4.6/51670+ reviews

4.6/51670+ reviewsWhen you invest in office furniture, such as desks, chairs, and cabinets, you are acquiring long-term assets for your business. A common and significant tax mistake is treating these purchases as office supplies and deducting the full cost in the year of purchase.

The IRS, however, views furniture as a capital expense. This means you cannot deduct the cost immediately. Instead, you must capitalize the expense and recover it over several years through a process called depreciation. This guide explains the correct tax treatment for office furniture, ensuring your business remains compliant and maximizes its tax benefits.

Office furniture is a tangible business asset with a useful life of more than one year. As such, IRS Publication 535 categorizes its cost as a capital expenditure. This means the cost is not a current-year expense but an investment in your business.

The cost of these assets is recovered through annual depreciation deductions. The annual depreciation expense is calculated on Form 4562, and the total is then carried to your main business tax return.

The key to handling these costs correctly is to understand the difference between a small, deductible expense and a larger, depreciable asset.

The cost of office furniture, including any freight and installation charges, must be capitalized and depreciated over its useful life or recovery period.

IRS Publication 535 provides a significant exception for small-cost items. You can elect to deduct the cost of tangible property in the current year if it falls below a certain threshold.

If you repair existing furniture, the cost is a currently deductible repair and maintenance expense. However, if you pay for a significant improvement or betterment—such as completely reupholstering all office chairs—that cost must be capitalized and depreciated over time.

The primary way to recover the cost of office furniture is through depreciation or the Section 179 deduction.

For tax purposes, office furniture is generally classified as 7-year property under the Modified Accelerated Cost Recovery System (MACRS), as detailed in IRS Publication 946. This means you will deduct the cost over a period of 8 calendar years (due to the half-year convention).

As an alternative to depreciation, IRS Publication 334 explains that you may be able to elect to deduct the full cost of qualifying property, including office furniture, in the year it is placed in service. This is referred to as the Section 179 deduction. This valuable deduction is subject to annual dollar limits, but it allows for immediate cost recovery rather than waiting years.

Whether you use MACRS depreciation or the Section 179 deduction, the amount is calculated and reported on Form 4562. The total from this form is then carried to Line 13 of Schedule C.

You must keep detailed records to substantiate the cost and purchase of your office furniture. This includes:

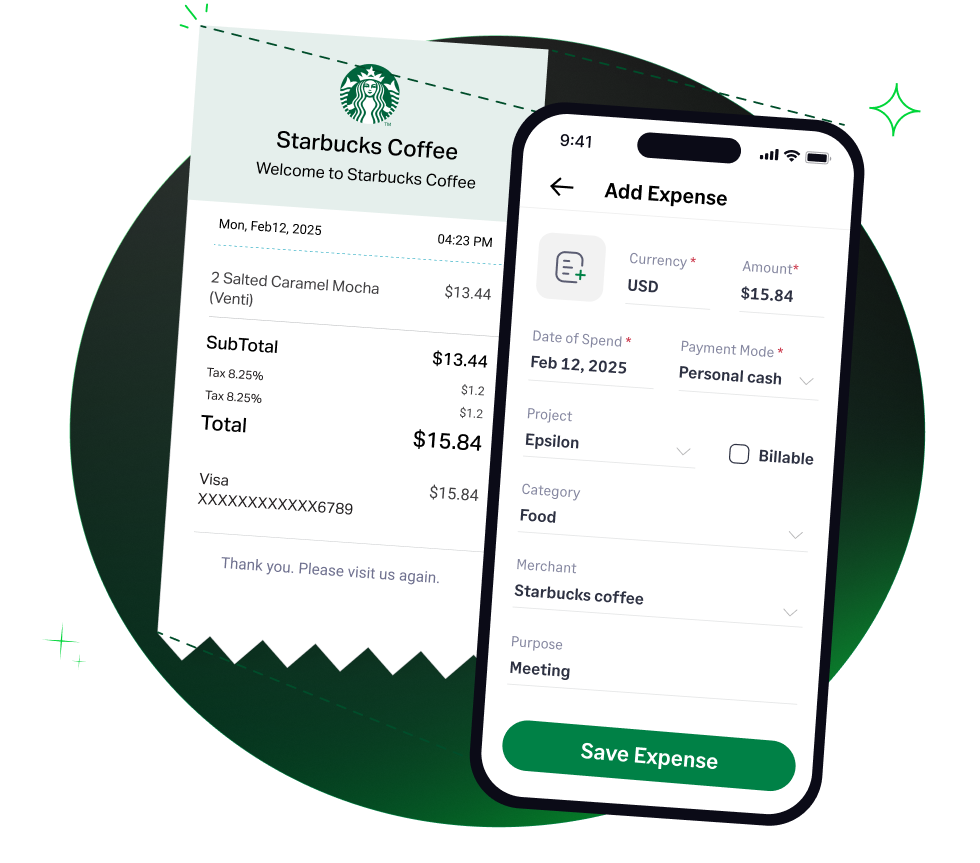

Sage Expense Management is the ideal system for the first and most critical step in depreciation: capturing and documenting the purchase of a capital asset, such as office furniture.