What Counts As Business Mileage?

One of the questions that The IRS states that vehicle expenses can be considered as an "ordinary and necessary" cost in the course of doing business. This includes costs such as fuel, maintenance, insurance, and the vehicle's depreciation. However, for these costs to be considered deductible, the vehicle should be used for business purposes. For mixed use vehicles (both personal and business), expenses must be divided based on actual mileage.

To ensure your vehicle expenses are entirely deductible, a car must be exclusively for business use. But, in cases where the vehicle serves both personal and business functions, only the part attributable to business usage is deductible. Business usage is typically calculated by using a driving log or mileage tracking apps to track the total mileage driven for business purposes and applying either the actual cost method or the standard mileage rate method.

Here are some common trips you can claim as business usage:

- Meeting with clients for business purposes

- Sales calls or client servicing visits

- Traveling to the post office to send customer shipments

- Picking up inventory from a vendor

- Traveling for business-related tasks such as bank visits, and

- Attending business meetings, trade fairs or conferences.

However, detours for personal errands during these journeys would not contribute to deductible mileage. Only mileage directly related to business can be deducted.

What Is Deductible Mileage?

Deductible driving mileage refers to the miles you cover during business operations that you can deduct from your taxes. Not all miles count, and the Internal Revenue Service (IRS) has peculiar guidelines. For instance:

- Miles driven for commuting are not tax deductible for W-2 employees

- Miles driven in a non-passenger in the car have special rules

- Miles driven returning from drop-off points, or while waiting for another ride request

Remember, the first drive from your home to a pickup location doesn't count, neither does your last ride home. Also, personal trips in between rides don't qualify. For example, if your business is ride-sharing and you drive from Oakland to San Francisco to pick up your first passenger, the miles in that trip are deductible.

Why Should You Track Business Mileage?

1. Potential tax savings

Self-employed individuals pay both income tax and self-employment tax to cover Social Security and Medicare obligations. They track taxes and file them quarterly if more than $1,000 is owed.

For example, a self-employed taxpayer in the 24% income tax bracket deducting a 100-mile trip using the IRS standard mileage rate of 70 cents per mile (2025 rate) would save $16.80 ($24 tax saving per $100 profit). This supports the concept of creating a driving log to properly account for business-related trips, helping to efficiently log miles, calculate mileage reimbursement, and deduct the associated mileage tax deduction.

As a self-employed individual, you can deduct your actual automobile expenses using a detailed vehicle mileage tracker. Start by recording your car's odometer reading on January 1st and then again at the end of the year. In between, diligently track all your business trips noting down the starting and ending readings.

For each trip, record the location and business purpose. This can be simplified by keeping a driving log in your car. Divide your business mileage by your total mileage to estimate what percentage of the car use is for business. Use this percentage to deduct the proportional amount of your total expenses. While not a requirement, a detailed mileage log can yield a larger tax break.

Remember: accurate record-keeping is crucial for this method.

Properly tracking mileage for taxes can lead to substantial savings. Here's why it's a game-changer for claiming mileage on taxes:

- Utilizing actual expenses, such as mileage, lodging, food, airfare, and other travel costs, typically leads to bigger savings. Remember, you can only deduct the expenses you incur.

- Thanks to sophisticated expense tracking software, maintaining a record of all vehicle expenses and transactions is a breeze. The app provides an annual summary, making the process efficient.

- Opting for tools to manage receipts adds an edge. Paid apps like Fyle, dash cams, alongside parking and toll charges, roadside assistance, and even certain service apps can all be expensed if more than 30% of their usage is for business purposes, further reducing tax liability.

2. Increased convenience of mileage tracking apps

GPS-enabled mileage tracking apps have simplified business travel deduction processes. These apps accurately and automatically record all business travel miles using GPS tracking, converting them into IRS-compliant reports. The tracked mileage proves helpful for claiming tax savings and for maintaining accurate records during an IRS audit. Moreover, they classify trips, reducing the hassle of handling a driving log, gas receipts, or credit card statements.

3. Enhanced audit preparation

The IRS requires detailed records for proof of business automobile mileage. This includes the total business mileage and total mileage accumulation for the year (business + personal), trip's date, destination, and purpose. It's essential to record activities promptly and maintain a contemporaneous driving log detailing date, miles driven, and business purpose. Here’s how you can improve record-keeping for audit purposes:

- Start with ensuring a meticulous mileage log for all business-related travel. This acts as an effective audit trail, aiding you in proving validity should the IRS request documentation in an audit. Remember, failing to prove your claimed deductions could result in fines due to underpayment of taxes.

- A key tip is to create a template with columns for travel date, destination, purpose, total trip mileage, and expenses like gas, tolls, etc. This ensures you capture all required details for each trip, all neatly laid out for a potential audit.

- Finally, remember to consult with tax professionals who can guide you in optimizing your income tax returns and calculate your tax savings. This not only enhances your audit readiness but also ensures you save every possible cent.

How To Calculate Mileage Reimbursement

There are two ways you can calculate business mileage:

1. The Standard Mileage Method

The standard mileage method is a simplified method to deduct business mileage expenses on your tax returns. Instead of tracking and calculating actual expenses related to your vehicle, you use a standard mileage rate provided by the IRS to determine your deduction. The standard mileage rate considers various vehicle ownership and operation costs, including fuel, depreciation, maintenance, and insurance.

For example, let's assume you use your personal vehicle for business purposes and want to calculate your business mileage deduction using the standard mileage method for the tax year.

- Determine the IRS Standard Mileage Rate: You can check the IRS website or consult a tax professional to find the standard mileage rate for the tax year. For this example, let's use the 2025 rate of $0.70 per mile.

- Calculate the Total Business Miles You Drove During the Year: Let's assume you drove 10,000 miles for business.

- Calculate the Deduction: Multiply the total business miles by the IRS standard mileage rate.

10,000miles (Business Miles Driven)×0.70(Standard Mileage Rate)=7,000

In this example, using the standard mileage method, you would be eligible to deduct $7,000 as your business mileage expenses for the year.

Key Points to Remember:

- The standard mileage rate typically covers various vehicle operating costs, such as fuel, depreciation, maintenance, and insurance.

- You cannot deduct additional expenses, such as tolls, parking fees, or interest on a car loan, separately when using the standard mileage method.

- You must have accurate records of your business mileage, including the date, purpose, and number of miles driven for each business trip.

- The IRS updates the standard mileage rate annually, so ensure you check the updated rate each tax year.

The standard mileage method offers simplicity and convenience, making it a popular choice for many taxpayers.

2. The Actual Expense Method

The actual expenses method is an alternative to the standard mileage rate method. Instead of calculating your deduction based on a predetermined rate per mile, the actual expenses method allows you to deduct the actual costs associated with using your vehicle for business purposes. These costs include fuel, maintenance, repairs, insurance, depreciation, and other related expenses.

For example, let's say you use your personal vehicle for business purposes, and you want to calculate your business mileage tax deduction using the actual expenses method for the tax year.

1. Gather Expense Information:

- Fuel Costs: $5,000

- Maintenance and Repairs: $1,500

- Insurance: $1,200

- Depreciation: $2,500 (based on the vehicle's depreciation over the year)

- Other Expenses (e.g., tolls, parking fees, interest on a car loan): $2000

- Total actual expenses: $12,200

2. Calculate the total number of business miles driven: Suppose you drove 10,000 miles for business.

3. Determine the Business Use Percentage: Divide your business miles by the total miles driven during the year. Let's say you drove a total of 20,000 miles in the year, so the business use percentage is 50%.

4. Calculate the Deduction: Multiply the total actual expenses by the business use percentage

$12,200 (Total Actual Expenses) * 50% (Business Use Percentage) = $6,100

In this example, using the actual expenses method, you would be eligible to deduct $6,100 as your mileage tax deduction for the year. This deduction reflects the actual costs you incurred while using your vehicle for business purposes, taking into account fuel, maintenance, insurance, depreciation, and other relevant expenses.

Key Points to Remember:

- Actual expenses method can be more complex to calculate and requires thorough record-keeping to substantiate your expenses.

- You must meet certain IRS mileage reimbursement rules and maintain detailed driving logs and records to support your deduction.

Standard Mileage Vs Actual Expenses: Which Should You Choose?

Whether to use the standard mileage method or the actual expenses method for deducting business mileage depends on your specific circumstances and financial considerations. If you have relatively low vehicle expenses and a straightforward business mileage situation, you may find the standard mileage method more convenient and sufficient.

However, those with significant vehicle-related expenses or unique conditions may benefit from the actual expenses method. Please note electing S-corp status can change this calculation. Ultimately, your chosen method should align with your specific financial goals and tax situation.

What is the Standard Mileage Rate?

The Standard Mileage Rate is a measure issued annually by the IRS to determine the deductible costs of operating an automobile for business.

IRS Standard Mileage Rate 2025

IRS standard mileage rates for the year 2025 are:

- For business use: 70 cents per mile

- For medical or moving (qualified Armed-Forces members): 21 cents per mile

- For charitable organizations: 14 cents per mile

Source: IRS 2025 Mileage Rates

How To Calculate Mileage For Taxes

Here’s how to track mileage for taxes. There are three ways:

1. Set your odometer readings at the start and end of the tax year

To use the trip setting on an odometer, simply press the odometer's "trip" button until it displays "Trip A" or "Trip B". Reset it to zero before departing. Once the trip ends, note the miles driven. Always remember to reset before each new trip for accurate mileage recording.

- Start your tax year by noting down the odometer reading on January 1st in your driving log.

- Whenever you use your car for business trips, record the miles traveled.

- At the end of the year, again note down the odometer reading.

- Calculate your total business miles by using your start and end odometer readings, and your recorded business miles.

Expert tip: Accurately tracking your exact mileage for business trips aids in substantiating your tax deduction, especially if you opt for the Standard Mileage method. Plus, the IRS may require this data for validation! Remember, proper bookkeeping pays off during tax time.

2. Keep a mileage log

To keep a manual mileage log for taxes with pen and paper, start with a new notebook dedicated for this purpose. Write down the date, the purpose of your trip, your starting and ending locations, and the beginning and ending odometer readings on each trip. Subtract the starting reading from the ending reading to find out how many miles you drove. Make sure to keep this record updated regularly for accurate tracking.

Keeping track of your mileage manually can require diligence, but remember, it could save you money on your taxes. Follow these steps:

- Write down the date of each drive.

- Record the total mileage driven. Consider noting your odometer readings before and after each trip.

- Jot down the starting and ending points for your journey.

- Specify the purpose of your trip. If it's for business, add some details.

- Adding receipts for related expenses like parking or tolls can be beneficial.

- Update your driving log regularly, ideally at the end of each business trip.

- Double-check your entries weekly for accuracy and completeness. Don't forget, precise record-keeping is key.

Download your free IRS-compliant mileage log today!

3. Using a mile tracker app

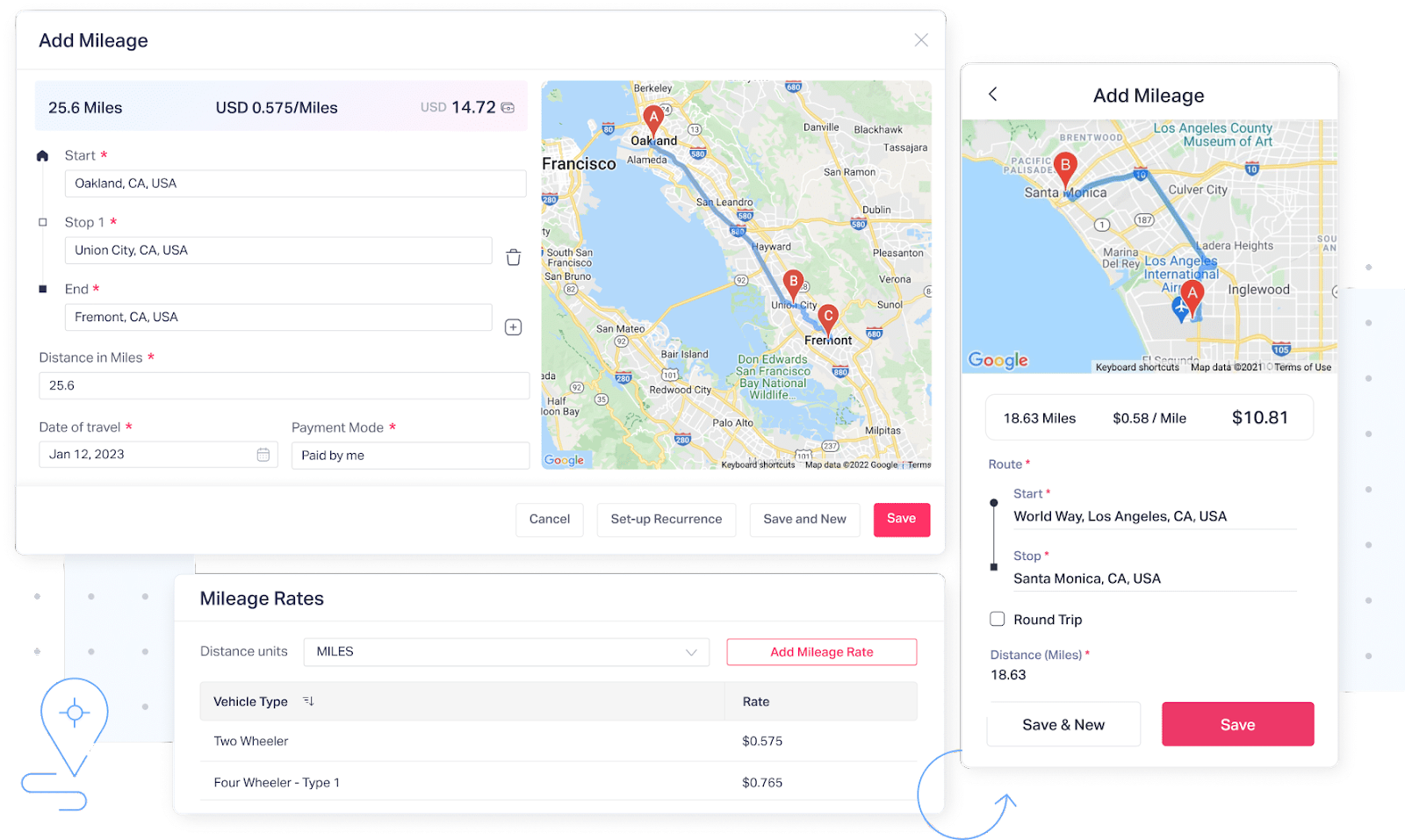

The easiest way to calculate mileage reimbursement is by using a business mileage tracker. And the best mileage tracking app in the market is Fyle. Fyle uses Google Maps for tracking, which has pinpoint precision, eliminating the inaccuracies associated with manual methods. This saves you time and helps you keep a detailed record of your business trip with no extra effort.

All you need to do is add your start, stop, and end location, and the system will automatically calculate distance and cost based on differential mileage rates set by Finance.

The mile tracker app enables employees to duplicate or automate a recurring mileage expense in case they use the same route repeatedly (for example, home to office and back). Additionally, with Fyle's new deduct commute feature, you can ensure that your employees only track business-related mileage, preventing overpayment due to personal commute distances.

Detailed records, including each trip's date, time, distance, and purpose, are automatically maintained, simplifying tax and audit preparation.

Fyle also integrates seamlessly with accounting software like NetSuite, QuickBooks, Sage Intacct, and Xero, streamlining the tax filing process. Fyle's mobile app for tracking mileage is user-friendly, cost-effective solution redefines how businesses manage mileage, offering precision, convenience, and compliance in one package.

Why Using Mileage Tracking Apps Are Better

- Greater accuracy: One of the biggest advantages of using a mile tracker is its unparalleled accuracy. These apps use GPS or Google Maps to track your trips, eliminating the margin for human error that comes with manual tracking methods. This accuracy ensures you claim the correct tax deduction, minimizing the risk of audits and penalties.

- Comprehensive Records: The IRS mileage reimbursement rules require detailed records to substantiate mileage deductions. You can access a lot of information using mileage tracker apps, including the trip's date, time, distance, and purpose. If you're ever audited, having such comprehensive records at your fingertips can be invaluable.

- Saves time: Traditional mileage tracking methods, like pen and paper, spreadsheets, or a mileage log, can be time-consuming. On the other hand, mileage tracking apps automate the process, saving you precious time better spent on other value-adding activities. When you begin, punch in your current location and destination in the app, and let it take care of the rest.

- Easy expense tracking: Besides calculating mileage, some mileage tracker apps also allow you to record related expenses, such as tolls, parking fees, and other costs. These features can simplify your record-keeping process further and provide a more comprehensive view of your deductible business expenses, ultimately maximizing your tax savings.

- IRS Compliance: Using a mileage tracking app ensures that you comply with IRS mileage reimbursement rules for mileage deduction. The IRS requires taxpayers to maintain records created at or near the time of the expense. Mileage tracking apps fulfill this requirement seamlessly, reducing the risk of your mileage tax deduction being disallowed due to record-keeping deficiencies.

- Seamless Integration: Many mileage tracking apps can integrate with popular accounting software and tax preparation platforms. This streamlines the tax deduction for mileage, as you can easily export your mileage logs, reducing the chances of errors during manual data entry.

Suggested read: Ultimate Guide to Mileage Reimbursement in 2025

In Conclusion

When you calculate mileage reimbursement efficiently for tax purposes, it is not only about complying with the regulations but also a strategic move to maximize tax deduction for mileage and minimize mileage tax liabilities. By understanding what qualifies as a mileage tax deduction, you can take advantage of deductible opportunities, and by selecting the appropriate method to track taxes for your specific travel mileage situation - the standard mileage or actual expense method - you position yourself for potential tax savings.

The significance of keeping an accurate driving log cannot be overstated, and tools like Fyle's mileage and expense tracking app become invaluable assets by providing precision, convenience, and compliance in a single package. For businesses seeking to save on taxes or optimize expenses, the key takeaway is clear: calculating mileage in detail pays off, and with Fyle, the best mileage tracker app, it can make a significant difference in your tax obligations.

%20Expenses%20-%20main.webp)