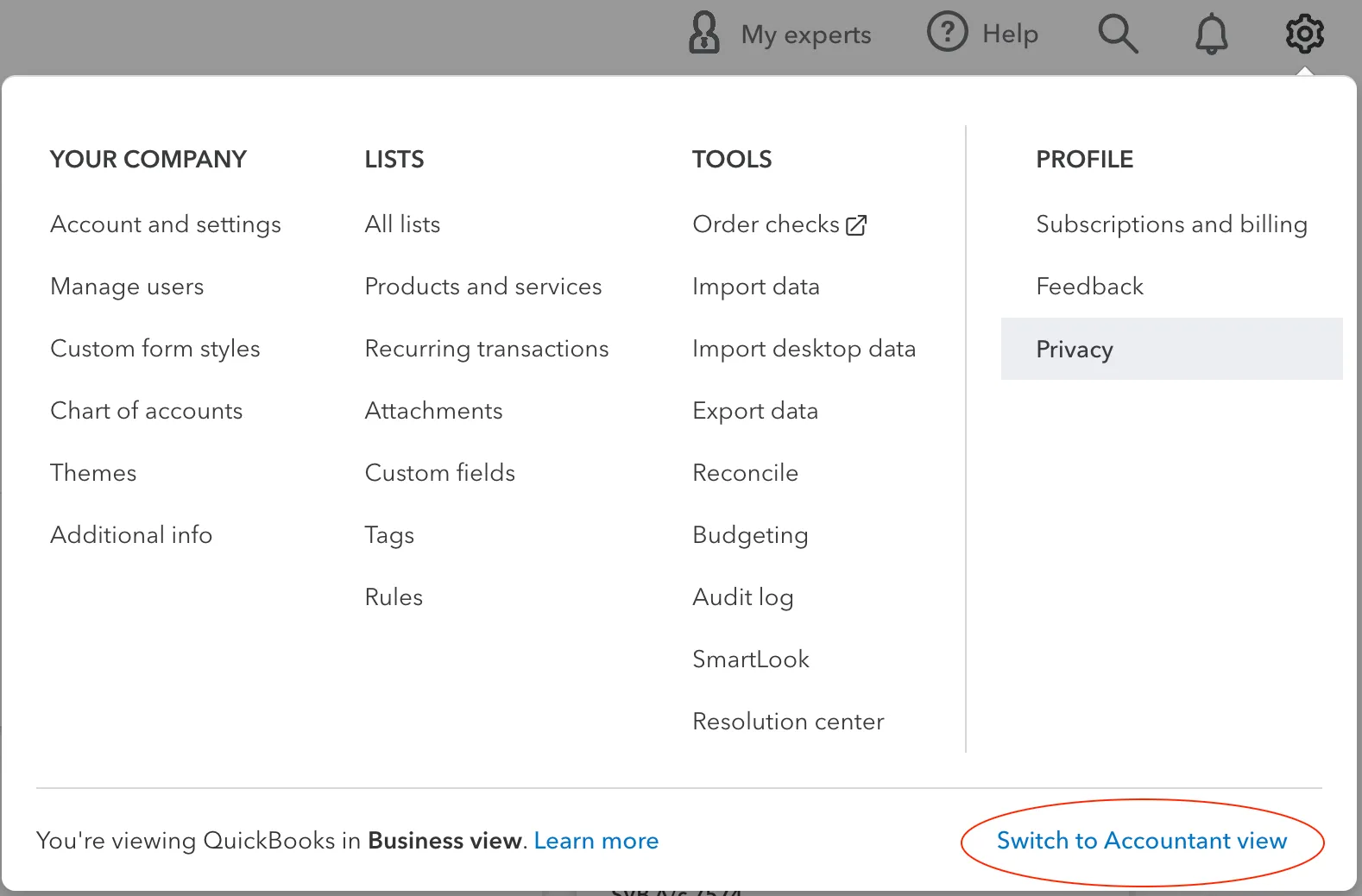

Note: Quickbooks has two users views. If you’re seeing a different navigation menu on your left side, it means you are on Business View. Click on the gear icon on the top right of your Quickbooks dashboard and see if the button on the lower right-hand says Switch to Account View.

If yes, it means you are in Business View. Click on the Switch to Accountant View to change the appearance of your navigation menu on your left. You will see the same menu as the screenshot above in a few seconds.

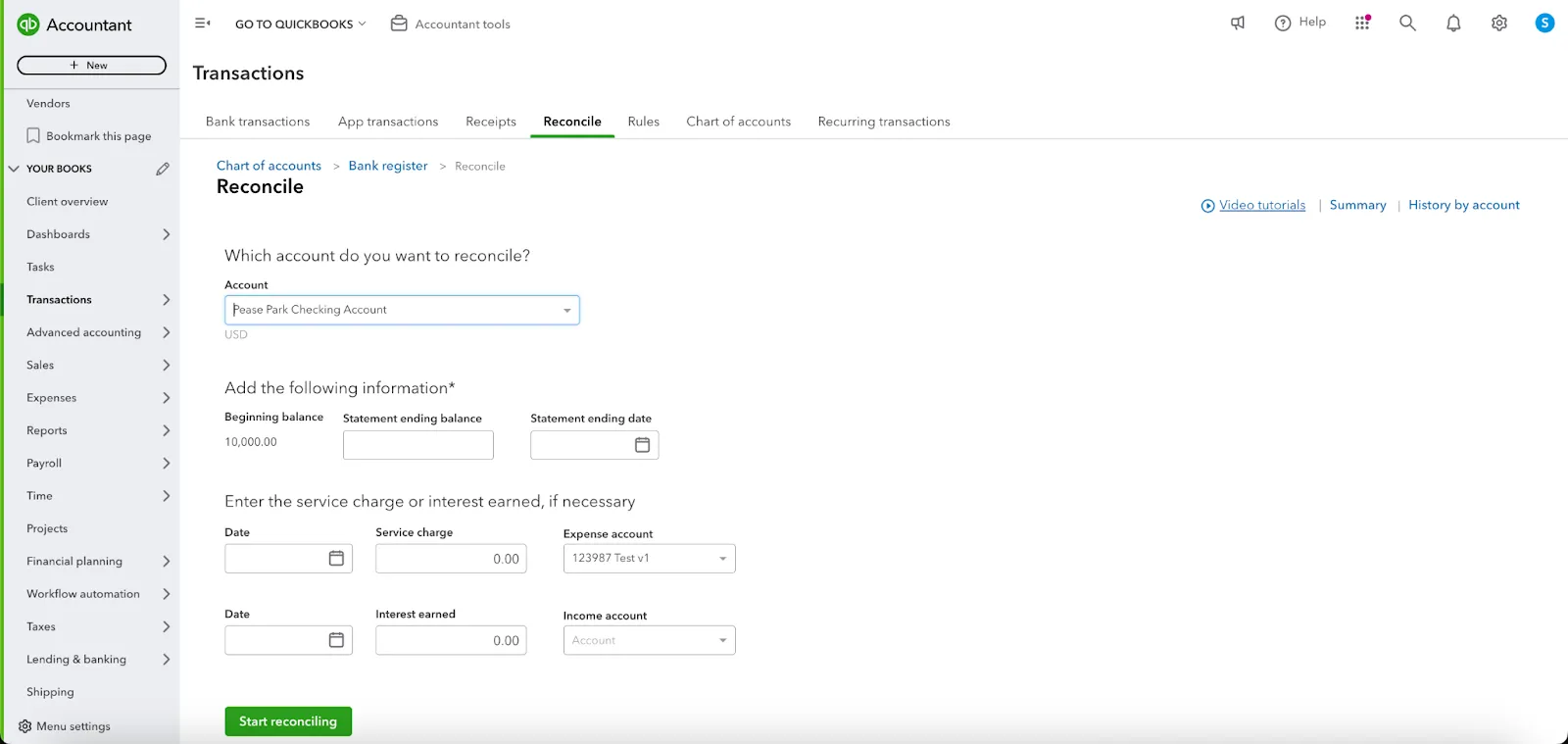

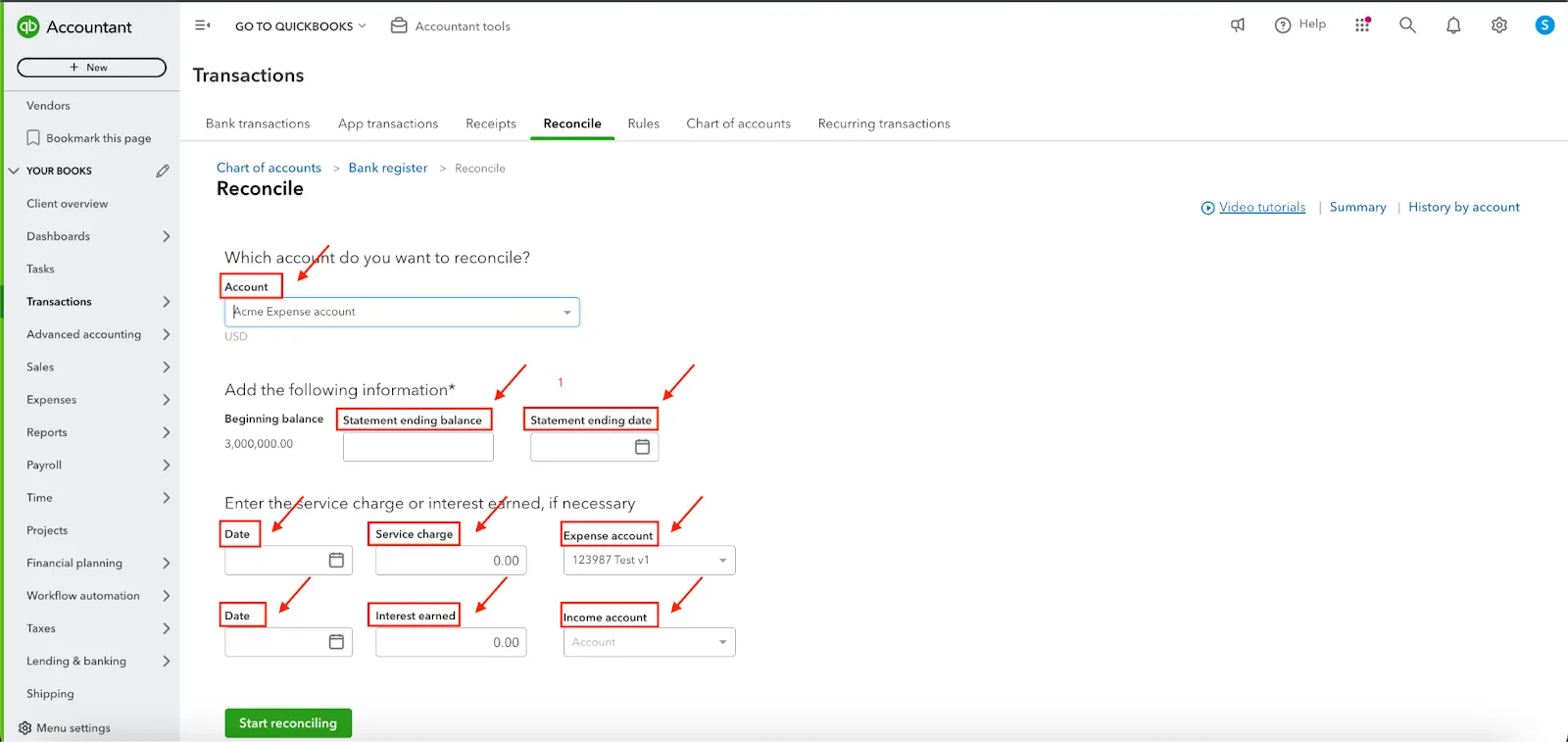

On clicking on the “Reconcile” tab, you will see the following screen.

Step 2: Add details about the account you want to reconcile

Before you start the reconciliation process, you need to:

- Pick an account from the drop-down menu that you want to reconcile (mandatory).

- Account: This is the credit card account you want to reconcile.

- Add additional information such as:

- Beginning Balance: This is the ending balance from your previous reconciliation. QBO should populate this automatically.

- Statement ending balance: This is the ending balance from your credit card statement. (mandatory)

- Statement ending date: This is the ending date from your statement. (mandatory)

- Add service charges or interest earned, if needed. (not mandatory)

- To add these:

- You need to add the date, service charge, and associated expense account

- You need to add the date, interest earned, and associated income account

- Once you have added all these details, you can hit the “Start reconciling” button.

Before reconciling your credit card, ensure the opening balance in QBO matches the opening balance on your statement.

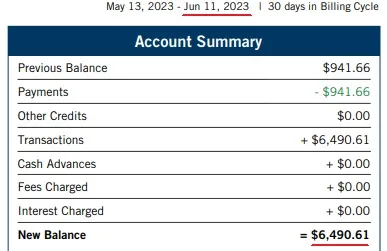

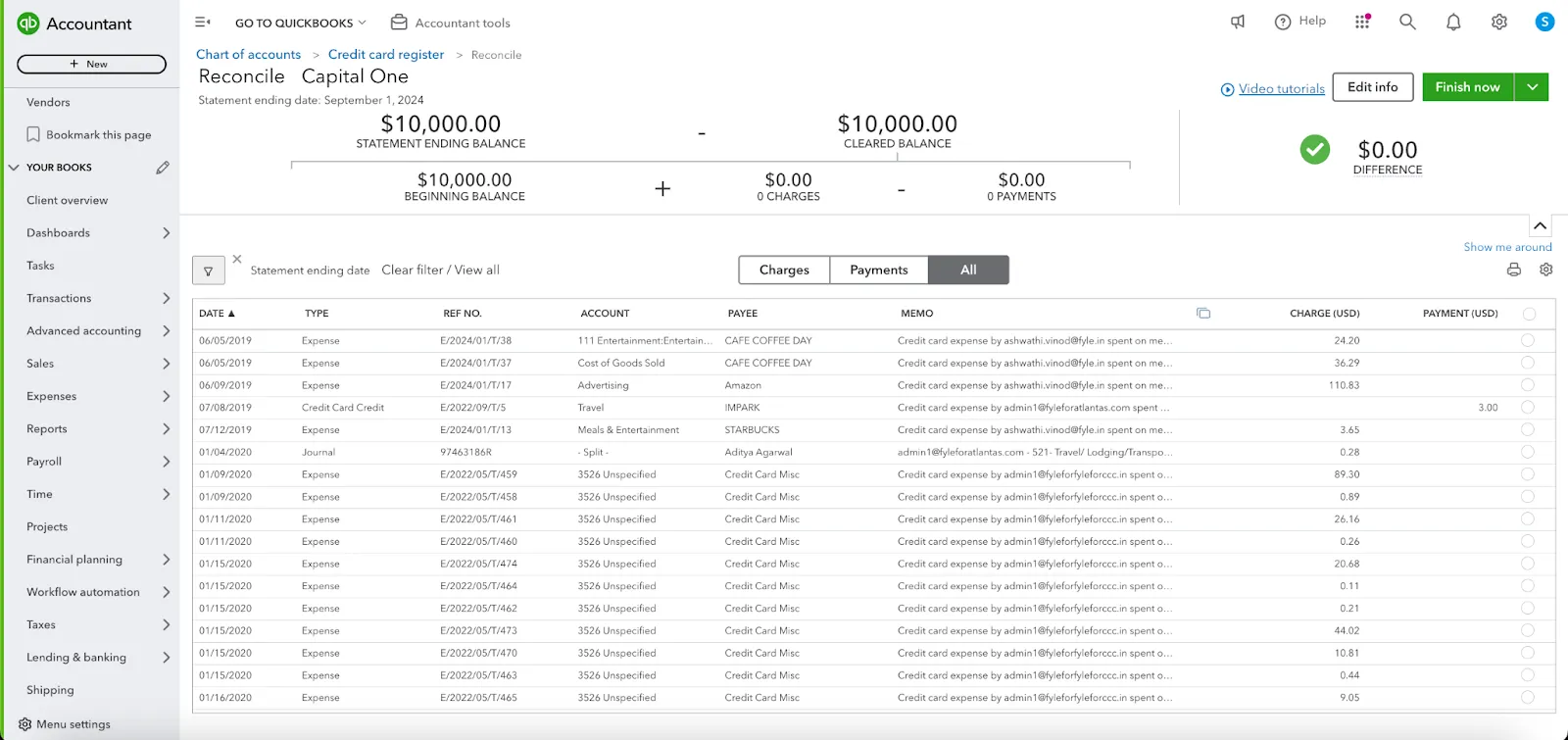

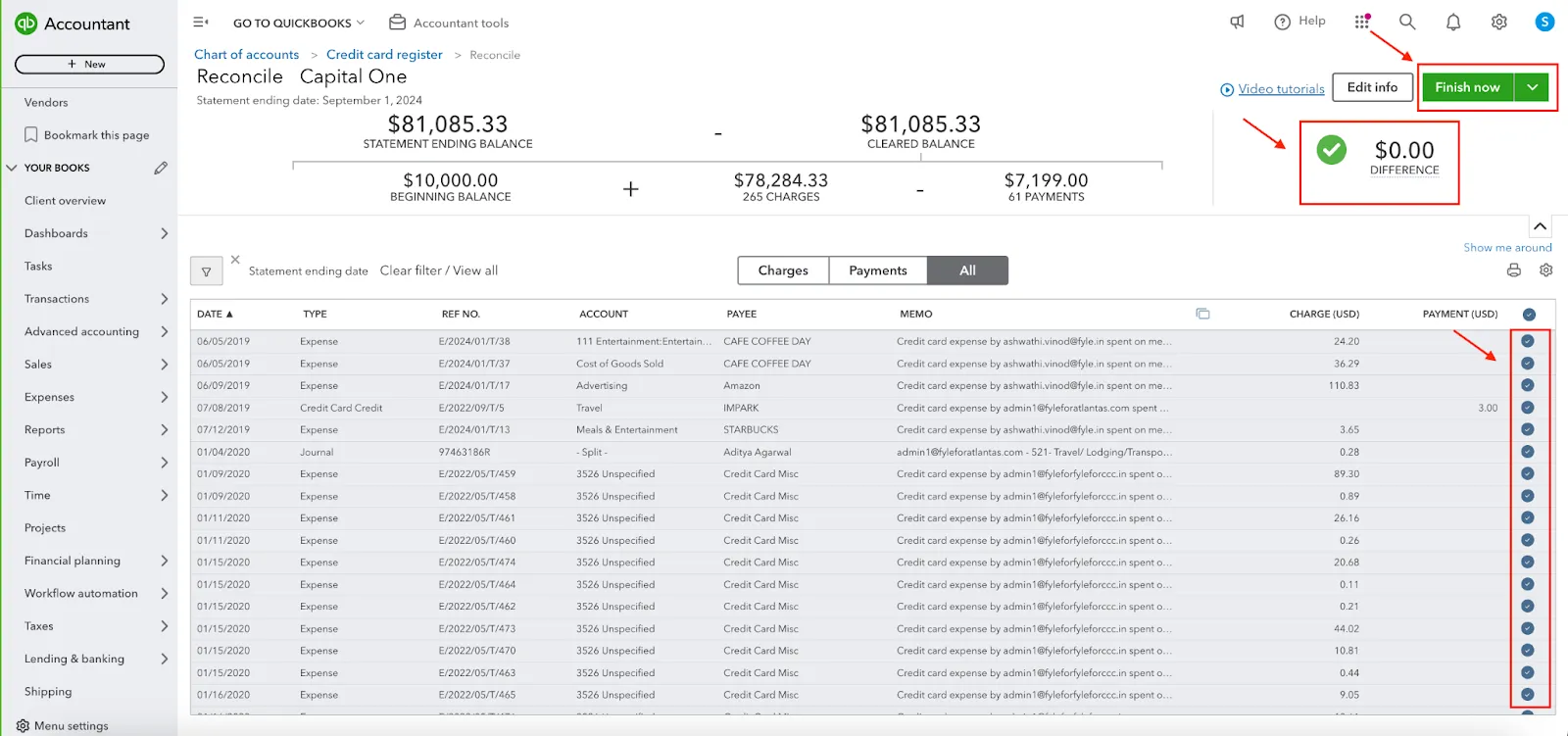

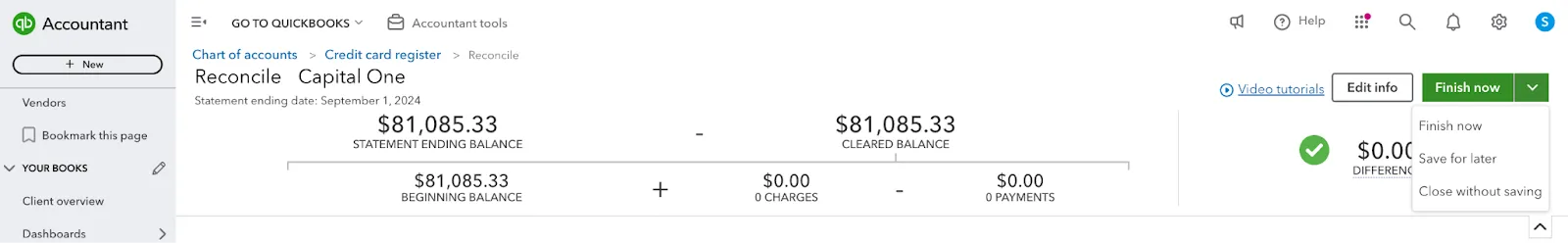

Step 3: Reconcile credit card transactions

- Once you click “Start reconciling”, the next screen appears with all the uncleared transactions.

- Carefully compare each transaction listed in QBO with those on your statement. If the transaction matches, check it off in QBO.

- The goal is to get the difference (shown at the top of the page) to zero out by matching all transactions.

- Once you've matched all transactions and the difference is zero, click "Finish now."

- If you need more time, click "Save for later," and QBO will save your progress.

- If you want to exist without saving the changes you have made you can click on “Close without saving.”

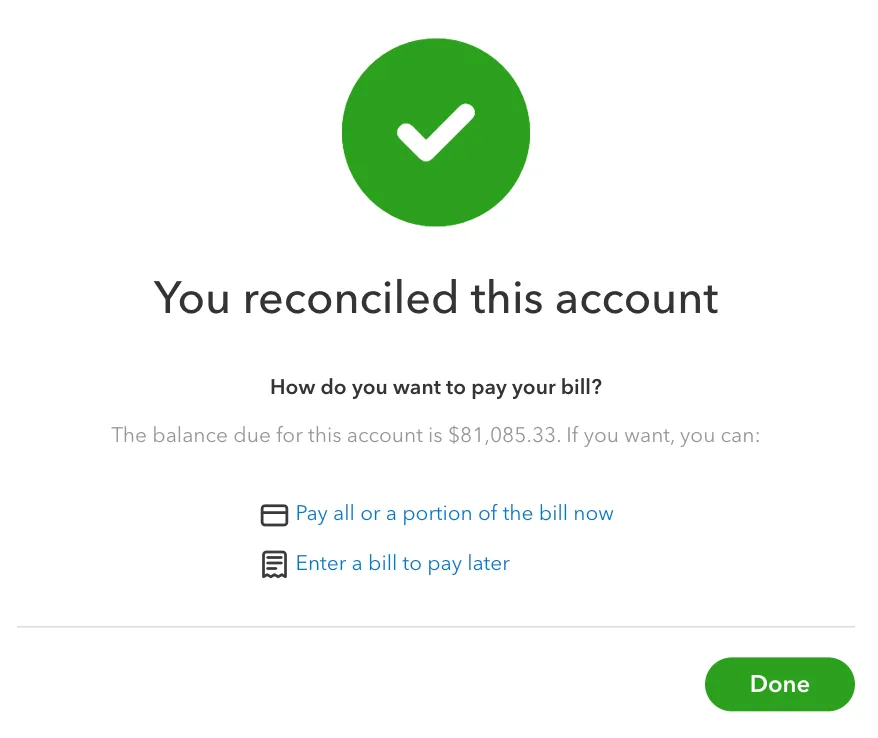

This is the screen you will see once you have reconciled your credit card charges and clicked “Finish now.”

How Fyle Can Help

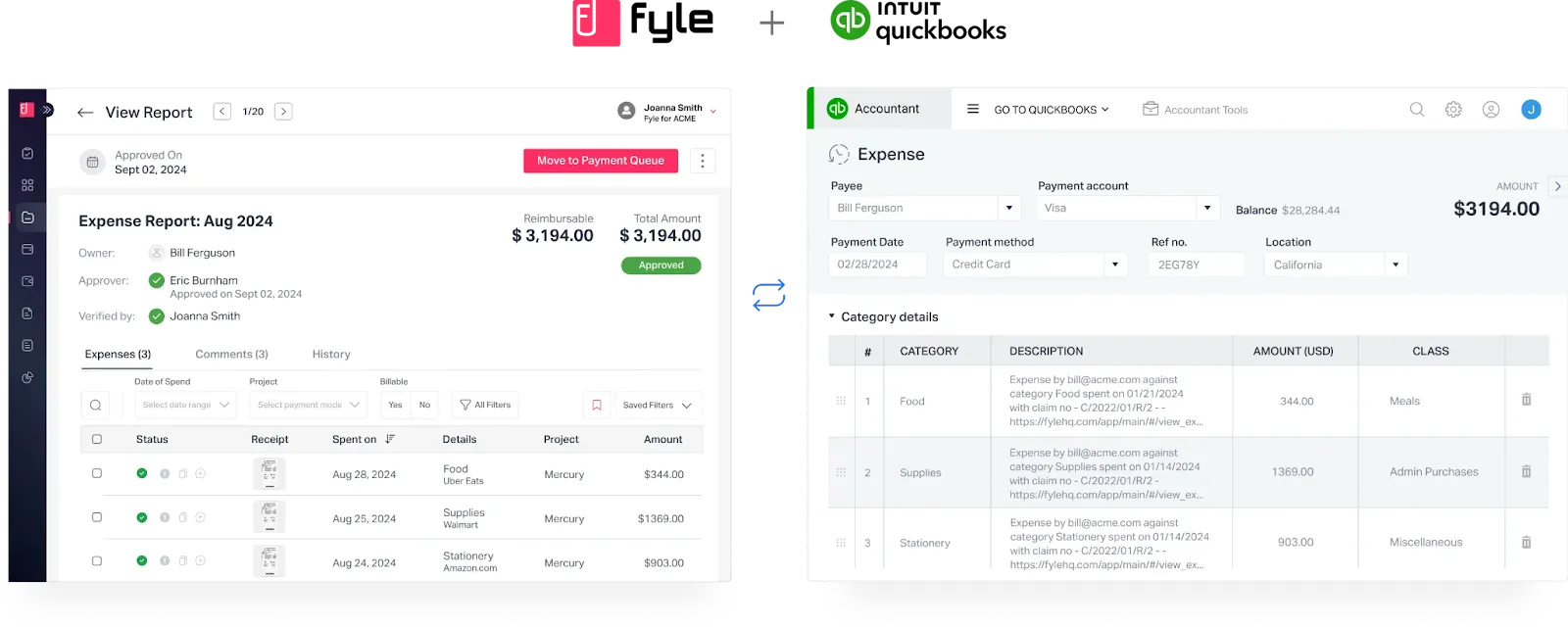

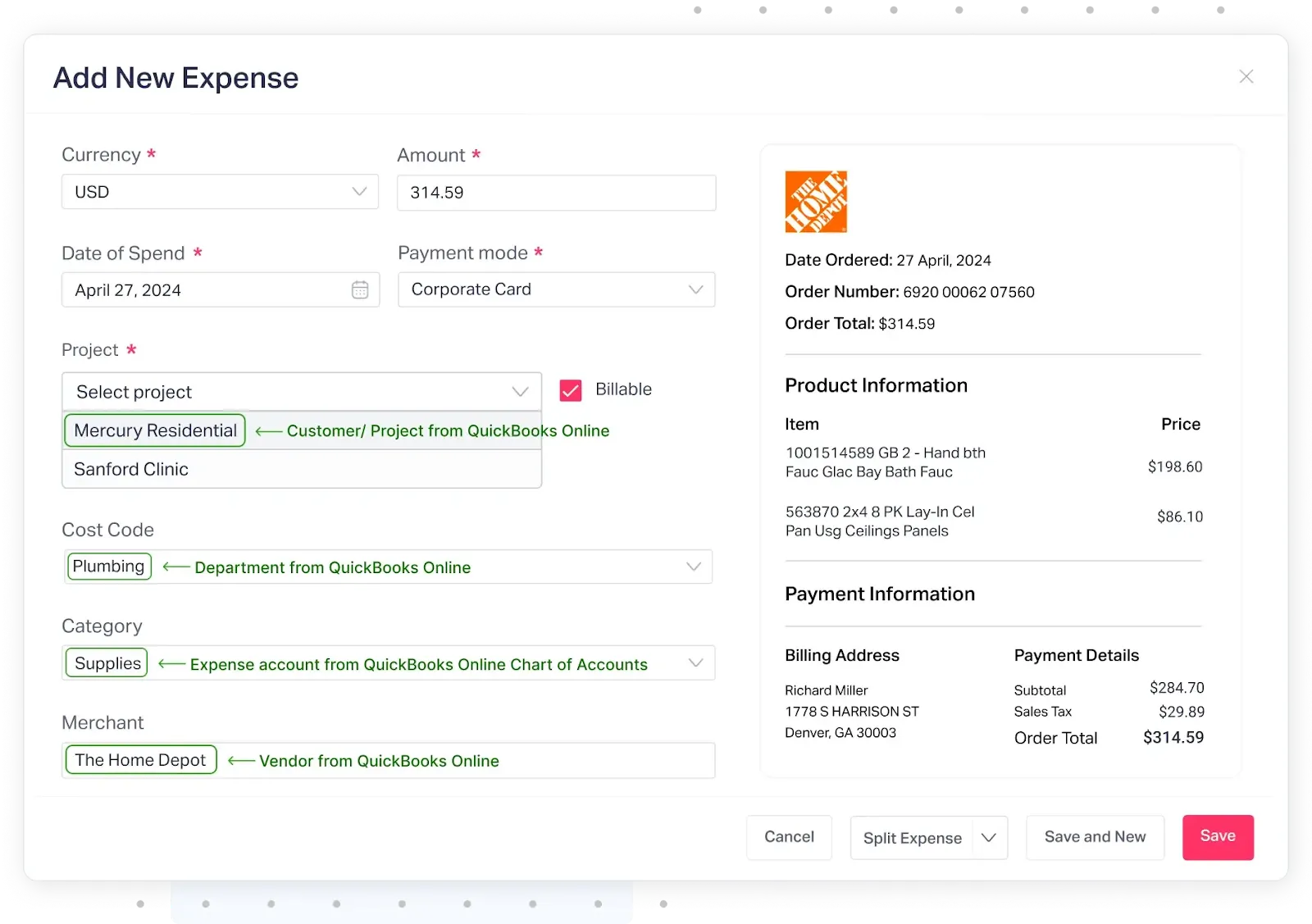

Fyle enhances the credit card reconciliation process in QuickBooks Online by streamlining the workflow and ensuring that data is accurately captured and synced. Here's how Fyle can assist with credit card reconciliations:

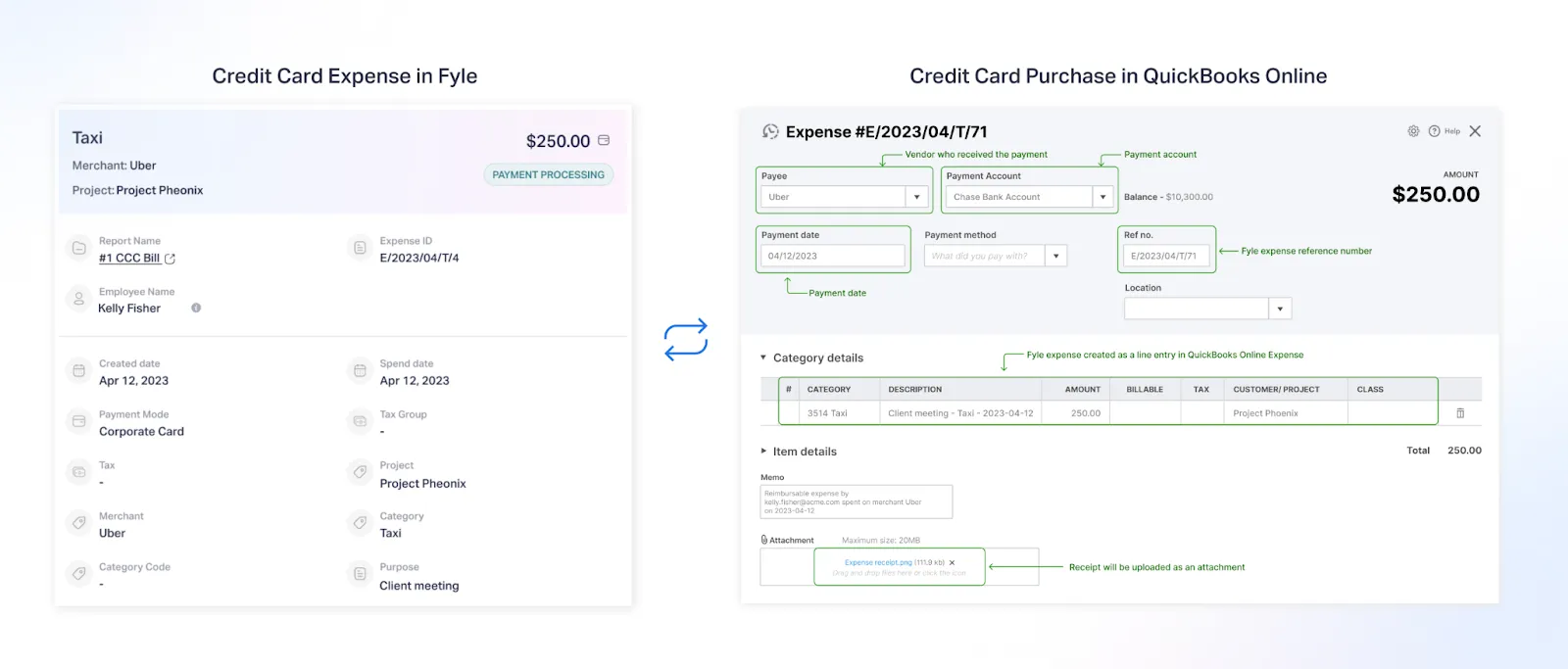

1. Automatic Sync of Credit Card Expenses

Fyle seamlessly exports credit card expenses directly to QuickBooks Online, including out-of-pocket expenses and real-time transaction data from credit cards. This automatic process ensures that all expenses are correctly categorized and captured without manual intervention, which is crucial for accurate reconciliation.

2. Employee Expense Coding and Receipt Submission

Employees can easily submit receipts through multiple platforms, including text, Gmail, Outlook, Slack, and the Fyle mobile app. These receipts are automatically coded into expenses. Instead of a central admin manually handling credit card transactions, employees can take responsibility for coding their expenses, significantly speeding up the reconciliation process.

3. Automatic Receipt Matching

Fyle helps automatically match receipts to credit card transactions in real-time. Once receipts are captured and expenses are coded, they are automatically reconciled with credit card charges in QuickBooks Online. This matching process eliminates the need for manual reconciliation of receipts and ensures that every transaction is backed by appropriate documentation.

4. Fast Approval and Compliance

Fyle enables automated approval workflows, allowing managers to approve expenses directly through email, Slack, or the mobile app. These workflows ensure that expense reports meet compliance requirements before they are exported to QuickBooks Online, reducing errors and the need for adjustments during reconciliation.

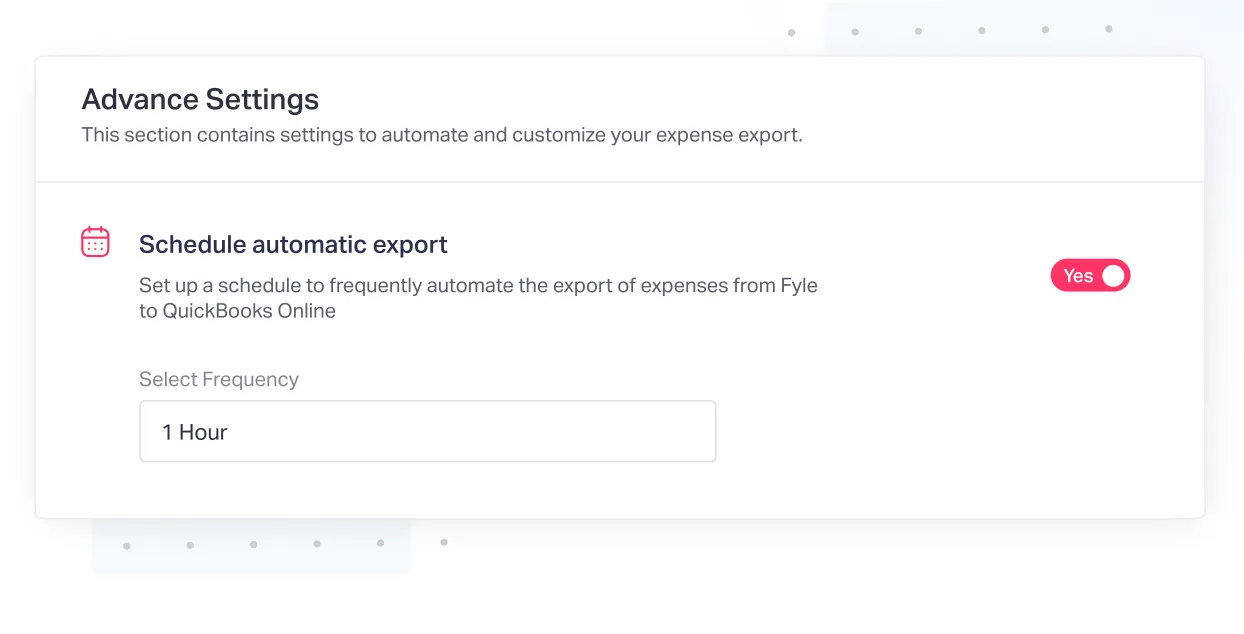

5. Scheduled Exports

Fyle enables you to schedule exports of expense data to QuickBooks Online at regular intervals. This ensures that the data is continuously updated, allowing QuickBooks to stay in sync with credit card transactions and reducing delays during reconciliations.

6. Detailed Export Logs

With detailed logs of expense exports and receipt matching, Fyle provides full visibility into what has been synced and any potential errors. This detailed reporting simplifies troubleshooting and ensures that reconciliations in QuickBooks Online are accurate and timely.

7. Accurate Mapping and Matching

Fyle enables accurate mapping of credit card transactions to the correct accounts in QuickBooks, ensuring that all expenses are properly categorized. This accuracy ensures smooth reconciliation when comparing QuickBooks Online data with credit card statements.

8. Multi-Currency Reconciliation

Fyle's multi-currency support ensures that foreign credit card transactions are reconciled correctly by using QuickBooks Online's exchange rates. This is particularly useful for businesses that deal with multiple currencies, ensuring that reconciliations are accurate.

With these features, Fyle significantly reduces the time and effort involved in credit card reconciliations in QuickBooks Online by automating receipt capture, coding, approval, and reconciliation, leading to more accurate and efficient processes.

Benefits of QuickBooks Credit Card Reconciliation

- Accurate financial records: Regular reconciliation ensures that your financial records are up-to-date and accurate.

- Error identification: It helps identify discrepancies, such as duplicate or missing charges.

- Fraud detection: Regular reconciliation can help spot fraudulent activity by comparing credit card statements with your QBO records.

- Tax preparation: Accurate records simplify tax filing and ensure that all deductions are captured.

How Do I Process Quickbooks Credit Card Reconciliation?

To process credit card reconciliation, simply follow the steps outlined above. Ensure you have the necessary account details and your credit card statetement on hand to compare with Quickbooks.

What Should I Do If There Are Missing Credit Card Transactions In Quickbooks?

If you discover missing transactions in Quickbooks, follow these steps:

- Check the import settings: Ensure that your bank or credit card feed is set up correctly in Quickbooks.

- Manually add transactions: If some transactions are missing, you can manually add them to your credit card account in Quickbooks.

- Re-import transactions: In some cases, it might be necessary to disconnect and reconnect your credit card account to re-import the missing data.

Conclusion

QuickBooks Online is a powerful tool for managing business finances. Knowing how to reconcile card expenses ensures that your financial records are accurate and up to date. However, manually managing these reconciliations can be time-consuming and prone to errors.

By integrating Fyle with QuickBooks Online, businesses can automate this process, significantly reducing manual effort while ensuring accuracy and compliance. Fyle’s seamless sync of credit card expenses, automatic receipt matching, and scheduled exports allow businesses to stay on top of their financials in real-time, empowering them to focus on growth rather than administrative tasks.

Visit Fyle’s QuickBooks Integration page to learn more about how it can transform your expense management and make reconciliations easier than ever.

.webp)