To have a successful restaurant, you need to do more than just serve delicious meals. You also need to implement the proper accounting practices to ensure financial stability and growth.

So, how can you effectively handle your restaurant’s finances to ensure its success and profitability?

Well, everything you need to know about restaurant accounting is right here in this guide.

Let's dive in!

What Is Restaurant Accounting?

Restaurant accounting is a specific form of accounting that caters to the restaurant industry. It involves recording, tracking, and analyzing financial transactions specific to restaurants. Accounting usually takes place quarterly or annually.

With the data provided by restaurant accounting, owners can ensure the establishment’s efficient operation, compliance, and profitability.

Restaurant Accounting vs Restaurant Bookkeeping

While both restaurant accounting and bookkeeping are crucial for financial health, they play distinct roles. Here’s a breakdown to ensure your restaurant’s finances are in top shape:

Restaurant Bookkeeping: The Foundation of Financial Records

Think of restaurant bookkeeping as the meticulous record-keeping that lays the groundwork for informed financial decisions. Bookkeepers meticulously track the daily transactions that keep your restaurant running:

- Sales recording: Every dollar that comes in, whether dine-in, takeout, or delivery, is meticulously recorded and often integrated with your Point-of-Sale (POS) system.

- Expense management: Purchases from vendors (food, beverages, supplies), employee payroll, rent, utilities, and all other expenses are documented and categorized.

- Accounts payable & receivable: Track what you owe vendors (accounts payable) and what customers owe you (accounts receivable).

- Payroll processing: Ensure accurate and timely payment of staff wages and withholdings.

- Bank reconciliation: Regularly match your bank statements with your internal records and rectify any discrepancies.

To summarize, restaurant bookkeeping focuses on daily and short-term financial activities, providing real-time data for informed decision-making.

Restaurant Accounting: Making Sense of the Numbers

Restaurant accounting builds upon the foundation laid by bookkeeping, transforming raw data into actionable insights. Accountants are the financial detectives who analyze, interpret, and translate the numbers into a story that helps you steer your restaurant towards success:

- Financial statement preparation: Accountants create crucial reports like income statements (profit and loss statements), balance sheets, and cash flow statements. These reports reveal your restaurant’s profitability, financial position, and cash flow health.

- Cost of goods sold (COGS) analysis: a cornerstone metric in the restaurant industry, COGS represents the cost of ingredients as a percentage of revenue. Analyzing COGS helps identify areas for cost reduction, like menu pricing optimization or inventory management strategies.

- Labor cost management: Accountants analyze labor costs as a percentage of revenue to ensure you’re staffed efficiently.

- Tax planning and compliance: Accountants ensure your restaurant adheres to tax regulations and filing deadlines, minimizing tax liabilities.

- Budgeting and forecasting: Based on historical data and industry trends, accountants help you create realistic budgets and financial forecasts to guide your business decisions.

What Makes Restaurant Accounting Unique?

Restaurant accounting goes beyond the basic principles of bookkeeping and requires a unique approach due to several key factors:

Tipping

Unlike most businesses, restaurants grapple with tip management. Whether you choose tip pooling, server splits, or cash vs. paycheck tips, ensuring employee satisfaction while maintaining accurate financial records and payroll taxes is a delicate balancing act.

The ever-evolving tipping landscape adds another layer of complexity. Some restaurants are opting to raise wages and eliminate tipping altogether, requiring adjustments to accounting practices.

Inventory Management

Restaurants manage perishable inventory that gets transformed into finished products (delicious meals!). This requires frequent inventory counts (daily, weekly, or monthly) to ensure accurate cost of goods sold (COGS) and to track the beginning and ending inventory values for specific periods.

Cash Flow Management

Regularly generating profit and loss (P&L) statements is a recipe for success in the restaurant industry. Knowing your restaurant's performance not only on a monthly basis but also weekly, provides valuable insights.

This week-to-week view offers a clear picture of your sales and cost trends, empowering you to make informed decisions about menu pricing, staffing, and overall cash flow management.

Weekly Accounting Schedules

While many businesses operate with monthly accounting periods, restaurants benefit from a weekly schedule. This offers several advantages:

- Improved accuracy: Weekly comparisons provide a more precise picture of performance fluctuations.

- Flexibility: You can choose the start and end days of your accounting "week" for optimal scheduling.

- Cyclical nature: Weekly accounting aligns with the restaurant industry's seasonal and cyclical trends.

- Payroll alignment: Bi-weekly payroll periods often coincide with weekly accounting periods, simplifying reporting for your accountant.

The recommended method utilizes the 52-week 4-4-5 or 4-5-4 calendar.

This divides your year into four quarters, each consisting of thirteen weeks. Two quarters (4-4-5) use two four-week periods and one five-week period, ensuring a balanced annual representation.

Also Read:

Utilizing Prepaid Accounts

Weekly accounting periods require special considerations for monthly or annual expenses like rent, utilities, or restaurant software subscriptions.

To avoid reflecting the entire cost in a single week, utilize prepaid accounts. For instance, a yearly software subscription can be divided into twelve equal portions, with each week reflecting a portion of the expense.

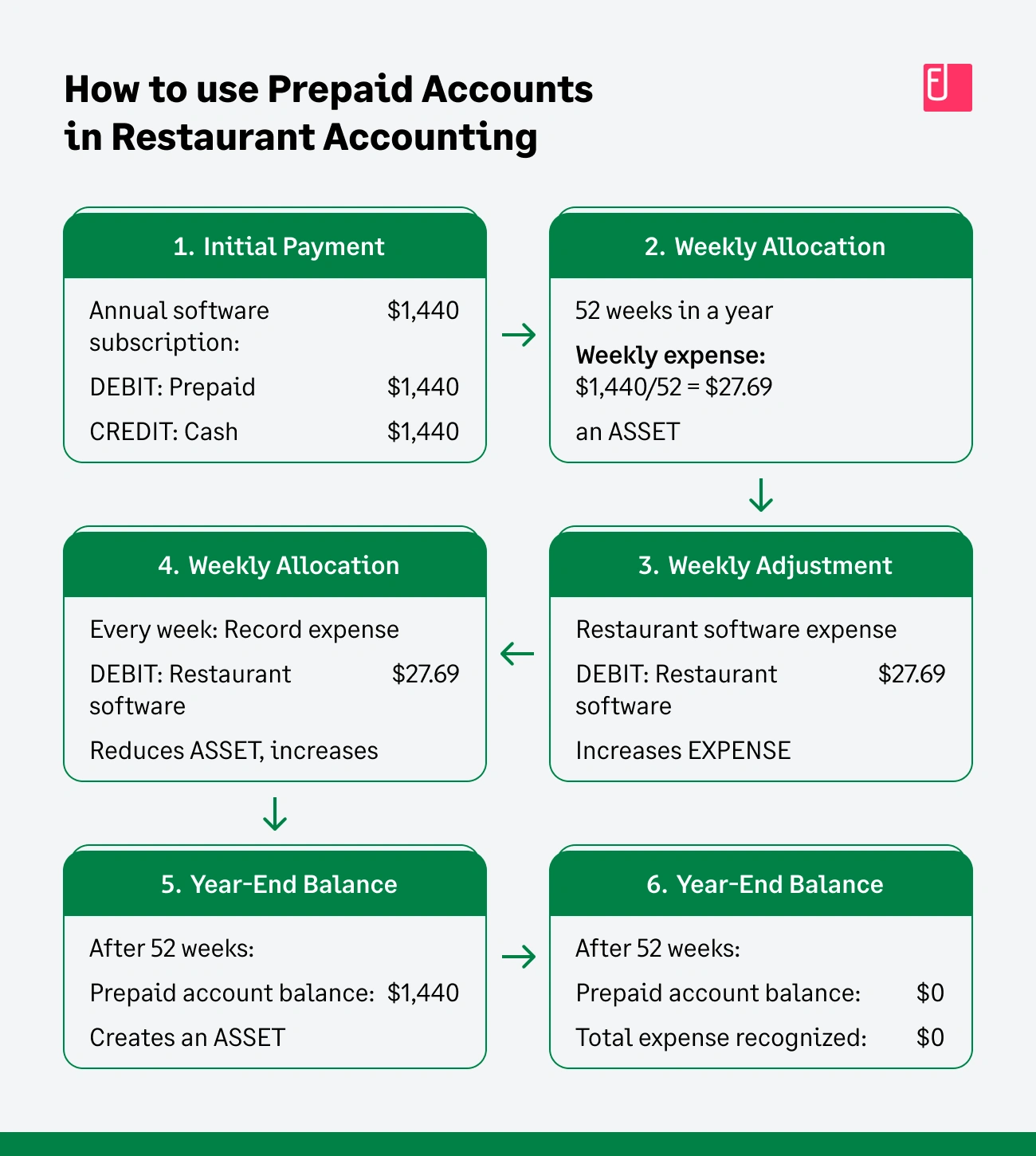

Example of Prepaid Accounts in Restaurant Accounting

Imagine your restaurant pays an annual subscription of $1,440 for a restaurant management software. With weekly accounting periods, reflecting the entire cost ($1,440) in a single week would distort your financial picture.

Here's how prepaid accounts help spread the cost evenly:

- Create a prepaid account: Set up a dedicated account in your chart of accounts named "Prepaid Restaurant Software."

- Record the initial payment: When you pay the $1,440 subscription fee, record it as a debit to "Prepaid Restaurant Software" and a credit to "Cash." This reflects the initial cash outlay and the creation of a "prepaid" asset (the remaining software service for the year).

- Weekly expense allocation: Since there are 52 weeks in a year, divide the total cost ($1,440) by 52 to determine the weekly expense amount: $1,440 / 52 weeks = $27.69 per week.

- Weekly adjustment: Record an expense for the software every week by debiting "Restaurant Software Expense" (an expense account) and crediting "Prepaid Restaurant Software" for $27.69.

This weekly adjustment gradually reduces the balance in the "Prepaid Restaurant Software" account. By the end of the year (52 weeks), the entire $1,440 will have been expensed through weekly adjustments, accurately reflecting the software cost throughout the year.

Vendor Credits

Restaurant deliveries might not always be perfect. Spoiled items or discrepancies with invoices necessitate vendor credits.

These credits require adjustments to your invoice totals. You can either “short pay” the vendor (pay the adjusted amount) or pay the full amount and account for the credit later. Regardless of the method, proper documentation is vital to ensure accurate reconciliation of monthly vendor statements.

Outsourced vs In-House Restaurant Accounting

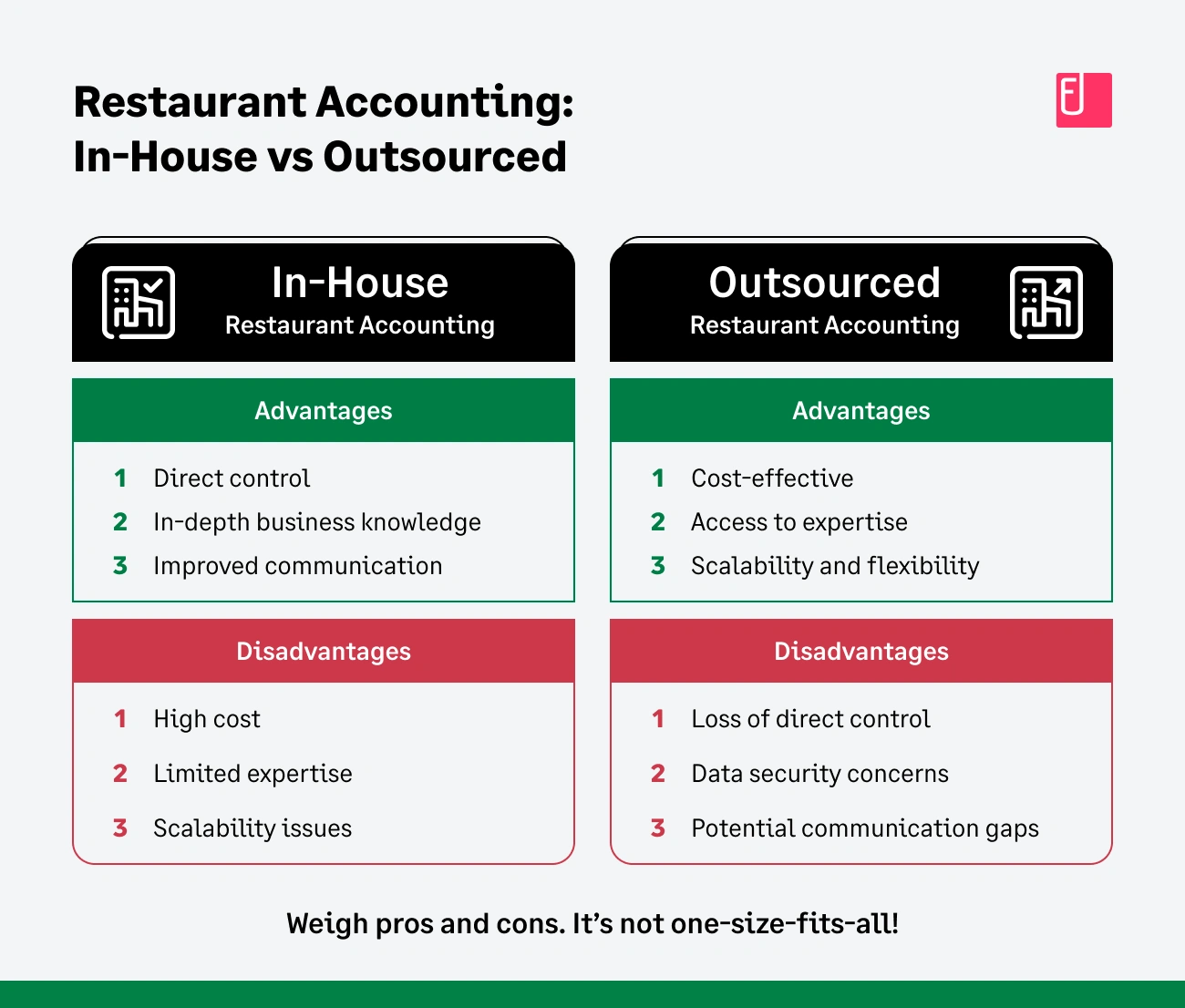

The age-old question: Should you handle your accounting in-house by hiring an accountant or outsourcing it to a professional accounting firm? Here’s a breakdown of both approaches to help you make an informed decision:

In-House Restaurant Accounting

Advantages

- Direct control and oversight: You have immediate access to your financial data and can directly supervise the accounting processes.

- In-depth knowledge of your business: An in-house accountant can become intimately familiar with your restaurant's operations and tailor financial strategies accordingly.

- Improved Communication and Collaboration: Direct communication with your accountant fosters closer collaboration between finance and other departments.

Disadvantages

- High cost: Salaries, benefits, and office space contribute to significant overhead costs.

- Limited expertise: Finding an accountant with specific restaurant industry knowledge can be challenging, especially for smaller restaurants.

- Scalability issues: Hiring additional staff might be necessary as your business grows, impacting your budget.

Outsourced Restaurant Accounting

Advantages

- Cost-effective: Outsourcing can be significantly cheaper than hiring an in-house accountant, especially for smaller businesses.

- Access to expertise: Accounting firms employ professionals with specialized restaurant industry knowledge, ensuring best practices and compliance.

- Scalability and flexibility: Scale your service level up or down as your business needs change, without additional hiring burdens.

- Focus on core business: Free up time and resources to focus on running your restaurant.

Disadvantages

- Loss of direct control: You relinquish some control over your financial data and rely on the outsourced firm's expertise and communication.

- Data security concerns: Choosing a reputable firm with robust data security measures is crucial.

- Potential communication gaps: Clear communication with the outsourced team is essential to ensure they understand your specific needs.

Do I choose In-House or Outsourced Restaurant Accounting?

The best option for your restaurant depends on various factors, including:

- Business size and complexity: Smaller restaurants might benefit from outsourcing, while larger ones might require in-house expertise.

- Budget: Consider the ongoing costs associated with each approach.

- Your time constraints: If you lack the time to manage accounting tasks, outsourcing can be a lifesaver.

- Your comfort level: Do you feel comfortable entrusting your financial data to an external firm?

It's not a one-size-fits-all decision. Weigh the pros and cons carefully to determine if in-house accounting or outsourcing best aligns with your restaurant's needs and growth goals.

Key Benefits Of Restaurant Accounting

Restaurant accounting helps ensure a restaurant's long-term success. Here are some of the key benefits of using good restaurant accounting practices:

Decision-Making Support

Restaurant accounting gives clear visibility into the restaurant's financial performance, helping owners and management make more educated choices to maximize profitability.

Budgeting And Forecasting

Effective restaurant accounting helps ensure the proper tracking and management of costs related to food, labor, utilities, rent, and other operating expenses. That ensures effective budgeting, forecasting, and variance analysis to identify cost-saving opportunities, reduce waste, and improve overall cost-efficiency.

Tax Compliance

Accounting in a restaurant ensures the creation of detailed financial reports. Consequently, it helps facilitate adherence to tax legislation and regulations and helps a restaurant identify tax liabilities, eligible deductions, and credits.

Improves Cash Flow Management

Restaurant accounting offers the tools, insights, and data required to monitor expenditures, income, budgeting, inventory, and debt, among other areas. Addressing these areas may improve cash flow.

Different Restaurant Accounting Methods

Now let's talk about the two common accounting methods used in restaurants:

Cash Accounting Method

Cash accounting ensures the documentation of revenue at the moment the restaurant receives the money.

- Revenue: You record income only when a customer pays you. This could be cash, credit card, or even a digital payment service.

- Expenses: Expenses are recorded only when you actually pay out cash. Whether you're paying a vendor for ingredients, renting your space, or paying your staff salaries, you record the expense when the money leaves your bank account.

This method is simple and suitable for small eateries or companies with simpler financial processes.

Accrual Accounting Method

It doesn’t matter if the actual exchange of money hasn’t occurred yet. In accrual accounting, you record the transaction as soon as it happens.

- Revenue: You record revenue when it's earned, even if the customer hasn't paid yet. For example, if a customer dines at your restaurant and puts it on a credit card, you record the sale even though the credit card company hasn't sent you the payment yet.

- Expenses: You record expenses when you incur them, regardless of when you pay the bill. If you order a week's worth of groceries for your restaurant, you record the expense when you receive the delivery, not necessarily when you pay the invoice.

What Accounting Method Should I Use For My Restaurant?

The cash method is available to most businesses, with a few exceptions. Here's a breakdown:

- Corporations and partnerships (except tax shelters): If they pass the gross receipts test, these entities can use the cash method.

- Qualified personal service corporations (PSCs): These corporations also qualify for the cash method.

The Gross Receipts Test

To use the cash method, corporations and partnerships (excluding tax shelters) must have average annual gross receipts of $26 million or less (adjusted for inflation) over the past three tax years.

Calculating Average Annual Gross Receipts:

- Add your gross receipts from the past three tax years.

- Divide the total by 3.

You can typically use the cash method if your average falls below the threshold.

Switching to Accrual Accounting

Businesses that exceed the gross receipts test ($26 million or less, adjusted for inflation) lose eligibility for the cash method in any given year. They must switch to accrual accounting starting in the year they fail the test.

To make this change, Form 3115 needs to be filed with the IRS. For further details, refer to the Instructions for Form 3115.

For more information on Accounting Periods and Methods, please refer to IRS Publication 538.

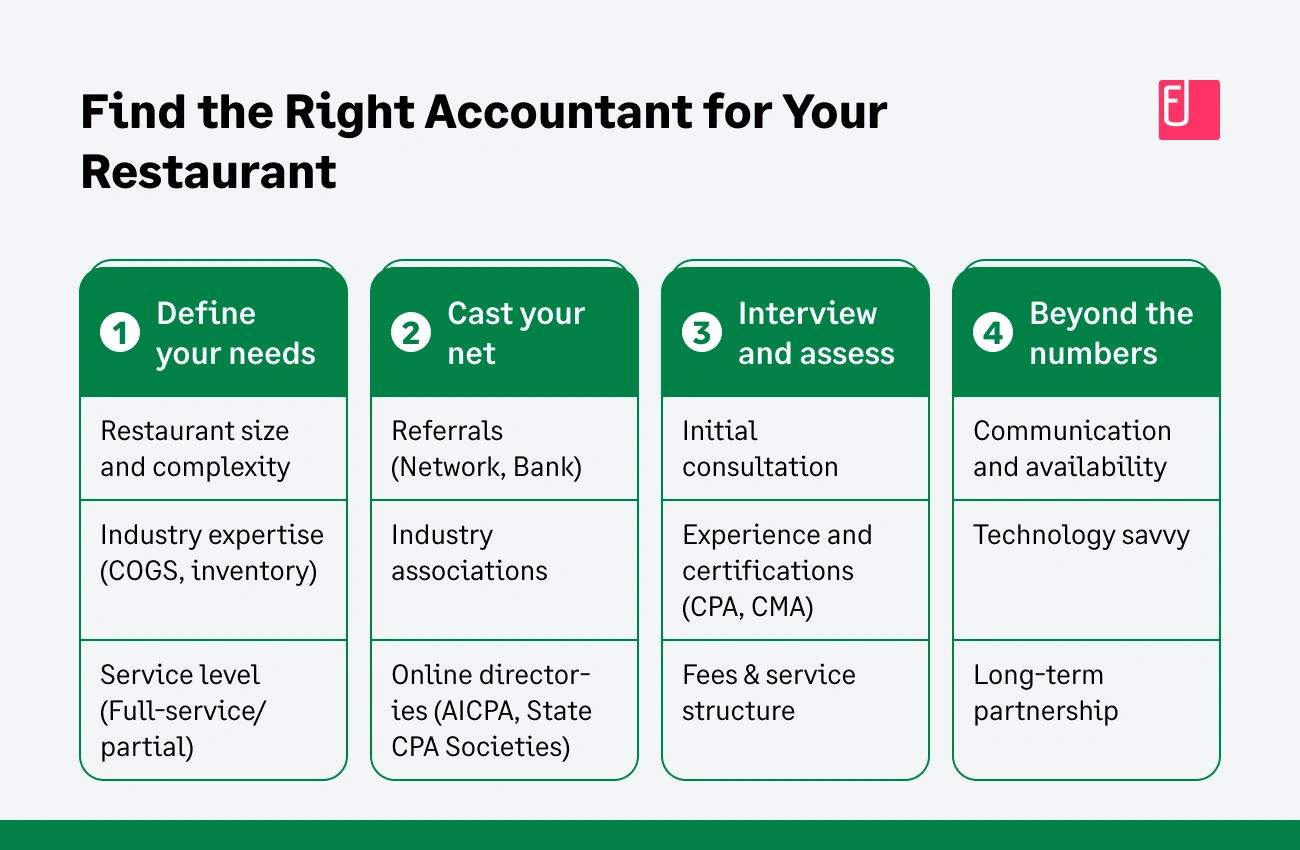

How Do You Find the Right Accountant for Your Restaurant?

Running a restaurant is no small feat. Between managing staff, maintaining quality control, and keeping customers happy, finances can easily become an overwhelming aspect.

That's where a qualified accountant comes in–a financial partner who understands the unique challenges of the restaurant industry and helps you navigate the complexities of bookkeeping and financial management.

Here's a breakdown of how to find the right accountant for your restaurant:

Define Your Needs

- Restaurant size and complexity: Smaller restaurants might need basic bookkeeping and tax filing assistance, while larger operations might require more in-depth financial analysis and strategic planning.

- Industry expertise: Look for an accountant with proven experience working with restaurants. They'll understand the specific accounting nuances of your industry, like inventory management and cost of goods sold (COGS) analysis.

- Service level: Do you need full-service accounting, or are you comfortable handling day-to-day bookkeeping tasks in-house?

Cast Your Net

- Referrals: Ask fellow restaurateurs, your bank, or your professional network for recommendations.

- Industry associations: Many restaurant industry associations offer member directories that include accountants specializing in the field.

- Online directories: Search online directories like the American Institute of Certified Public Accountants (AICPA) or your state's Society of Certified Public Accountants (CPA) to find qualified professionals in your area.

Interview and Assess

- Initial consultation: Schedule consultations with shortlisted candidates. Gauge their communication style, industry knowledge, and understanding of your specific needs.

- Experience and certifications: Look for accountants with relevant certifications (CPA, CMA) and a proven track record of success with restaurants.

- Fees and service structure: Be transparent about your budget and inquire about their fee structure – hourly rates, monthly retainers, or project-based fees.

Go Beyond the Numbers

- Communication and availability: Ensure you can easily reach your accountant and that they communicate clearly and promptly in a way you understand.

- Technology savvy: In today's digital world, find an accountant who is comfortable using restaurant-specific accounting software and cloud-based solutions.

- Long-term partnership: Hiring an accountant is an investment. Look for someone you trust and can build a strong, collaborative relationship with for the long term.

For a more detailed breakdown of How You Can Hire the Right Accountant for Your Business, read our detailed guide by CFO Andrew Lokenauth.

Accounting Services for Restaurants

Keeping your financial books balanced can feel more complicated than cleaning up your kitchen after an entire day’s service. This is why finding the right accounting firm becomes crucial–they’ll ensure your finances are in order, helping you to maximize profits, stay compliant, and make smarter decisions.

The good news? Sage Expense Management (formerly Fyle) makes finding the perfect fit easier! We've partnered with several accounting firms specialising in restaurants. These partnerships streamline the process, allowing you to:

- Simplify expense management: Easily submit and track receipts through Sage Expense Management.

- Save time: Reduce manual data entry and streamline communication with your accountant.

- Focus on what matters: Spend less time on paperwork and more time creating amazing culinary experiences.

Key Financial Reports for Efficient Restaurant Accounting

To manage restaurant finances, use these accounting reports:

Profit And Loss Statement (P&L)

Profit and Loss Statements (P&Ls) or Income Statements summarize the restaurant's income, expenditures, and net profit or loss for a certain period (monthly, quarterly, yearly, etc.).

Restaurant owners and managers can use it to assess profitability, identify patterns, and make informed financial decisions.

The P&L statement covers food, beverage, and other service revenues, as well as all operational expenditures, including food, labor, rent, utilities, and marketing.

Cash Flow Statement

The cash flow statement provides a comprehensive overview of the cash inflows and outflows resulting from various activities, including operations, investments, and financing, during a given time frame.

The cash flow statement encompasses various sources and uses of cash, such as sales, payments to suppliers and vendors, payments to employees, cash from loans or investments, and other cash transactions.

Restaurant owners and managers can use it to track cash flow, identify patterns, and keep enough cash for immediate and future financial obligations.

Balance Sheet

The balance sheet offers a comprehensive overview of the restaurant's financial standing at a particular moment, displaying its assets, liabilities, and equity. Here is a list of what it includes:

- Restaurant assets such as equipment, furniture, and buildings, cash, accounts receivable, and inventory

- Restaurant liabilities, such as accounts payable, loans, and mortgages

- Restaurant equity, such as owner's equity and retained earnings.

The balance sheet provides restaurant owners and managers with valuable insights into the restaurant's financial health, allowing them to evaluate its liquidity, solvency, and overall financial stability.

Revenue Report

Revenue reports require the calculation and analysis of different financial ratios, including gross profit margin, net profit margin, return on investment (ROI), and inventory turnover.

This report allows restaurant owners and managers to assess the establishment's financial performance, efficiency, liquidity, and profitability. It also helps them compare the restaurant's performance to industry benchmarks and pinpoint areas that need improvement.

What Key Performance Indicators Should You Track?

Here are some key performance indicators every restaurateur should track:

Cost of Goods Sold and COGS Ratio

What is COGS?

COGS is the direct cost of the ingredients you use to prepare the dishes you sell. Think food, beverages, and any other supplies used to create menu items.

Why Is It Important?

A healthy COGS indicates you're pricing your menu effectively and controlling your food and beverage costs. A rising COGS could signal areas for improvement, like negotiating with suppliers or adjusting portion sizes.

How to Calculate COGS?

Use the formula: COGS = Beginning Inventory + Purchases – Ending Inventory.

For example, if you start March with $12,000 in inventory, purchase $5,000 in supplies, and have $7,000 remaining at the end of the month:

COGS = $12,000 + $5000 - $7,000 = $10,000

The COGS Ratio

The COGS ratio reveals the percentage of your sales that goes towards COGS. Divide your COGS by your total sales for the period. Monitoring this ratio helps identify any significant cost increases.

Prime Cost

What is Prime Cost?

Prime Cost builds on COGS by adding your labor costs (wages, salaries, benefits) to the COGS amount.

Why Is It Important?

Prime cost represents your two biggest restaurant expenses—food and labor. Monitoring it allows you to manage these costs effectively and ensure profitability.

Ideally, your prime cost ratio (prime cost divided by sales) should fall between 55% and 60%.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

What is EBITDA?

EBITDA provides a clearer picture of your restaurant's operational performance. It reflects your earnings from core business activities before considering financing decisions (interest, taxes), non-cash accounting adjustments (depreciation, amortization), and capital expenditures.

Why Is It Important?

EBITDA helps assess your restaurant's profitability on a more fundamental level. This is crucial for making informed decisions like buying, selling, or investing in a restaurant.

Revenue per Head (Average Ticket Size)

What is Revenue per Head?

Revenue per Head, also known as sales per head or average ticket, tracks your average customer spending.

Why Is It Important?

Monitoring revenue per head allows you to:

- Set realistic sales targets

- Evaluate if you're meeting those targets

- Understand how to maximize customer sales

- Identify spending patterns based on time of day or year

Net Profit Margin

What is Net Profit Margin?

Net Profit Margin reflects your profitability as a percentage of your total sales. It essentially reveals how much profit you earn for every dollar of revenue.

Why Is It Important?

A higher net profit margin indicates effective menu pricing, controlled food and labor costs, and a healthy bottom line.

Calculating Your Net Profit Margin

- Calculate your net profit by subtracting all expenses (COGS, operating expenses like rent and utilities) from your total sales.

- Divide your net profit by your gross revenue (total sales) and multiply by 100.

What Is The Average Profit Margin For Restaurants?

Your restaurant's profit margin is its earnings after costs. Thus, it shows how well your restaurant converts revenues into profit.

Profit margins in the restaurant industry may vary significantly due to factors such as the restaurant's type (e.g., fast-food, casual dining, fine dining), location, size, level of competition, and overall business model. Typically, restaurants see a Gross Margin of 32.43% and a Net Margin of 10.66%.

(Source: New York University)

Also Read:

How To Do Restaurant Accounting: A Step-by-Step Breakdown

Let's go over some steps that form part of a good restaurant accounting workflow:

Choose The Right Accounting Software

Appropriate restaurant accounting software can facilitate financial management and tax compliance.

Thus, do your research on trustworthy and easy-to-use restaurant accounting solutions. Ideally, you want a system that can handle your financial management needs, from creating invoices to generating reports.

Before making a final selection, use free trials, demonstrations, or pilot programs provided by software vendors to evaluate the software's functionality and compatibility with your restaurant's requirements.

For a more detailed review of restaurant accounting software, refer to our guide on Accounting Automation.

Set Up A Restaurant Chart Of Accounts

You’ll need to set up a chart of accounts. A chart of accounts allows you to break down all your restaurant’s financial activities during a period into specific categories.

In general, your restaurant's chart of accounts will have at least seven categories. They include assets, liabilities, equity, income, cost of goods sold, costs, and others.

To help you organise and report, each account and subaccount within the chart of accounts may need to be assigned a unique account number or code. You can use generative AI to automatically generate these account numbers based on specific criteria such as account type, department, or location.

Also Read

Implement POS Integration

Your multiple point-of-sale systems can provide more financial data to analyse for accounting purposes. After all, this is where your customers consummate their purchases.

So, make sure you integrate your accounting software with POS devices like your restaurant card readers and barcode scanners.

Integrate the software with your e-commerce payment solutions as well. You want to capture important financial data when customers use your online ordering services. Don’t forget to use the fastest website hosting to deliver a smooth customer experience to customers online. That’s the only way they’ll push through with the digital payment process in the first place.

With your accounting software’s integration with relevant systems, you won’t have to input financial data into the accounting solution for analysis manually. You can ensure the automatic transmission of sales, inventory, and economic data to the software.

Establish Daily Sales Reporting Process

Don’t just rely on your POS systems to collect restaurant sales data. You’ll need to track your daily sales manually, too. With this check and balance strategy, you further ensure the accuracy of your financial data for accounting purposes.

Apart from ensuring accurate financial data collection, daily sales reporting helps your business by:

- Ensuring cash control. You can track how the money came in and see if it reached the bank.

- Tracking your gross sales per category (specific dish, merchandise, specific drink). This will allow you to make informed decisions about which products to focus on selling.

- Empowering you (or your manager) to implement solutions for the business: When you (or your manager) monitor the sales data yourself, you can implement solutions to help the restaurant save and ensure its long-term profitability. For instance, you can control labor costs when you see on your spreadsheet that it’s beyond what the restaurant budget allows.

That said, establish a separate daily sales reporting process. You can use a template you or your manager can just fill out at the end of every business day. Then, reconcile the data you manually gather with the data in your POS system. Make the necessary data updates in your POS system (or your manual sheet) if necessary.

Monitor Inventory Levels

Restaurant inventory levels are the amount and value of food, drinks, supplies, and other products in stock. They help ensure your restaurant can meet customer demand while effectively managing costs.

You or your manager can use digital spreadsheets or inventory management software to track inventory levels. You can also forecast inventory requirements using past sales, seasonal patterns, and forthcoming promotions and events.

Finally, confirm inventory levels with regular physical inventory counts. These counts should be done during off-peak hours to avoid restaurant disturbances.

Stay Compliant With Tax Regulations

Complying with tax requirements, like VAT and HMRC compliance, protects your restaurants from fines, audits, and legal concerns.

So, keep up with changes in tax laws, rates, and filing requirements to guarantee correct and timely compliance. Also, maintain comprehensive and structured financial records, including income, spending, sales receipts, invoices, payroll records, and tax returns.

How Sage Expense Management Can Help with Restaurant Accounting

Restaurants often operate on tight margins, so streamlining any process that involves money can have a significant impact. Tracking all your expenses ensures financial transparency, cost management, and profitability.

While you can construct a restaurant-specific chart of accounts to classify spending, selecting tools like Sage Expense Management that automate expense management and integrate with your accounting tool can help you in the following ways:

- Simplified receipt capture: Say goodbye to mountains of paper receipts! Our tool allows employees to easily submit receipts via text messages or other everyday apps like Gmail, Outlook, Slack, or Teams. This eliminates the need for manual data entry and reduces the risk of lost receipts.

- Automated expense categorization: We use artificial intelligence to categorize expenses based on merchant information automatically. This saves time and ensures accurate expense tracking, eliminating the need for manual categorization.

- Improved cash flow management: Gain real-time visibility into your spending with our intuitive dashboards. You can easily track expenses by category, department, or employee, allowing for better cash flow management and informed budgeting decisions.

- Streamlined approvals: Our platform empowers approvers to review, edit, approve, or return expense reports with just a tap, anytime, anywhere, expediting the expense reimbursement process.

- Integration with accounting systems: We integrate seamlessly with popular accounting software used by restaurants, eliminating the need for double data entry and saving your accounting team valuable time.

FAQs on Restaurant Accounting

What is a Restaurant Chart of Accounts?

A restaurant chart of accounts is a list of all the financial accounts in a restaurant’s general ledger, tailored to the specific needs of the industry. It includes categories for things like Cost of Goods Sold (COGS), food and beverage revenue, and labor costs. A well-organized chart of accounts is crucial for accurate financial reporting and strategic analysis.

What is the difference between food cost and COGS?

Food cost is the raw cost of the ingredients needed to create a single menu item. COGS (Cost of Goods Sold) is a broader term that accounts for the cost of all food and beverages sold over a period, taking into account beginning and ending inventory. While food cost is a useful metric for pricing a single dish, COGS is a more comprehensive metric for assessing overall profitability.

Is It Better to Use Cash or Accrual Accounting for a Restaurant?

For most restaurants, accrual accounting is the better and more accurate method. While cash accounting is simple, it can give a misleading picture of profitability by not recording expenses until cash is paid. Accrual accounting, which records revenue when it’s earned and expenses when they are incurred, provides a clearer, more accurate view of a restaurant's financial health and is the preferred method under GAAP.

How Can Technology Help With Restaurant Accounting?

Technology, such as POS integration and expense management software, can help automate many of the tedious and time-consuming tasks associated with restaurant accounting. It can help you track daily sales, monitor inventory levels, and streamline expense reporting, freeing up your team to focus on serving customers and growing your business.

.webp)