Cost control is an essential process for any business looking to maximize profitability for long-term success. Keeping expenses in check ensures that businesses can stay competitive in their industries while being able to free up resources to reinvest in their growth.

This guide will explore the basis of cost control and effective strategies that businesses can implement to reduce their expenses without compromising quality or service.

What Is Cost Control?

Cost control involves managing and regulating business expenses to meet financial goals. It usually involves monitoring, analyzing, and adjusting your operating expenses to ensure that they don’t exceed the allocated budget.

Please note that cost control is not the same as cost reduction; the latter focuses solely on cutting expenses, while cost control tries to ensure that even by reducing costs, you’re still aligned with financial goals.

The Basics of Cost Control

Here are some of the basics of cost control you’d need to understand to implement your strategies effectively:

- Target Net Income: Helps businesses set income goals based on expense estimates, thereby providing a benchmark for financial planning.

Target Net Income = Sales - Fixed Costs - Variable Costs

- Identifying Cost Drivers: Have a clear understanding of what’s driving your expenses, be it labor, materials, or overhead.

- Fixed vs. Variable Costs: Separate your fixed costs (rent, salaries) from variable costs (supplies, utilities) so you can manage them differently.

Source: (U.S. Bureau of Labor Statistics)

Why Is Cost Control Important for Businesses?

Cost control is critical for businesses to maintain a healthy profit margin. Unchecked expenses can often eat into profits and threaten a business’s sustainability. Having effective cost control measures in place ensures that you can operate efficiently, reinvest in key areas, and remain competitive.

Here are three main ways in which cost control helps businesses:

- Improved Profitability: Helps reduce unnecessary spending, leading to a higher net income.

- Operational Efficiency: Streamlining processes ensures your resources are better utilized.

- Financial Flexibility: Having a guardrail on costs ensures there’s always room for reinvestment and growth.

9 Cost Control Methods Business Can Implement

Here are nine practical methods businesses can use to control costs effectively:

Budgeting

A clear and well-defined budget provides your business with a financial roadmap. You could try zero-based budgeting, where each expense would need justification from scratch, ensuring that only essential costs are considered.

Expense Tracking

Tracking your business expenses in real time can help avoid overspending. For instance, tools like Sage Expense Management integrate directly with credit card networks to give you real-time notifications on all business credit card spend.

This ensures you have instant visibility on all employee spending and are always aware of company-wide spending.

Identify and Eliminate Unnecessary Spending

Evaluate all your expenses regularly to identify those that no longer serve your business. From unused subscriptions to redundant processes or workflows, eliminating waste can ensure you save thousands annually.

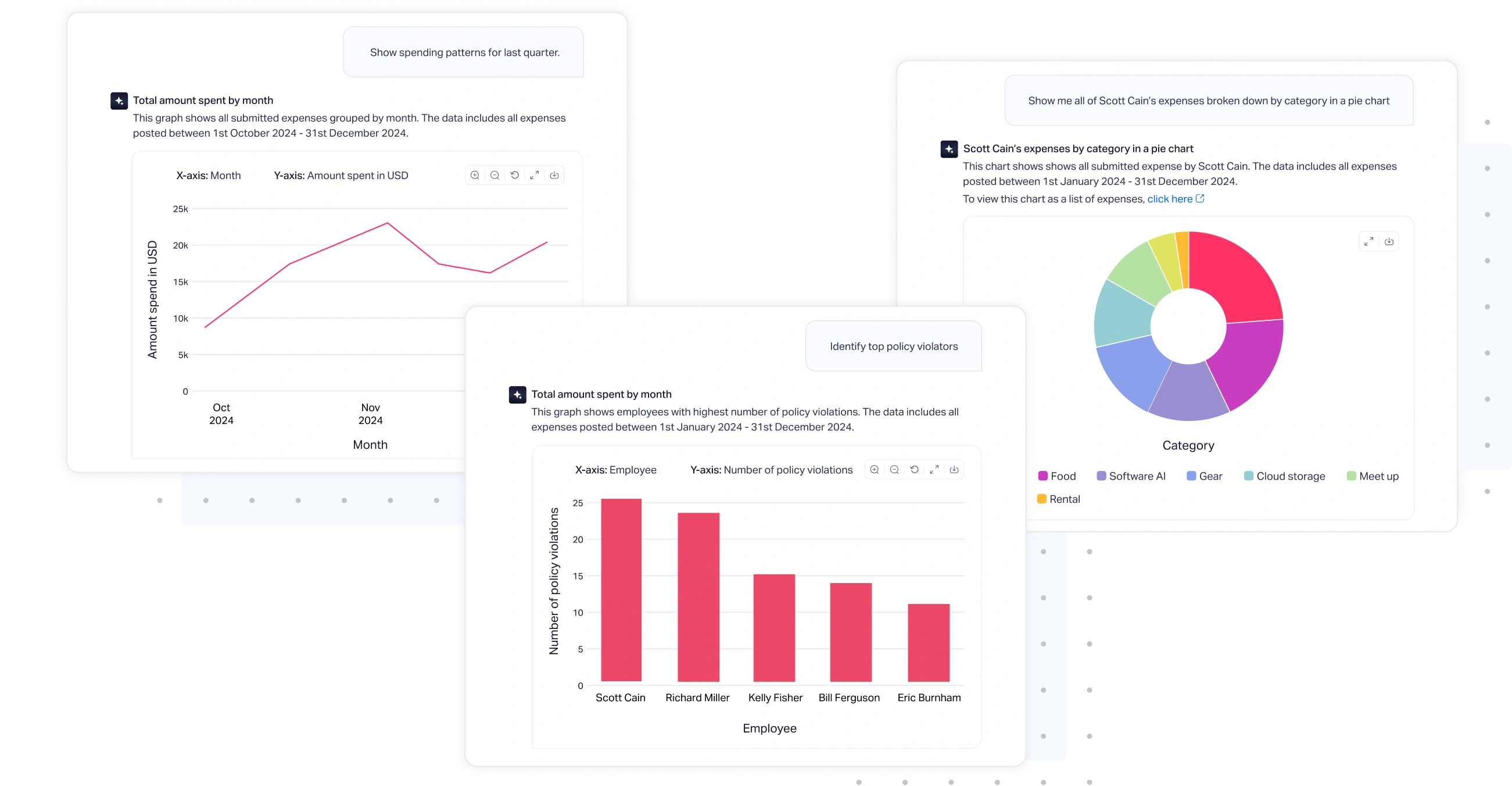

With Sage Expense Management's CoPilot, you can examine your business credit card and reimbursable spending patterns, compare them across different time frames, and gain valuable AI-driven insights that guide you toward more informed decision-making, all through simple queries.

Improve Operational Efficiency

Streamline all your existing workflows to reduce wasted time and resources. Automation is key here, especially in areas like invoicing, expense management, inventory management, and payroll processing.

Outsourcing and Freelancing

You might not always need full-time staff for every role in your organization. Consider outsourcing specific tasks or hiring freelancers.

This is because it’s more cost-effective to bring in freelancers or contractors for specific tasks rather than adding a permanent staff member, which could cost businesses between $4,000 to $20,000 before even factoring in salaries (Indeed).

Source: Shopify

Energy Efficiency

Invest in energy-efficient technology or similar initiatives to help reduce utility costs in the long run. For instance, switching to LED lighting, reducing water consumption, or even using renewable energy can create lasting savings.

Inventory Management

Mismanaging your inventory can lead to high holding costs or stockouts. Implement a just-in-time inventory to optimize your supply chain and reduce excess stock.

Vendor Negotiations

Review your vendor contracts regularly to negotiate better deals, or try switching to a cost-effective supplier. Remember that long-term relationships with vendors may also lead to volume discounts.

Employee Costs

Balancing your employee’s morale along with labor costs is a fine line. Introduce flexible work hours, offer remote or hybrid work, and optimize staffing levels to maintain productivity while reducing overhead.

How Sage Expense Management (formerly Fyle) Can Help Businesses Control Costs

Sage Expense Management makes expense management seamless by offering real-time expense tracking and analytics. Employees are instantly notified of corporate card transactions via text or Slack. They just need to reply with a picture of the receipt post which it automatically matches to the correct expense.

Sage Expense Management's dashboard offers powerful analytics, providing instant visibility into business credit card and reimbursable spend data. You can track spend patterns, compare them over time, and break down expenses by merchant, department, or project to make more informed decisions.

With detailed insights, you can monitor policy violations, top spenders, and ensure budgets stay on track for better financial control.

In Conclusion

Cost control is an ongoing process that requires thoughtful planning, regular monitoring, and the use of efficient tools. From budgeting to real-time expense tracking, businesses can implement several strategies to optimize their costs.

With tools like Sage Expense Management, businesses gain better visibility into their spending, ensuring they remain agile and financially healthy in an ever-changing market.