Lock-in contracts, unsolicited communications, slow implementation cycles, and an outdated experience. Does this sound like your average experience with an expense management tool?

At Fyle, we've tried to build an accounting-friendly modern expense solution that your employees will truly love. We offer a better ROI, faster implementation, and the industry's best customer support experience. Also, we do not send unsolicited emails to your employees. Period.

But this is just the beginning. There's more to why Fyle isn't just another expense management solution. Read on to find out why!

Why Fyle is the best expense management tool

1. Real-time Credit Card Feeds

Accountants, it's time to say goodbye to broken direct bank feeds and delayed statement uploads! There's a new way to manage credit card expenses with Fyle's real-time feeds.

Real-time credit card feeds connect to credit card networks like Visa, Mastercard, and American Express to bring transaction data directly to your expense management system as soon as a credit card is swiped. This means accountants don't have to wait for bank statements to arrive or chase employees for receipts.

Additionally, since the data is available the moment a transaction happens, accountants can track credit card spend, reconcile card expenses, track budgets, and identify unauthorized spend in real time.

But that's not all; here's everything else Fyle's enable you to do:

Receipt Collection via SMS and Other Everyday Apps

- Traditionally, expense management tools require you to submit receipts from within the app and wait until the end of the week or month to reconcile card expenses if you rely on direct bank feeds or statement uploads. Once the card transaction data arrives, accountants must manually reach out to employees to submit receipts, resolve errors, and manually match transactions.

But with Fyle’s real-time feeds

- Employees get instant notifications via SMS on all credit card spend as Fyle integrates directly with credit card networks like Visa and Mastercard. This helps them submit receipts instantly via text, ensuring accurate and timely expense report submissions and reimbursements.

- Accountants can collect receipts instantly via SMS, which has reduced the time our customers spend on receipt collection by 48%. This simplifies the process, reduces back and forths with employees, and eliminates the need to send reminders for receipt submissions or clarifications.

- Fyle also lets employees easily submit e-receipts from Gmail or Outlook without leaving their inboxes. Employees can also submit and track receipts from SMS, Slack, Dropbox/Drive upload, and Fyle’s mobile and web app.

- Approvers can approve expense reports on the go from the mobile app, Slack, or within their inbox. This makes receipt tracking and approvals a truly one-click experience for employees and approvers alike.

Automated Credit Card Reconciliations

- Other expense management tools rely on broken bank feeds or statement uploads for credit card reconciliations. This means depending on your card program, accountants need to wait until the bank makes card data available to manually match transactions. To access instant credit card transaction data, expense management tools often also require you to switch from your existing credit cards to a fintech card.

- Fyle’s real-time credit card feeds reconciles transaction data with receipt data in seconds of it being uploaded by the user. What took days with other expense management tools can now be done in less than 2 minutes with Fyle. All this without changing your existing credit cards!

See how Fyle’s real-time feeds is helping Woodford Bros., Inc manage their credit card expenses

Also read:

- Why Should You Choose Real-time Feeds Over Direct Bank Feeds

- Why Real-time Credit Card Feeds are Better than Statement Uploads

- What Data Do You Get From Real-time Feeds, And How Do Businesses Benefit From It

2. Compliance

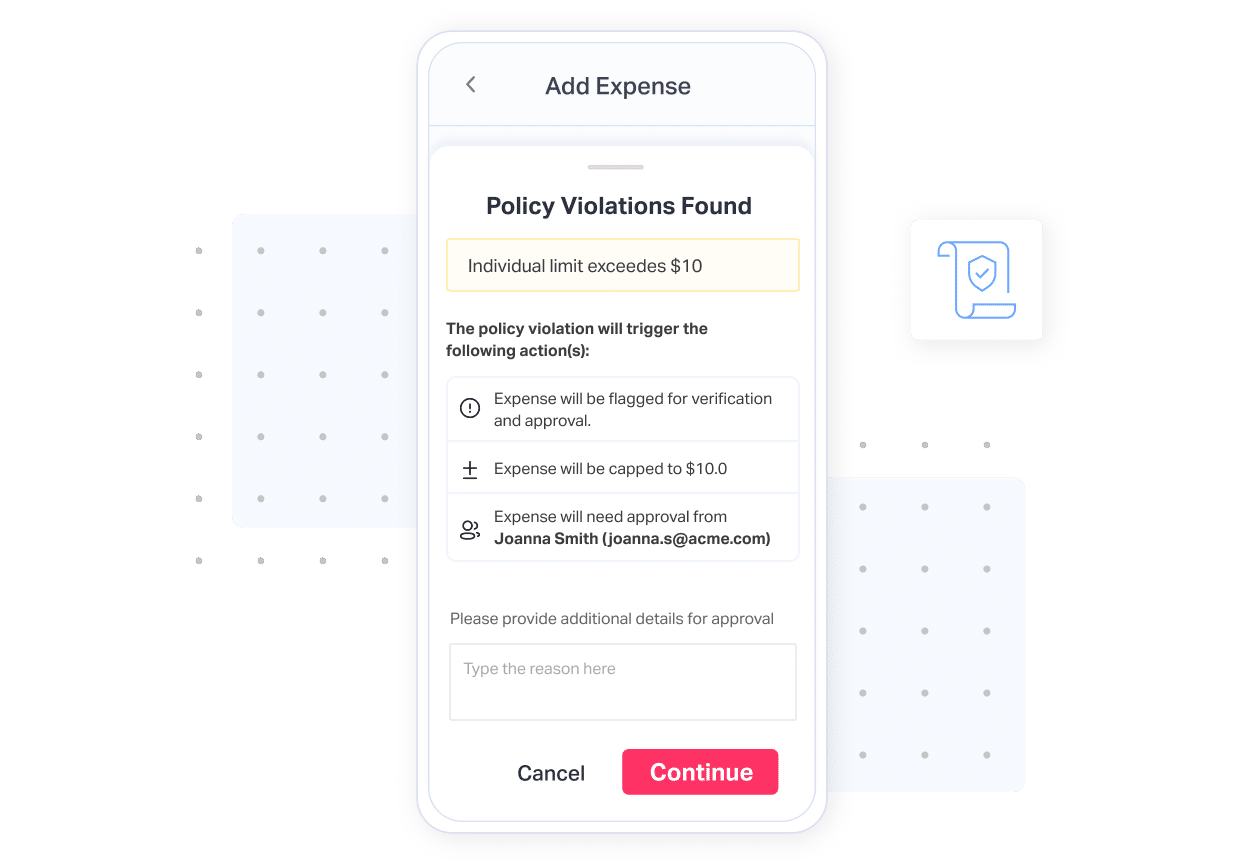

- Fyle checks for policy violations while employees create an expense even before submitting it. Based on the setting, one of the following will happen: the expense won't be submitted, an automatic cap will be added, or it’ll be forwarded for additional approval.

- Fyle’s duplicate detection and implicit merge module checks for duplicates if two submitted expenses are found to be the same. It instantly notifies the user and gives the option to merge the two expenses. With automated fraud and duplicate detection, Fyle ensures continuous compliance for your organization.

3. Real-time Spend Visibility

- Fyle's spend overview dashboard offers a real-time view of all employee credit card expenses. Accountants can delve into spend details effortlessly, analyzing transactions by categories, merchants, projects, employees, or departments. This ensures you’re well-equipped to spot potential risks, operational inefficiencies, and instances of overspending.

4. Project Spend Tracking

- Fyle enables admins to allocate spend to different dimensions like Projects, Cost Codes, Locations, Departments, and more. They can also import or set up fields in settings, which will then be present on an expense form. This ensures that accountants accurately track cost codes, budgets, and policies on specific projects.

Also read:

5. Multi-level approval workflows

- With Fyle’s advanced policy engine, you can configure any business rules and set additional approvals, receipt mandates, spend limits, and more. You can configure them based on projects, departments, employees, categories, and merchants. Approvers can also approve on the go via mobile app, email, Slack, or Teams.

6. Integrations

- Fyle has extremely customizable and granular, 2-way integrations with Quickbooks Online, Quickbooks Desktop, Sage Intacct, Xero, and NetSuite. The integrations are self-serve and have no-code setups. The average time to set up Fyle’s Quickbooks integration is 12.6 minutes!

- Fyle can automatically import data like employees, projects, categories, GL codes, departments, job codes, cost codes, taxes, and more while automatically exporting your expenses as bills, journal entries, or credit card charges in real-time. This saves time and manual effort for accountants.

7. Customer support

- Don't let poor customer support ruin your expense management process. We understand that you want the best expense management experience possible; that’s why our customer success team is around to assist you 24/7, with a 92% CSAT rating and a First Response Time (FRT) of under 30 minutes, the fastest in the industry.

- You also don’t need to worry about long implementation cycles, as our implementation team can help you get up and running within just 2 weeks!

See how Fyle’s Customer Support team helped the employees at Bright Futures For Youth

8. Pricing

Lock-in contracts, shady billing practices, or hidden costs have become synonymous with expense management pricing. At Fyle, we charge based on ‘active users’. An active user is someone who submits at least one expense report in a month. Fyle's Growth plan starts at $11.99 per active user / month, billed annually.

We also do not have lock-in contracts, you can opt out anytime and easily export your expense data too.

Concluding Thoughts

In today’s world, you can get access to any kind of information in seconds, and at Fyle, we want to make this true for your credit card transactions as well.

Why should you have to wait till the end of the week or month to know where your employees have been spending? If your business credit card is swiped anywhere in the world, you should be in the know.

Schedule a demo today to see how Fyle is changing everything you know about business credit card expense management!