Small businesses often face tight financial constraints while striving for growth. Even with a remarkable product or service and a strong customer base, managing finances efficiently is critical.

Thankfully, the tax system offers relief through various deductions and credits designed specifically for small businesses. These tools can help reduce tax liabilities, retain cash for growth, and improve overall financial health.

This blog explores the tax deductions and credits that small businesses can leverage to reduce taxable income and save money. It also highlights how tools like Sage Expense Management (formerly Fyle) can simplify the process of managing expenses, ensuring you don’t miss out on potential savings.

Let’s dive in!

What is a Tax Deduction?

A tax deduction reduces your taxable income by accounting for business-related expenses. For example, if you taxable income is $100,000 and you claim $20,000 in deductions, your taxable income drops to $80,000.

Understanding which expenses qualify for deductions and tracking them accurately is key to maximizing savings. Generally, these expenses must be ordinary and necessary for your business.

How Do Tax Deductions Help Businesses?

Tax deductions directly impact your bottom line. By reducing taxable income, they allow businesses to:

- Save money on taxes.

- Reinvest in growth initiatives like hiring, marketing, or expanding operations.

- Stay compliant with tax regulations.

These savings can make a significant difference for small businesses operating on slim margins.

What Qualifies as a Tax Deductible Expense?

To be deductible, an expense must be:

- Ordinary – Common and accepted in your trade or business.

- Necessary – Helpful and appropriate for your business.

Examples include utilities, office supplies, and wages. Expenses that are partly personal and partly business-related, such as internet costs, may be partially deductible. Accurate record-keeping is essential for claiming these deductions.

Essential Small Business Tax Deductions

Here is a list of the most common small business tax deductions you should take advantage of for your small business:

1. Utilities

Business-related expenses for utilities such as electricity, water, internet, and telephone services are fully deductible. However, if you use these utilities for both personal and business purposes, only the business-related portion is deductible.

For example:

- If 40% of your internet use is for business, you can deduct 40% of the cost.

- Detailed records, such as bills and usage logs, can help justify this deduction during audits.

2. Bad Debts

Bad debts arise when you are unable to collect money owed to your business, resulting in financial loss. These debts typically occur in situations where you have provided goods, services, or loans, but the payment is either partially or entirely uncollectible.

Deducting bad debts can help you offset the loss on your tax return, provided you meet the necessary criteria set by the IRS.

Examples of Bad Debts

Business bad debts may result from the following scenarios:

1. Loans to Clients, Suppliers, or Employees

- If your business extends a loan to a client, supplier, or employee for a legitimate business purpose and the borrower fails to repay, the unpaid amount may qualify as a deductible bad debt.

- For example, a supplier who receives an advance to complete an order but fails to deliver the goods or refund the money would create a bad debt situation.

2. Uncollected Payments from Customers

- Businesses using the accrual method of accounting report income when it is earned, not when it is received. If a customer fails to pay for goods or services, the uncollected amount may be deducted as a bad debt.

- For instance, an unpaid invoice for a large order delivered to a customer can be written off if the client defaults on payment.

3. Guarantees Paid on Behalf of Another Party

- If you guarantee a loan for a client or vendor and end up paying the loan on their behalf because they defaulted, this amount could also qualify as a bad debt.

- For example, a business owner guarantees a loan for one of their key distributors to maintain operations, but the distributor fails to repay the loan. The amount the owner repays on behalf of the distributor may be deducted as a bad debt.

Key Requirements for Deducting Bad Debts

To qualify for a bad debt reduction, you must meet the following criteria:

1. The Debt Must be Related to Your Trade or Business

The debt must have been created or acquired as part of your business activities. For example, personal loans to friends or family members do not qualify, even if the loan was intended to help them start a business.

2. You Must Prove that the Debt is Worthless

The IRS requires businesses to make a genuine effort to collect the debt before it can be considered bad. This includes sending payment reminders, attempting to renegotiate terms, and documenting all attempts to recover the debt.

If a customer files for bankruptcy or repeatedly ignores collection notices, these can serve as evidence of worthlessness.

3. Documentation is Essential

Keep thorough records of all relevant documents, including loan agreements, invoices, correspondence with the debtor, and evidence of collection attempts. This is crucial in case the IRS audits your deduction claim.

3. Depreciation

Depreciation is a tax deduction that enables businesses to recover the cost of tangible assets used in their operations. Instead of deducting the full expenses in the year the asset is purchased, depreciation spreads the deduction over the asset’s useful life. This approach aligns with the gradual wear and tear or obsolescence that assets experience over time.

What Can Be Depreciated?

Depreciation applies to tangible assets that:

- Are owned by the business: You must legally own the asset, even if it’s being paid for over time (e.g., through a loan or installment purchase).

- Are used for business purposes: The asset must be employed in your trade or business to produce income. Personal-use assets, such as a car used solely for commuting, are not eligible.

- Have a determinable useful life: Assets must have a predictable lifespan exceeding one year. For example, machinery may have a useful life of 10 years, while computers might last 3-5 years.

- Deteriorate over time: Assets that don’t physically deteriorate, like land, cannot be depreciated.

Examples of depreciable assets include:

- Buildings and improvements (excluding land).

- Machinery, tools, and manufacturing equipment.

- Office furniture, fixtures, and technology.

- Vehicles used exclusively for business.

- Intangible property like patents and copyrights (which are amortized instead of depreciated).

How to Claim Depreciation

- Identify assets eligible for depreciation and their costs, including installation or shipping fees.

- Choose the appropriate depreciation method (e.g., straight-line, Section 179).

- Complete and attach Form 4562 (Depreciation and Amortization) to your business tax return.

- Keep records of asset purchases, usage, and calculations for at least three years after filing.

Also Read

4. Amortization

Amortization is a method of deducting the cost of certain intangible assets over a specified period, typically reflecting the asset’s useful life. It’s similar to depreciation but applies to non-physical assets such as patents, copyrights, trademarks, and startup costs.

Key Points about Amortization

1. Intangible Assets

These include legal rights or intellectual property that contribute to business operations.

Examples: Trademarks, patents, goodwill, organizational costs, and software.

2. Straight-Line Deduction

Amortization spreads the cost evenly over the asset’s useful life. For instance, if you spend $15,000 to acquire a patent with a 15-year life, you can deduct $1,000 annually.

3. Startup Costs

Costs incurred before starting operations (e.g., market research, legal fees, and training) can also be amortized over 15 years, provided they exceed $5,000.

Steps to Claim Amortization

- Identify the qualifying intangible asset and determine its cost and useful life.

- Complete Part VI of Form 4562 to report amortization expenses for the current year.

- To substantiate the deduction, maintain documentation, such as purchase agreements or legal filings.

5. Office Supplies

Office supplies are day-to-day items necessary for running a business. They are fully deductible if purchased and used within the same tax year.

What Qualifies as Office Supplies?

- Basic Supplies: Paper, pens, notebooks, printer ink, staplers, and cleaning products.

- Electronics and Equipment: Computers, printers, and monitors. High-cost items may need to be depreciated or deducted under Section 179 instead.

Tips for Tracking Office Supply Expenses:

- Keep receipts and invoices for every purchase.

- Categorize expenses in your accounting system for easier tax reporting.

- Use tools like Sage Expense Management to streamline tracking and ensure no expense is overlooked.

6. Auto Expenses

If you use a vehicle for business purposes, the IRS allows you to deduct certain expenses, either using actual costs or the standard mileage rate.

Two Deduction Methods:

- Actual Expense Method: Deduct actual costs incurred for fuel, maintenance, insurance, repairs, depreciation, and lease payments.

- Standard Mileage Rate: For 2025, this is 70 cents per mile driven for business purposes.

What Counts as Business Mileage?

- Driving to client meetings or project sites.

- Traveling between two business locations.

- Running business errands (e.g., delivering products, picking up supplies).

Record-Keeping Requirements:

- Maintain a mileage log with dates, destinations, business purposes, and mileage for each trip.

- Keep receipts for fuel, repairs, and other auto-related expenses if using the actual expense method.

Also Read

- How To Track Mileage For Taxes: A Complete Guide

- Business Miles vs Commuting Miles: All The Differences

7. Business Meals

The IRS allows businesses to deduct the cost of meals incurred while conducting business, but there are rules and limitations.

Deduction Rules:

- Standard Deduction: 50% of the meal cost is deductible. However, some meals, such as those provided at office parties or during recreational events, are 100% deductible.

- Business Purpose: The meal must be directly related to business discussions or activities.

What to Document:

- Date and location of the meal.

- Names and roles of attendees.

- Purpose of the meal and its connection to business activities.

Examples of Deductible Meals:

- Lunch meetings with clients to discuss projects.

- Meals provided during a training seminar for employees.

- Office holiday parties or team-building dinners (100%

8. Employee Wages

Paying employees is a major business expense, but wages, salaries, and certain employee benefits are deductible.

What Qualifies as Deductible Wages?

- Salaries paid to employees who are not owners or partners in the business.

- Bonuses, commissions, and benefits paid under a pre-agreed structure.

- Vacation and sick pay, provided it aligns with your employment policies.

Tests for Deductibility

- Reasonableness Test: Wages must be reasonable for the services performed. Excessive pay may be disallowed.

- For Services Rendered: Payments must directly relate to work performed by the employee.

Filing Requirements

- Report wages using Form W-2 for each employee.

- File copies of the W-2 with the IRS and Social Security Administration (SSA).

9. Office Furniture

Office furniture is considered a type of office supply and can be deducted similarly to other office expenses like printer paper or cleaning products. Therefore, purchasing furniture for your small business will fall under deductible business expenses on your tax return.

10. Travel Expenses

Business-related travel expenses are deductible, but they must meet certain criteria to qualify.

Examples of Deductible Travel Expenses

- Transportation: Airfare, train tickets, rental cars, and mileage for personal vehicles used for business.

- Lodging: Hotel stays while traveling for business.

- Meals: Deductible at 50% for business trips.

- Incidental Expenses: Tips, dry cleaning, baggage fees, and internet charges.

Requirements for Deduction:

- The travel must be primarily for business purposes.

- The trip must take you away from your tax home (the city or area where your business is based).

- Personal activities during the trip, such as sightseeing, are not deductible.

11. Contracted Labor

If you use independent contractors or freelancers as part of your labor force, the cost of hiring contracted labor is a tax-deductible business expense. However, you must issue a Form 1099-MISC to any contract worker who received $600 or more from you in a given tax year. In addition, if the worker is being paid via credit card or PayPal, the payment processor must issue Form 1099-K to the worker.

12. Moving Expenses

If you move and the primary reason for doing so is work-related, you can deduct the costs associated with the move. To qualify, your move must meet the distance test. To pass the distance test, your new job location must be at least 50 miles farther from your former home than your old job location was from your previous home.

13. Home Office Expenses

If you use part of your home exclusively for business, you may qualify for home office deductions. This can significantly reduce your tax liability.

Deduction Methods:

- Simplified Method: Deduct $5 per square foot of your home office space, up to 300 square feet (maximum $1,500 deduction).

- Actual Expense Method: Calculate the percentage of your home used for business and apply it to total expenses like rent, utilities, insurance, and maintenance.

Eligibility Criteria:

- The space must be used exclusively and regularly for business.

- It must serve as your principal place of business or a location for meeting clients.

Examples of Deductible Home Office Expenses:

- Mortgage interest or rent.

- Utility bills (electricity, water, and internet).

- Repairs and maintenance for the office space.

Pro Tip: Use Form 8829 to calculate and report home office deductions. Ensure you maintain documentation, such as utility bills and floor plans, to substantiate your claim.

14. Business Property Rent

If your business rents a physical location, office space, or equipment, the rental payments can be fully deducted as a business expense. This deduction applies to various rentals, including long-term leases and short-term equipment rentals essential for business operations.

1. What Qualifies

- Rent for office spaces, retail shops, warehouses, or equipment used exclusively for business.

- Storage units or other facilities used for inventory or supplies.

2. What Doesn’t Qualify

- Rent paid for a personal residence, even if you have a home office. These expenses must instead be included under home office deductions if eligible.

- Lease-to-own payments where you eventually gain ownership of the property are not deductible as rent; they must be treated as capital expenses.

3. Unreasonable Rent

- The IRS disallows deductions for “unreasonable” rent, typically in cases where the landlord is a related party and charges above-market rates.

15. Software Subscription

If you have purchased or downloaded software for your business, remember that these are deductible business expenses from your tax return. This type of expense can be claimed under the “Other Common Business Expenses>Other Miscellaneous Expenses” category on your Schedule C tax form.

16. Business Entertainment

Entertaining clients or employees can boost morale and foster relationships, and the IRS allows certain business entertainment expenses to be deducted. However, the rules around deducting entertainment are strict and require proper documentation.

Rules around Deducting Business Entertainment Expenses

50% Deductible

- Most client-related meals or entertainment events fall under this category. Examples include taking a client to a sports game or hosting a business lunch.

100% Deductible

- Meals provided during office events, such as holiday parties or team-building activities, are fully deductible.

- Meals included in business-related recreational activities primarily benefiting employees, such as a company picnic.

What Doesn’t Qualify

- Extravagant or personal entertainment, such as vacations or non-business-related outings.

- Entertainment where no business discussion takes place or is incidental to the activity.

Pro Tip: Document every detail, including the purpose, attendees, and receipts. IRS scrutiny on entertainment expenses is high, so keep thorough records.

17. Child and Dependent Care

You can claim a tax deduction on your expenses for caring for your children or adult dependents. If you have children who are 12 years old or younger, deduct the expenses associated with their care.

Adult dependents, including spouses and certain other related adults who are unable to care for themselves due to physical or mental disability, also qualify for deductions.

18. Advertising and Marketing

As long as you have evidence that advertising and marketing expenses are related to your small business, you can claim a tax deduction for the money spent. This includes money spent on billboards, business cards, direct mails, or hiring a freelancer to design a business logo.

19. Employee Benefits Programs

Providing employee benefits not only boosts morale but also offers significant tax advantages for businesses.

Contributions towards benefits like healthcare, retirement plans, and education assistance are deductible.

1. Health Insurance Contributions

- Premiums paid for employee health coverage under a qualifying arrangement are deductible.

- Small businesses offering health coverage through the SHOP Marketplace may qualify for the Small Business Health Care Tax Credit.

2. Retirement Contributions

- Contributions to employee 401(k) plans, SIMPLE IRAs, or SEPs are deductible.

3. Other Benefits

- Dependent care assistance programs.

- Pre-tax deductions under Section 125 for health savings accounts (HSAs) and flexible spending accounts (FSAs).

Additional Benefits

- Employers providing paid leave may qualify for a credit of 12.5% to 25% of the wages paid during the leave period.

- Contributions toward an employee’s professional development or education assistance may also qualify as deductions.

Tax Credits for Small Business

Tax credits are a way to reduce the tax bill of your small business by a certain dollar amount or percentage of a specific cost, making them an effective way to alleviate tax liability. Let us take a look at various tax credits that you can benefit from:

1. Research and Development (R&D) Tax Credits

The R&D tax credit is designed to incentivize businesses to invest in innovation, including developing or improving products, processes, or software. This credit helps offset the costs associated with research and experimentation.

Qualifying Activities:

- Developing new products, formulations, or software.

- Improving existing products, increasing performance, reliability, or efficiency.

- Conducting prototype testing or experimentation.

Ineligible Activities:

- Research conducted after commercial production has started.

- Customizing existing products for individual customers.

- Activities performed outside the U.S.

How to Claim:

Businesses use Form 6765 (Credit for Increasing Research Activities) to claim this credit. Eligible small businesses can also use the R&D credit to offset their Alternative Minimum Tax (AMT).

2. Small Business Health Care Tax Credit

This credit is aimed at small employers offering their employees health insurance through the SHOP Marketplace. It can help alleviate the cost of providing coverage.

Eligibility Criteria:

- The employer must have fewer than 25 full-time equivalent employees (FTEs).

- The average annual wages per employee must be less than $62,000 (for 2024, adjusted annually).

- The employer must pay at least 50% of the employee's health insurance premiums.

Credit Amount:

- Up to 50% of premiums paid for small businesses.

- Up to 35% for tax-exempt employers.

How to Claim:

Calculate the credit using Form 8941 and file it with your annual tax return. Excess credit amounts can often be carried forward to future years.

3. Work Opportunity Tax Credit (WOTC)

The WOTC is a federal credit offered to employers who hire individuals from certain target groups facing significant employment barriers.

Qualifying Target Groups:

- Veterans.

- Long-term unemployed individuals.

- Recipients of Supplemental Nutrition Assistance Program (SNAP) benefits.

- Ex-felons and other economically disadvantaged individuals.

How to Claim:

- Employers must obtain certification by submitting Form 8850 to their state workforce agency within 28 days of the employee’s start date.

- Once certified, claim the WOTC using Form 5884.

Pro Tip: The credit amount varies based on the number of hours worked and the wages paid, so ensure proper documentation of both.

4. Energy Efficiency Tax Credit

This credit rewards businesses for making energy-efficient upgrades to their facilities. It supports sustainability efforts while lowering tax liability.

Qualifying Activities:

- Building Improvements: Earn up to $1.80 per square foot for improvements such as energy-efficient windows, lighting, or HVAC systems.

- Solar Investments: Claim a 26% credit for installing solar panels or other renewable energy solutions.

- Other Renewable Energy Projects: Wind turbines and geothermal heat pumps may also qualify.

How to Claim:

Use the appropriate tax forms based on the type of improvement, such as Form 3468 for renewable energy credits.

5. Employer-Provided Childcare Credit

This credit incentivizes businesses to support their employees by providing or subsidizing childcare services.

Credit Details:

- Equal to 25% of qualified childcare facility expenses (e.g., constructing, maintaining, or operating a childcare facility).

- Includes an additional 10% for referral services that connect employees with childcare providers.

- The credit is capped at $150,000 annually.

Eligibility Criteria:

- Expenses must be directly related to providing childcare services for employees.

- Costs for facility improvements, training childcare workers, or paying higher wages to qualified childcare staff are eligible.

How to Claim:

File the credit using Form 8882 (Credit for Employer-Provided Childcare Facilities and Services).

6. FICA Tip Credit

This credit is available to businesses in the food and beverage industry where tipping is customary. It allows employers to recover the 7.65% FICA taxes they pay on tips that exceed the federal minimum wage.

Eligibility Criteria:

- The business must employ tipped workers in the food or beverage industry.

- Tips must be reported by employees and used to calculate FICA taxes.

How to Calculate:

The credit equals the employer’s share of FICA taxes paid on tips beyond the federal minimum wage of $5.15/hour (the 2007 rate used for this calculation).

How to Claim:

File Form 8846 to calculate and claim the credit. Unused credits can be carried back one year or carried forward up to 20 years.

7. Small Employer Pension Plan Startup Costs And Auto-Enrollment

Small businesses that establish retirement savings plans can claim a tax credit for the costs of setting up and administering these plans.

Credit Details:

- Up to $5,000 annually for three years for the costs of starting a SEP, SIMPLE IRA, or other qualified retirement plans.

- An additional $500 credit is available for automatic employee enrollment plans.

Eligibility Criteria:

- Employers must have 100 or fewer employees, each earning at least $5,000 annually.

- The business must not have offered a similar plan in the past three years.

Qualifying Costs:

- Setting up and administering the plan.

- Employee education about the benefits of the plan.

How to Claim:

File Form 8881 (Credit for Small Employer Pension Plan Startup Costs) to claim the credit.

Pro Tip: Offering a retirement plan qualifies for tax benefits and attracts and retains talented employees.

How Sage Expense Management Can Help with Tax Deductions

Managing small business taxes can be overwhelming, especially when it comes to identifying deductible expenses, tracking receipts, and ensuring compliance with IRS regulations.

The platform simplifies this process, making it easier for small businesses to stay organized and maximize tax savings. Here's how its innovative features can help:

1. Real-Time Receipt Collection

Small businesses often miss deductions due to misplaced or forgotten receipts. It eliminates this issue by offering real-time receipt collection:

- Employees receive instant notifications for credit card transactions and can submit receipts via SMS or email.

- We supports receipt uploads from Gmail, Outlook, Slack, and Dropbox, making it effortless to track expenses in real-time.

- On average, businesses using Sage Expense Management reduced the time spent on receipt collection by 48%, minimizing back-and-forth communication between employees and accountants.

2. Automated Credit Card Reconciliation

Reconciling credit card expenses can take days with traditional methods.Our real-time credit card feeds integrate with major networks like Visa and Mastercard to:

- Instantly match transaction data with submitted receipts.

- Automate credit card reconciliation in under two minutes without requiring a switch to new cards.

- Provide accountants with visibility into unauthorized or policy-violating transactions in real-time.

3. Policy Compliance Made Simple

Compliance is critical for claiming deductions without triggering audits. Our advanced policy engine ensures:

- Real-time checks for policy violations during expense submissions.

- Automated fraud detection and duplicate expense alerts, helping maintain clean and accurate financial records.

- Notifications for non-compliant expenses, ensuring they’re flagged or adjusted before submission.

This level of automation reduces the risk of penalties and ensures that your deductions align with IRS requirements.

4. Simplified Tracking for Tax-Deductible Categories

From utilities and office supplies to travel expenses, the platform streamlines expense tracking across all deductible categories:

- Use the spend overview dashboard to analyze expenses by category, department, project, or merchant.

- Allocate costs to specific dimensions such as cost codes, locations, and projects to ensure accurate tracking for tax purposes.

For example, if your small business spends heavily on travel expenses, the tool automatically categorizes airfare, lodging, and mileage data, ensuring every deductible dollar is captured.

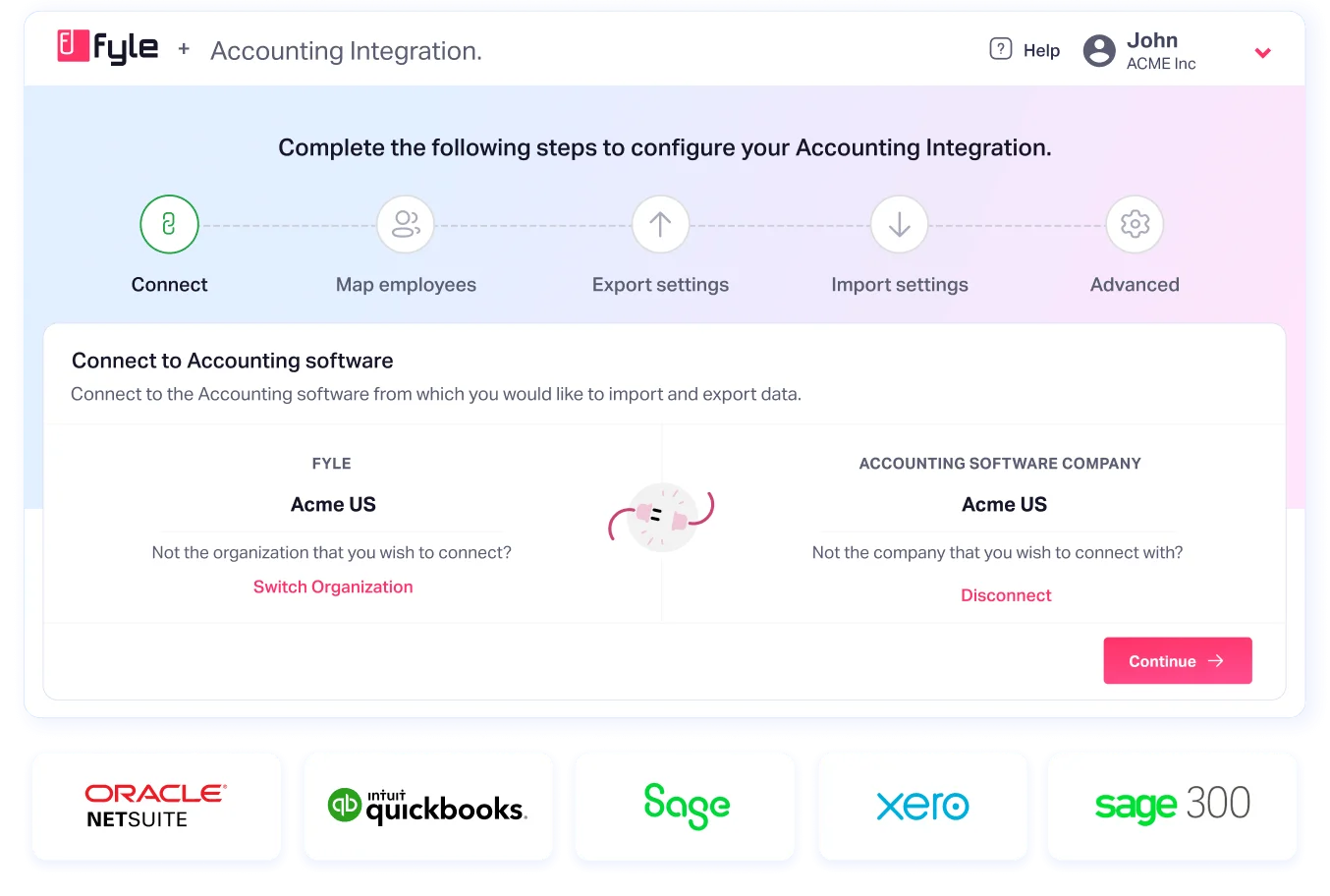

5. Integration with Accounting Tools

We seamlessly integrates with leading accounting platforms like QuickBooks, Xero, Sage Intacct, and NetSuite, enabling:

- Automatic data imports for employees, projects, and cost codes.

- Real-time exports of expenses such as bills, journal entries, or credit card charges.

- No-code setup with an average implementation time of just 12.6 minutes, ensuring you’re ready to manage expenses without delays.

Why Sage Expense Management is Perfect for Small Businesses

It isn’t just an expense management tool—it’s a tax-time lifesaver for small businesses. Here’s why:

- Streamlined Expense Tracking: Our intuitive interface ensures that all deductible expenses are logged accurately and categorized appropriately.

- Time Savings: By automating receipt collection, credit card reconciliation, and compliance checks, we saves businesses countless hours during tax season.

- Better ROI: With pricing starting at $11.99 per active user per month, it provides unmatched value for its features.

- Support When You Need It: Our customer support team has a 92% CSAT rating and responds within 30 minutes, ensuring help is always available.

In Conclusion

From tracking deductible expenses in real time to ensuring compliance with tax regulations, out platform takes the stress out of managing small business finances.

Small businesses can confidently maximize their deductions and reduce tax burdens by leveraging features like instant receipt collection, automated reconciliation, and real-time spend visibility.

Take the guesswork out of tax deductions—get started with Sage Expense Management today and see the difference it makes for your business.

.webp)