Traditional expense reporting and reimbursement methods are riddles with unnecessary issues and risks. Manual management of receipts and verifications is prone to errors and fraud, and the inefficiency of these processes can negatively impact employee morale, financial productivity, and your bottom line.

To mitigate these risks, leading companies are turning to an expense management software.

An expense management software simplifies life for everyone involved–employees, accountants, and approvers. In today’s eco-friendly and efficiency-driven work culture, it’s a must-have tool for businesses of all sizes.

So, let’s start right from the beginning.

What Is Expense Management?

Expense management encompasses the entire process of reporting, approving, and reimbursing employee business expenses.

Businesses incur various costs to maintain and grow their operations. As a company expands, so does its spending and the number of spenders. It's crucial to remember that expenses aren't just incurred by investors; employees also spend their own money to keep the business running.

These expenses are owed back to employees, and companies are responsible for reimbursing them promptly and efficiently. However, before reimbursement can occur, employees must first report their business expenses through expense reports.

These reports detail business spending, the purpose of each expense, and other relevant information. Once submitted, expense reports are verified, approved, and reimbursed.

Why Is Expense Management Important?

Effective expense management is vital for several reasons:

- Impact on Budgeting and Forecasting: Accurate expense tracking enables better budgeting and forecasting, allowing businesses to predict and manage their finances effectively.

- Prevention of Fraud and Errors: Manual expense management is prone to errors and fraud. Automated expense management helps mitigate these risks.

- Compliance and Regulations: An effective expense management process ensures compliance with tax regulations and other financial rules.

- Improved Financial Visibility: Expense management provides a clear view of spending patterns, enabling better financial control and decision-making.

- Controlling Spend and Reducing Unnecessary Expenses: By tracking expenses and identifying areas of overspending, businesses can reduce unnecessary costs and improve their bottom line.

What Is An Expense Management Software?

An expense management software is an application that helps employees manage and report their business expenses. It also enables finance teams to manage reimbursements, expense reports, and travel requests.

By streamlining every aspect of expense management, it minimizes the risks associated with traditional methods. It also enables a business to receive and process business expense reports from its traveling employees.

Who Uses Expense Management Software?

Expense management software benefits a wide range of users, including:

- Employees: Simplifies expense reporting and ensures timely reimbursements.

- Approvers: Streamlines the approval process and provides better visibility into spending.

- Finance Teams: Automates expense processing, reduces manual effort, and improves accuracy.

- Financial Controllers: Gain comprehensive insights into spending patterns, improve compliance, and enhance financial control.

What Does An Expense Management Software Do?

Tracks Your Receipts

Submitting receipts is a crucial part of expense reporting. An expense management software offers multiple ways for users to upload, update, and submit their expense information.

Instead of managing physical receipts, with tools like Fyle, employees can simply text images of their receipts, making the process quick and easy. Fyle’s AI will automatically create, code, and submit the expense.

All receipts are stored in a unified dashboard, providing instant access and tracking for approvers and finance teams. This organized system also benefits accountants during audits, as expenses can be easily traced back to their source.

Integrates with Business Credit Cards

An expense management software integrates with business credit cards to automate transaction tracking and reconciliation. This eliminates the need for manual data entry and reduces the risk of errors.

Fyle, a leading expense management solution, takes this a step further with its real-time credit card feeds. This feature connects directly to credit card networks like Visa and Mastercard, providing instant access to transaction data. This means no more waiting for bank statements or chasing employees for receipts.

Enforces Travel And Expense Policies

An expense management software automates policy checks and enforcement. It includes features to track and mitigate policy violations effectively.

Expenses are checked for compliance as soon as they are created, and notifications are sent immediately in case of breaches. By integrating with corporate credit card programs, the software can reconcile expenses with bank feeds, flagging any discrepancies.

Fyle's advanced policy engine allows you to configure any business rule, set additional approvals, enforce receipt mandates, set spend limits, and more. This ensures continuous compliance for your organization.

Streamlines Expense Approvals

Once an expense is uploaded, the software scrutinizes it and forwards it to the relevant stakeholders. If a policy violation is detected, the software flags the expense and notifies the approver and employee.

Approvers can then investigate and verify the flagged expense without needing to reference physical receipts or policy documents. The software also identifies the policy in question, speeding up the verification and approval process.

Fyle's multi-level approval workflows allow you to customize approval processes based on your business needs. Approvers can also approve expenses on the go via mobile app, email, Slack, or Teams.

Also Read

Some Additional Features of an Expense Management Software

- Mileage Tracking: Automatically track mileage for business trips and reimburse employees accurately.

- Per Diem Calculation: Simplify per diem calculations for travel expenses, ensuring compliance with company policies.

- Project-based expense tracking: Allocate expenses to specific projects for better cost management and analysis.

- Reporting and Analytics: Generate comprehensive reports and gain insights into spending patterns.

- Integration with accounting software: Seamlessly integrate with your accounting software for streamlined financial management.

- Audit Trail and Compliance: Maintain a complete audit trail of all expenses for compliance and reporting purposes.

- Tax compliance and reporting: Ensure compliance with tax regulations and simplify tax reporting.

- Data security and privacy: Protect sensitive financial data with robust security measures.

Why Should You Use An Expense Management Software?

Implementing an expense management software offers numerous benefits:

- Increased efficiency and productivity: Automating tasks and streamlining workflows frees up time for employees and finance teams.

- Reduced manual errors: Automated data entry and calculations minimize the risk of human error.

- Improved accuracy of financial data: Real-time expense tracking and automated reconciliations ensure accurate financial records.

- Faster reimbursement processes: Automated workflows and approvals speed up reimbursements, improving employee satisfaction.

- Enhanced employee satisfaction: Simplified expense reporting and timely reimbursements contribute to a positive employee experience.

- Real-time financial data: Access to real-time spending data enables better financial control and decision making.

Advantages Of Using An Expense Management Software

- Cost Savings: Reduce processing costs and eliminate errors that lead to financial losses.

- Time Savings: Automate tasks and streamline workflows, freeing up valuable time for employees and finance teams.

- Enhanced Visibility: Gain real-time insights into spending patterns, enabling better financial control and decision-making.

- Improved Compliance: Ensure compliance with expense policies, tax regulations, and other financial rules.

- Better Data-Driven Decision Making: Robust reporting and analytics capabilities provide valuable data for informed business decisions.

- Scalability: Adapt to business growth and changing needs without costly system upgrades.

- Device Agnostic Reporting: Employees can report expenses from any device, eliminating the need to collect and store physical receipts.

- Customizable Policies and Workflows: Tailor expense policies and approval workflows to meet your specific business requirements.

- Seamless Integrations: Integrate with card programs, accounting software, and travel management systems for a unified view of expenses.

- Real-time Fraud Detection: Automatically detect policy violations and reconcile expenses with bank feeds to prevent fraud.

- Complete Audit Trail: Maintain a digital audit trail of all expense-related actions for accounting and auditing purposes.

- Personalized Expense Fields: Customize expense fields to capture all necessary information for efficient processing.

- Reduced Manual Effort: Automate tasks and streamline processes to minimize manual work for employees and finance teams.

Steps to Simplify Your Expense Management Software Selection

1. Define Your Requirements and Objectives

- Identify your specific expense management challenges.

- Outline your must-have features and functionalities.

- Consider your budget and potential ROI.

2. Request Demos and Evaluate Solutions

- Schedule demos with shortlisted vendors.

- Test the software's features and usability.

- Involve key stakeholders in the evaluation process.

3. Measure Success and ROI

- Establish KPIs to track the software's performance.

- Monitor key metrics and analyze results.

- Evaluate user satisfaction and gather feedback.

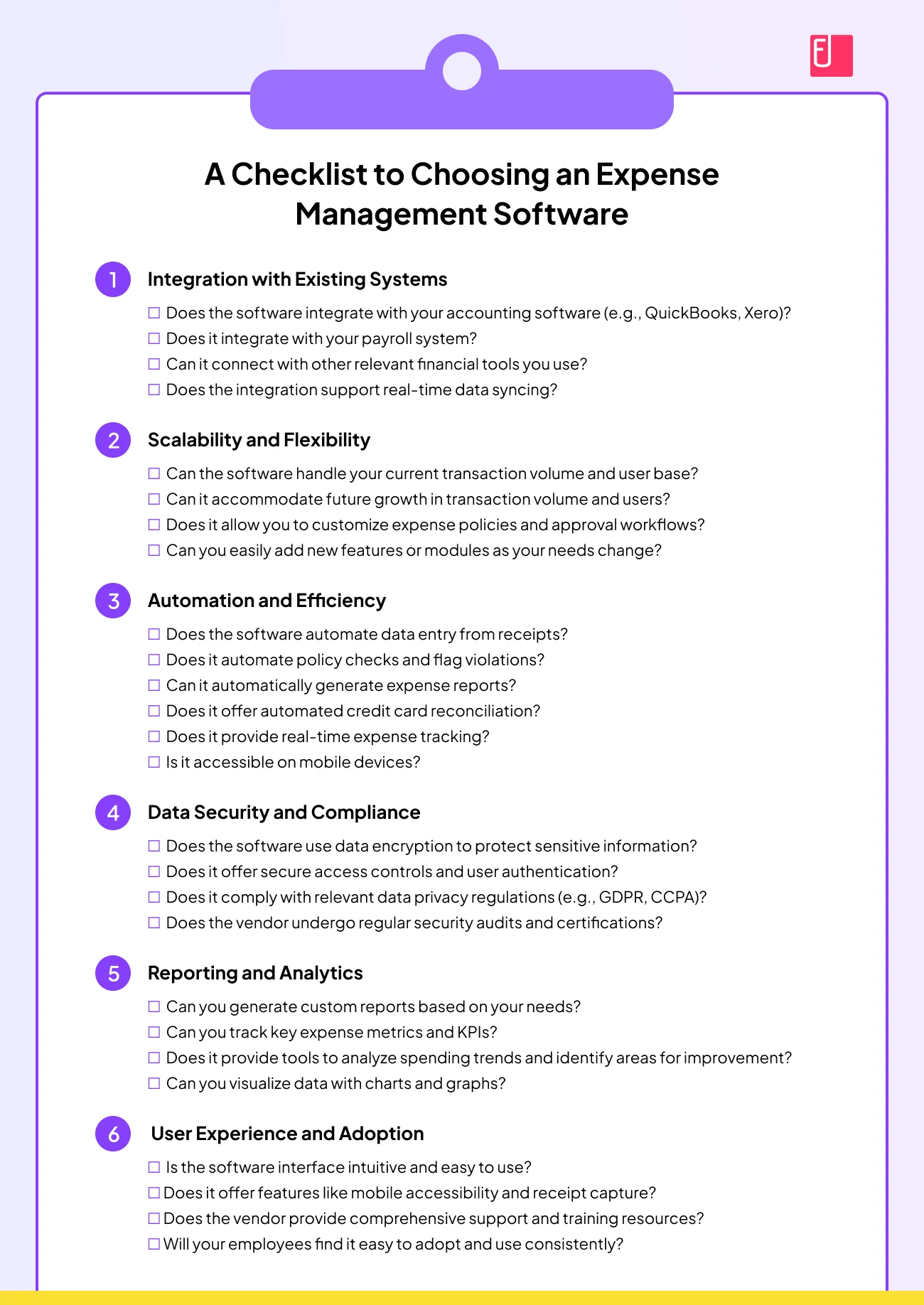

How To Choose An Expense Management Software: A Checklist

Here’s a simple checklist to help you evaluate an expense management software:

1. Integration with Existing Systems

- Does the software integrate with your accounting software (e.g., QuickBooks, Xero)?

- Does it integrate with your payroll system?

- Can it connect with other relevant financial tools you use?

- Does the integration support real-time data syncing?

2. Scalability and Flexibility

- Can the software handle your current transaction volume and user base?

- Can it accommodate future growth in transaction volume and users?

- Does it allow you to customize expense policies and approval workflows?

- Can you easily add new features or modules as your needs change?

3. Automation and Efficiency

- Does the software automate data entry from receipts?

- Does it automate policy checks and flag violations?

- Can it automatically generate expense reports?

- Does it offer automated credit card reconciliation?

- Does it provide real-time expense tracking?

- Is it accessible on mobile devices?

4. Data Security and Compliance

- Does the software use data encryption to protect sensitive information?

- Does it offer secure access controls and user authentication?

- Does it comply with relevant data privacy regulations (e.g., GDPR, CCPA)?

- Does the vendor undergo regular security audits and certifications?

5. Reporting and Analytics

- Can you generate custom reports based on your needs?

- Can you track key expense metrics and KPIs?

- Does it provide tools to analyze spending trends and identify areas for improvement?

- Can you visualize data with charts and graphs?

6. User Experience and Adoption

- Is the software interface intuitive and easy to use?

- Does it offer features like mobile accessibility and receipt capture?

- Does the vendor provide comprehensive support and training resources?

- Will your employees find it easy to adopt and use consistently?

Choose Fyle: The Best Expense Management Software

Tired of the headaches and hassles of traditional expense management?

Fyle is a modern, accounting-friendly solution designed to simplify expense reporting, streamline financial operations, and empower your business with real-time financial insights.

Here’s why Fyle stands out:

Real-Time Credit Card Transaction Data

Gain instant visibility into company spending with Fyle's real-time credit card feeds. No more waiting for bank statements or chasing down employees for receipts!

Fyle connects directly to major credit card networks, providing up-to-the-minute transaction data so you can monitor expenses as they happen. This real-time visibility allows for proactive budget management, fraud prevention, and data-driven decision-making.

Easy Receipt Management

Employees can easily submit receipts on the go via text messages, mobile apps, Slack, Gmail, or other everyday apps, and their reimbursement status can be tracked in real-time.

Finance teams benefit from streamlined workflows, automated processes, and a clean dashboard that provides a clear overview of company spending.

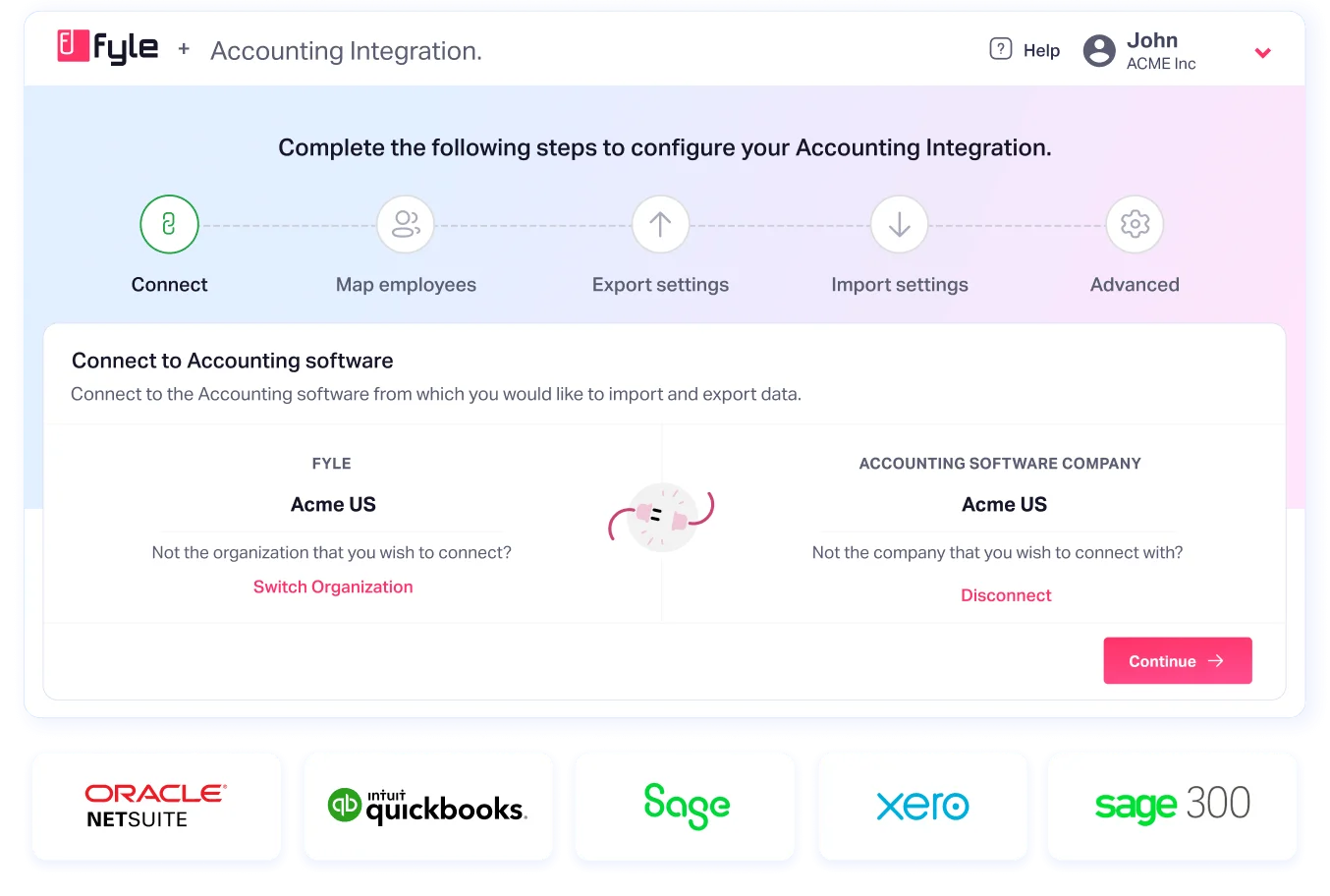

Strong Accounting Integrations

Fyle seamlessly integrates with all major accounting software, including QuickBooks Online, QuickBooks Desktop, Xero, Sage Intacct, and NetSuite. This eliminates manual data entry, reduces errors, and ensures that your expense data is always in sync with your accounting system.

Fyle also integrates with HR systems, travel management tools, and other business applications to create a truly connected expense management ecosystem.

Transparent Pricing

Fyle's pricing is simple and straightforward. You pay only for active users, with no hidden fees or lock-in contracts. This transparent pricing model makes it easy to budget for expense management and ensures that you're only paying for what you use.

Exceptional Customer Support

Fyle is committed to providing exceptional customer support. With a dedicated team available 24/7, you can get help whenever you need it.

Fyle boasts a 92% customer satisfaction rating and an industry-leading first response time, ensuring that your questions and concerns are addressed quickly and efficiently.

Ready to Experience the Fyle Difference?

Schedule a demo today and discover how Fyle can transform your expense management process, save you time and money, and empower your business with real-time financial intelligence.