If you use Quickbooks Online (QBO) as your accounting software, a complementary expense management software can do wonders. Fyle’s direct integration with QBO ensures quick setup, automated mappings, and a two-way data flow. In addition to this, you can customize the integration to fit your organization’s use case.

The QBO - Fyle Integration

The entire integration setup is self-serve, which means it's incredibly easy to configure. To get started, all you need are the credentials for QBO and Fyle. Let’s take you through the setup.

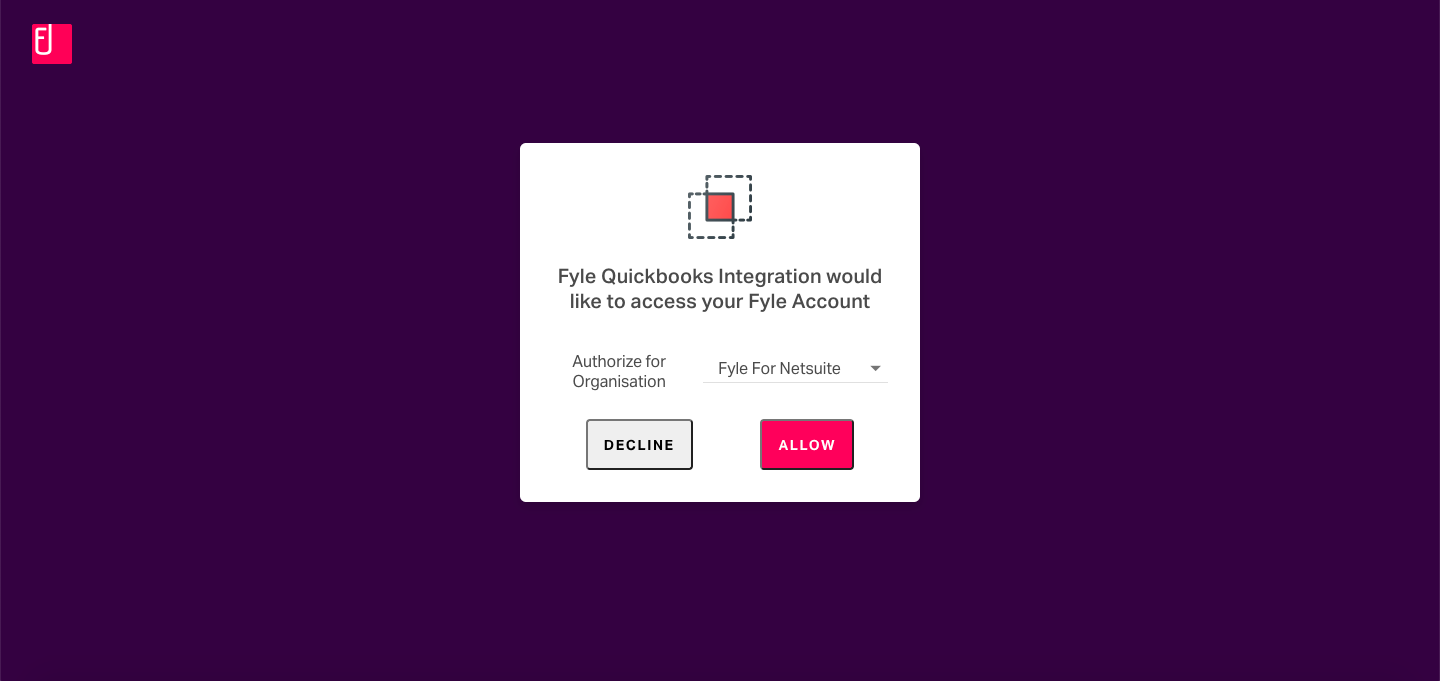

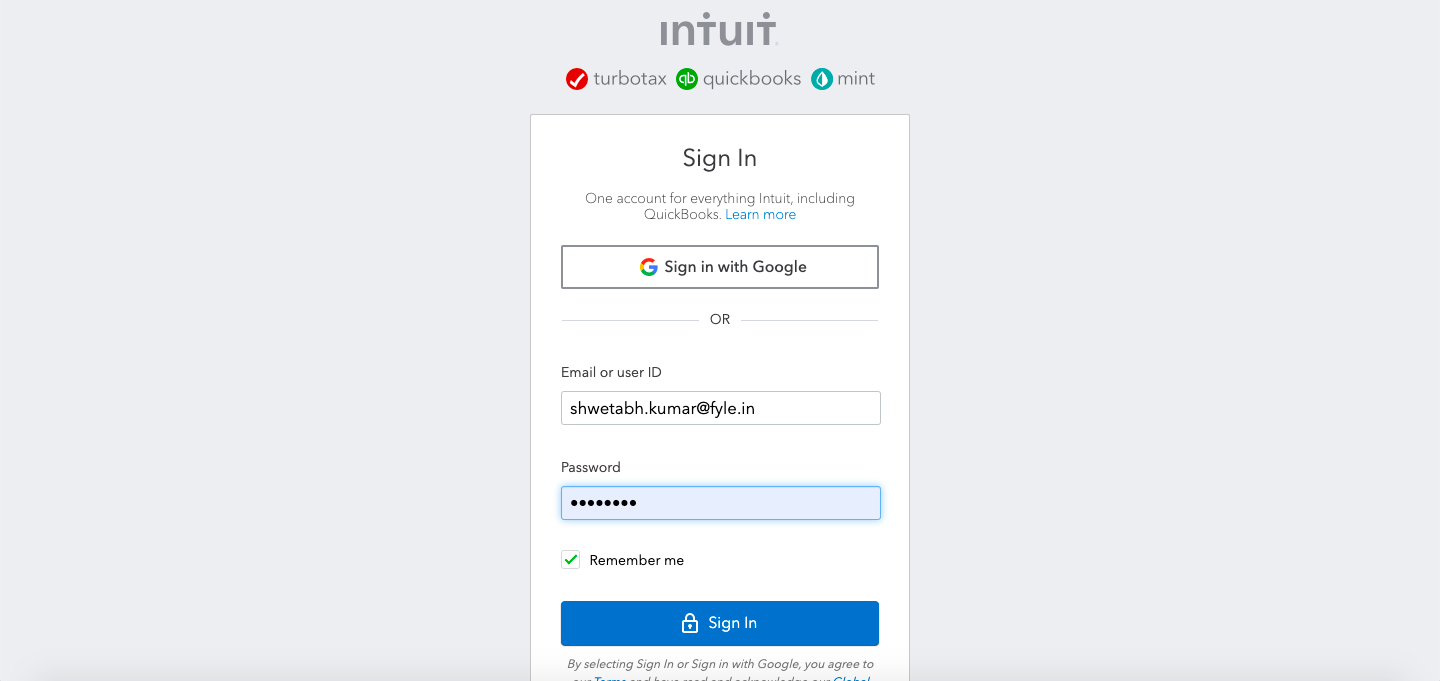

Step 1: Log into your Fyle account from the Fyle-QBO portal.

Connect your QBO account with Fyle. You can directly login to your Quickbooks account from this portal, without the need for any extra steps.

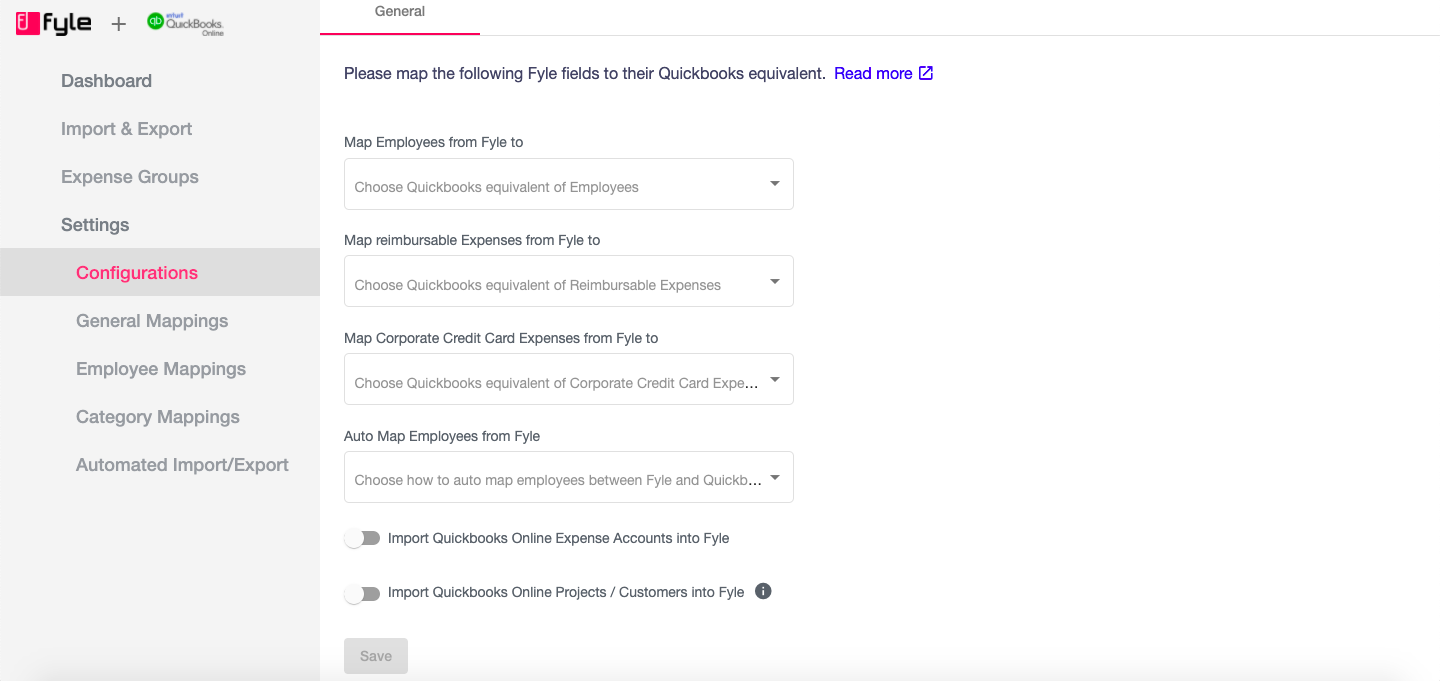

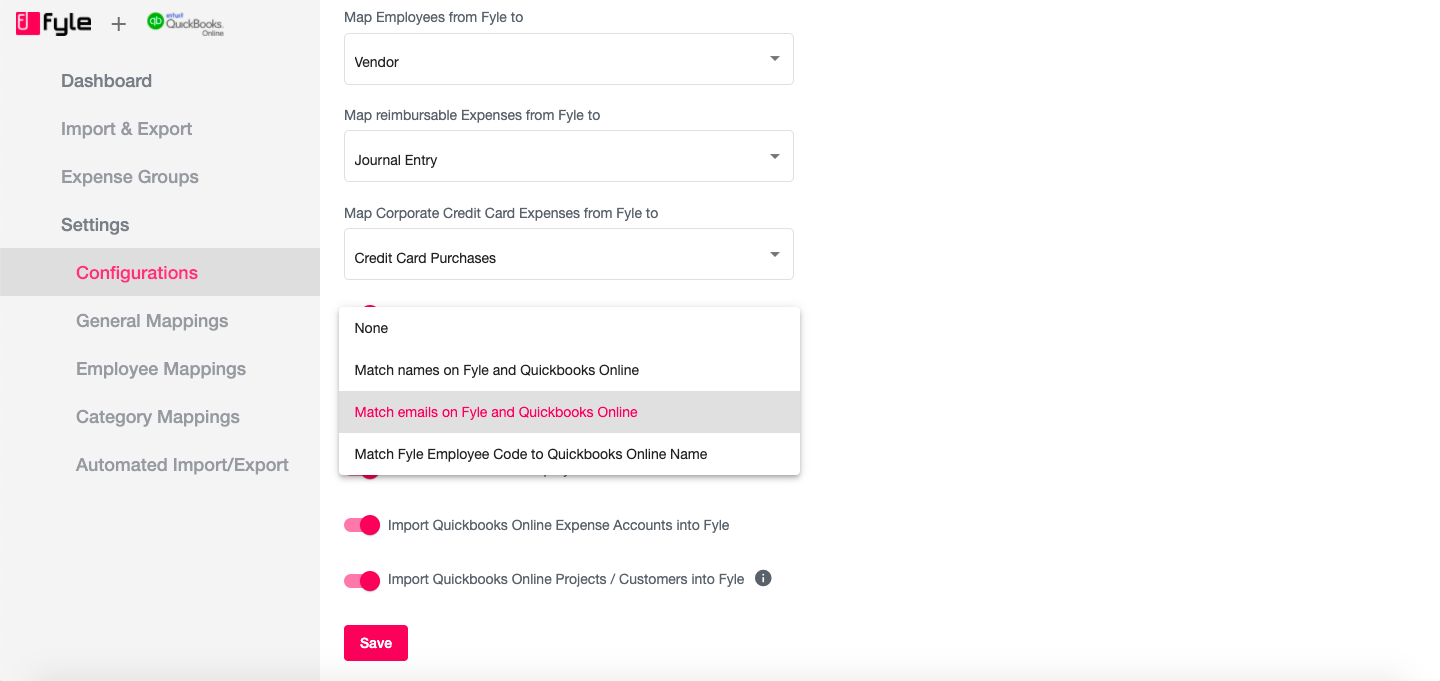

Step 2: General Configurations

Next, we map the Fyle fields to the QBO fields. Through these mappings, you are letting the integration know which fields in your QBO account correspond to which fields in Fyle. You only have to set this up once. You’re defining how you want the reimbursable expenses and card transactions to be exported into QBO. You can choose to export them as either journal entries, bills, checks, or charge credit card transactions. You also mention whether employees in Fyle are mapped to vendors or employees in QBO.

Depending on how you want to make your reimbursements, you can export the QBO payments into Fyle, so the reimbursements get marked as paid automatically. Or if you use Fyle’s ACH feature, you can export the ACH reports to QBO. This way, the payment status is synced on both platforms.

The auto-match employees option enables the integration to populate employee data into Fyle. You can select whether you want to import employee information by name, email, or employee code. So whenever you hire a new employee or make changes to an existing one in QBO, the data gets updated in Fyle.

Additionally, you can enable auto-import of expense types (categories) and projects/customers within Fyle. So all your existing categories and projects get pulled into Fyle automatically.

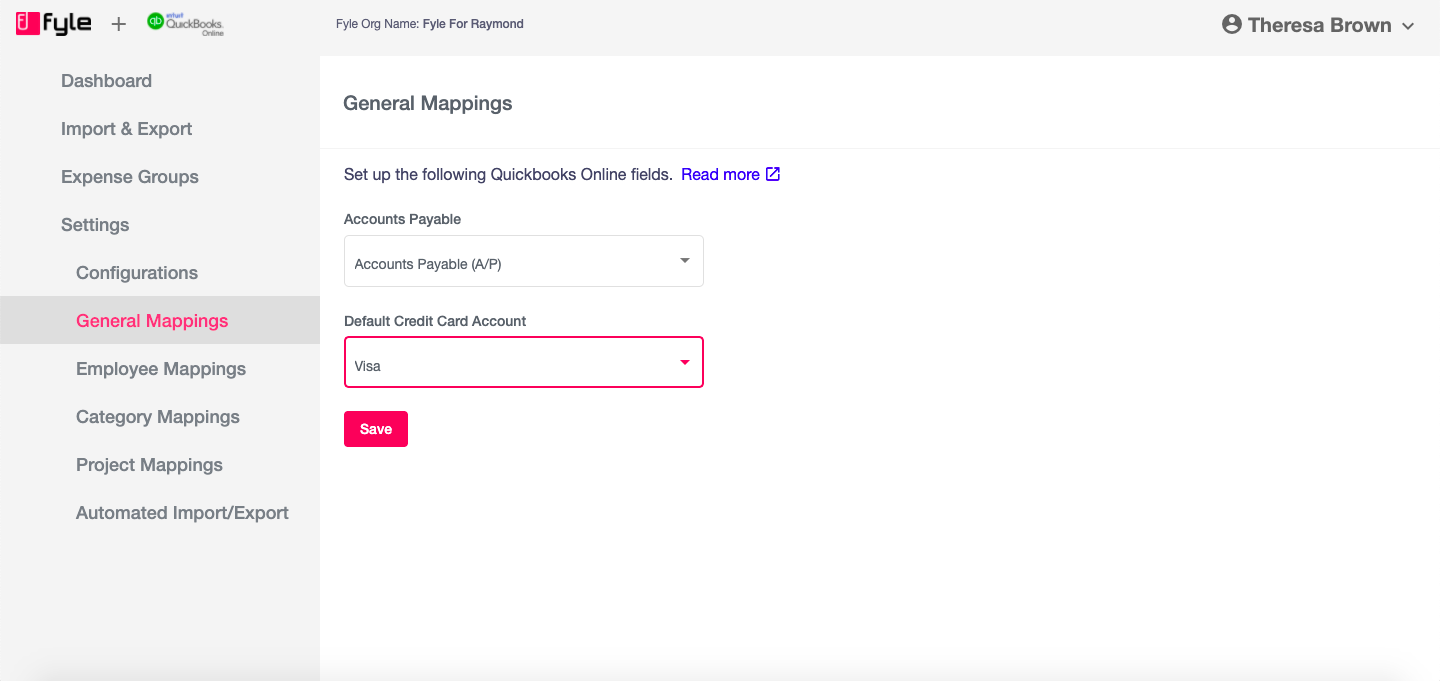

Step 3: General Mappings

These mappings help you define your default account payables when expense information is exported from Fyle into QBO.

You can choose the default payment account, and credit card account.

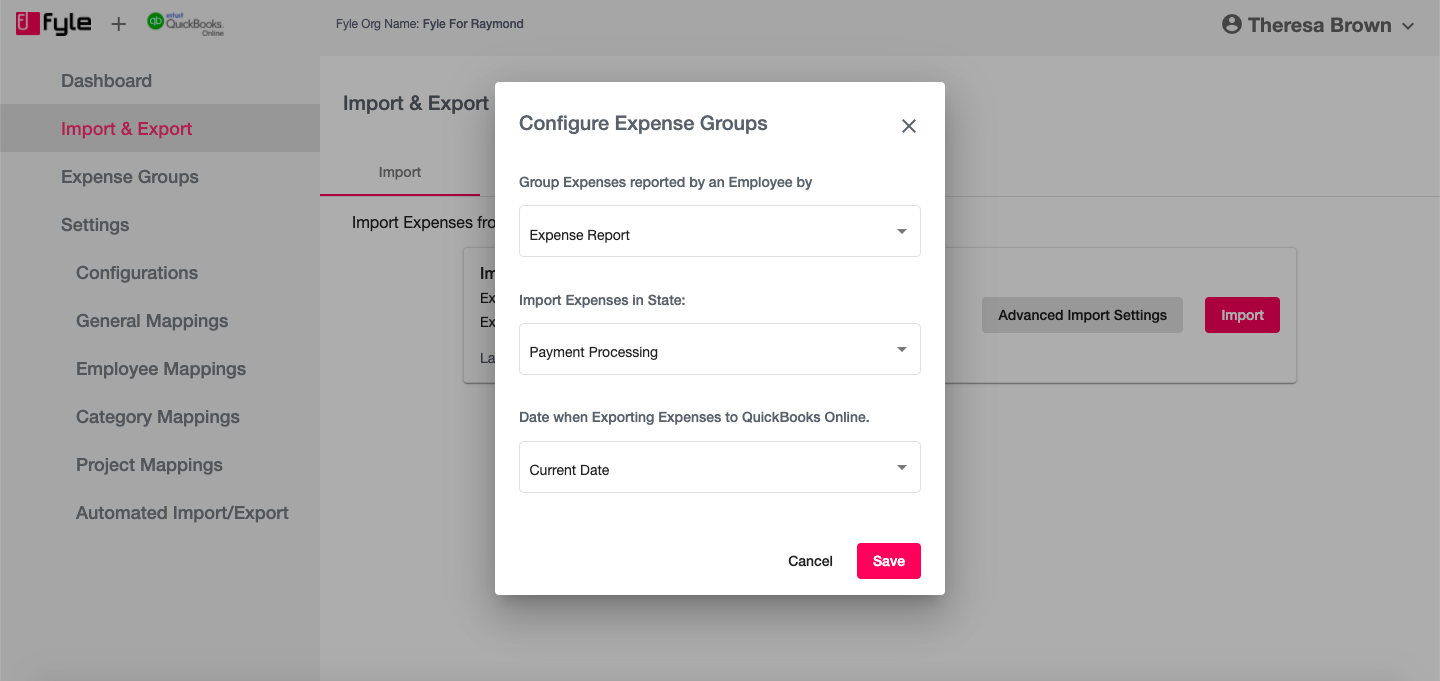

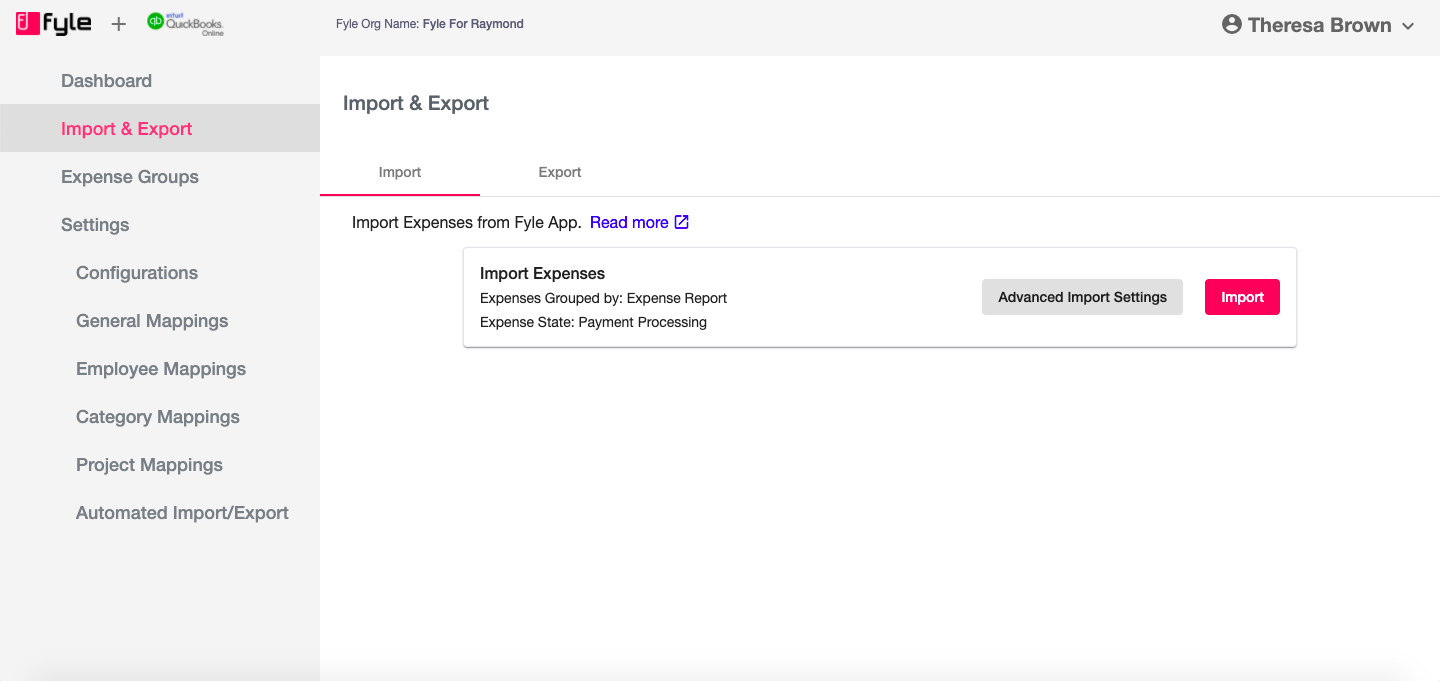

Step 4: Import and Export from Fyle

In the Fyle-QBO portal, you can import expenses from Fyle and export them into QBO. Go to ‘Import/Export’ and select ‘Import’.

In the ‘Advanced Import Settings’, you can choose how you want to group your expenses. They can be grouped on the basis of expense reports, categories, merchant or payment mode.

Here, you can also select at which stage in Fyle the import happens - whether it's the payment processing stage or payment completed stage. Similarly, mention the date you want reflected in the expenses - current date, verification date, spend date, approval date, or last spend date

Once you’ve set the expense groups, you can click on ‘Import’. The system will import all the relevant expenses from Fyle into this portal.

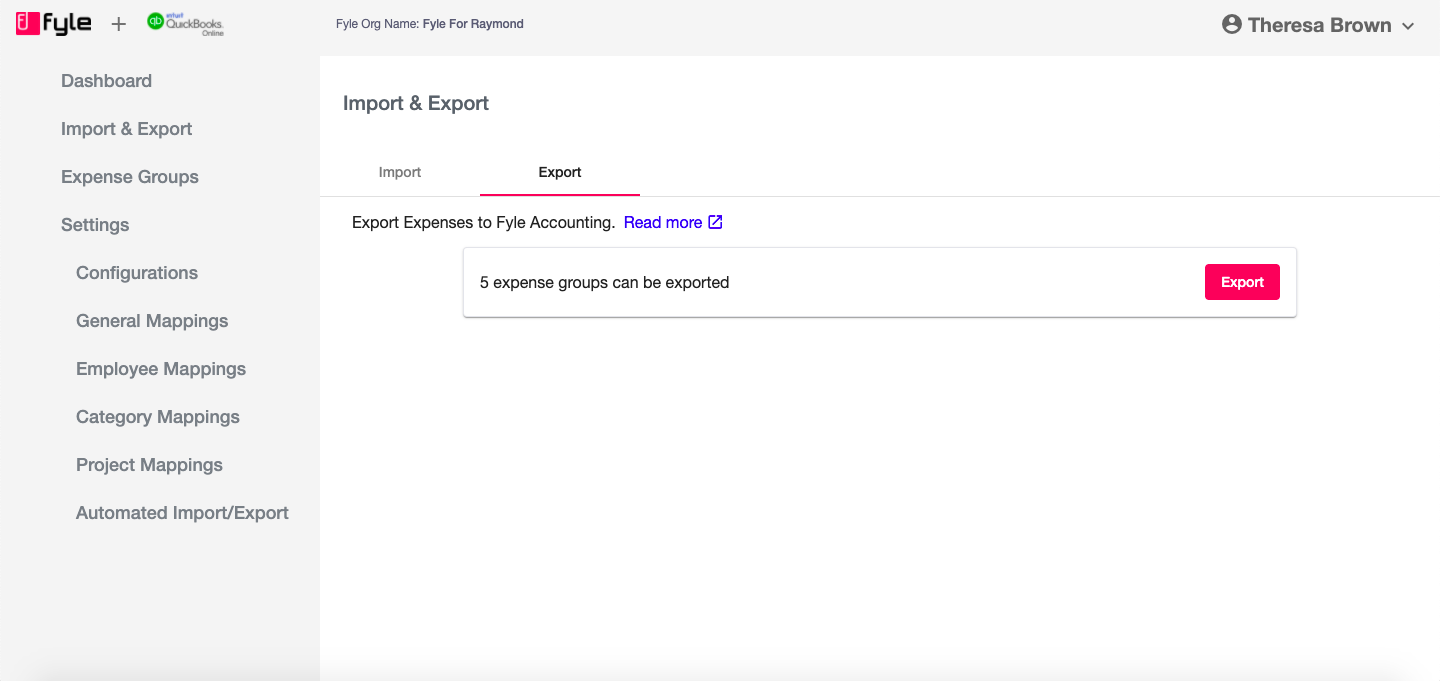

To export this into QBO, simply go to the ‘Export’ tab, and click on export.

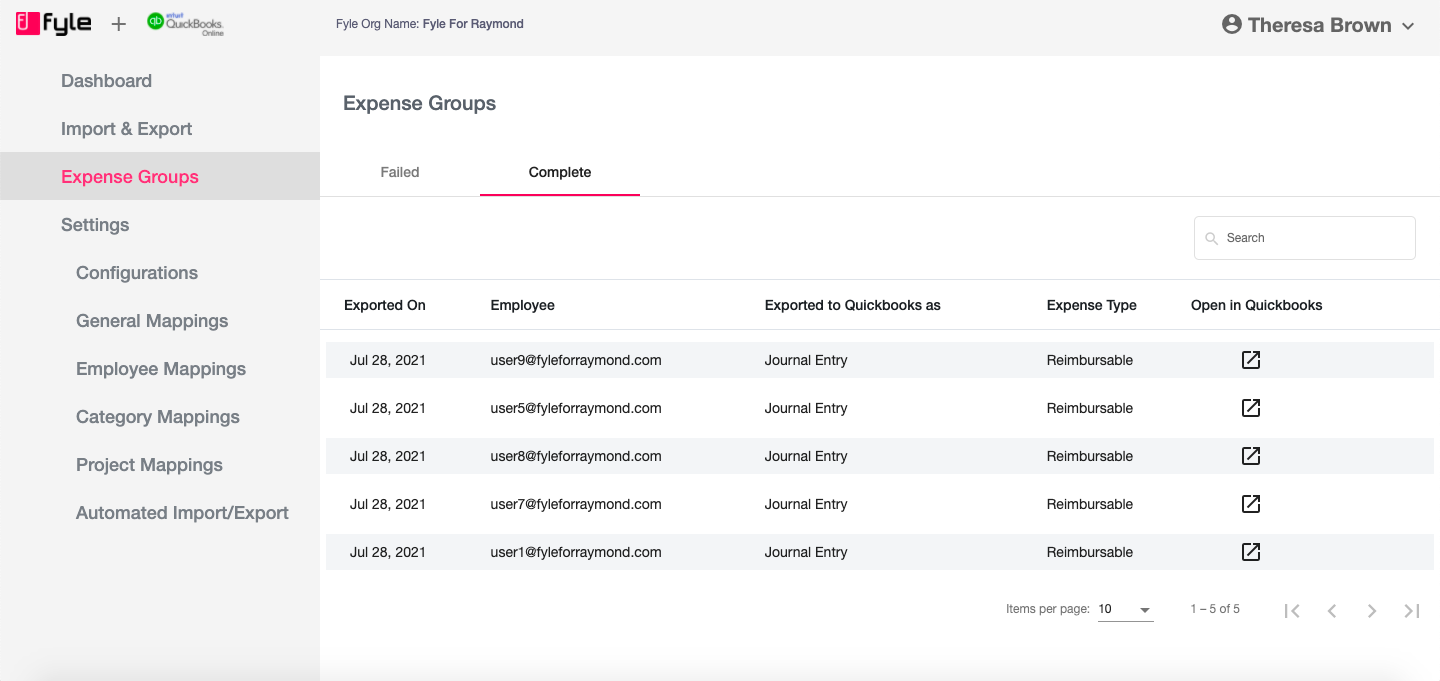

You can view all expense groups that have been exported within the app. It also gives you the details of the mappings (what the expense was exported as and what the expense type is), and a direct link to the newly created expense report/journal entry/bill/credit card transaction in QBO.

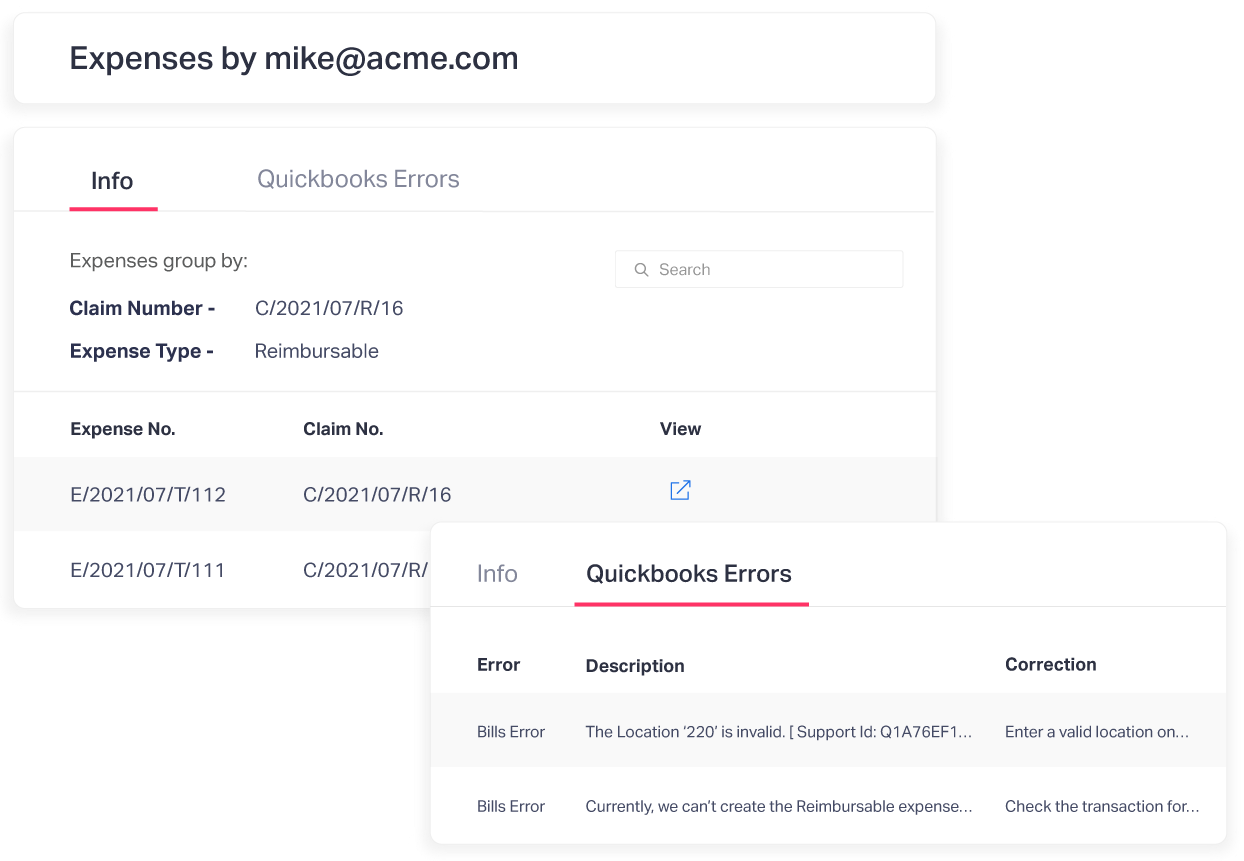

Troubleshooting failed imports and exports

In the event of a failure, the app will tell you why the line export failed. You can quickly review your payment queue and promptly troubleshoot. This means you do not have to depend on support for smaller issues.

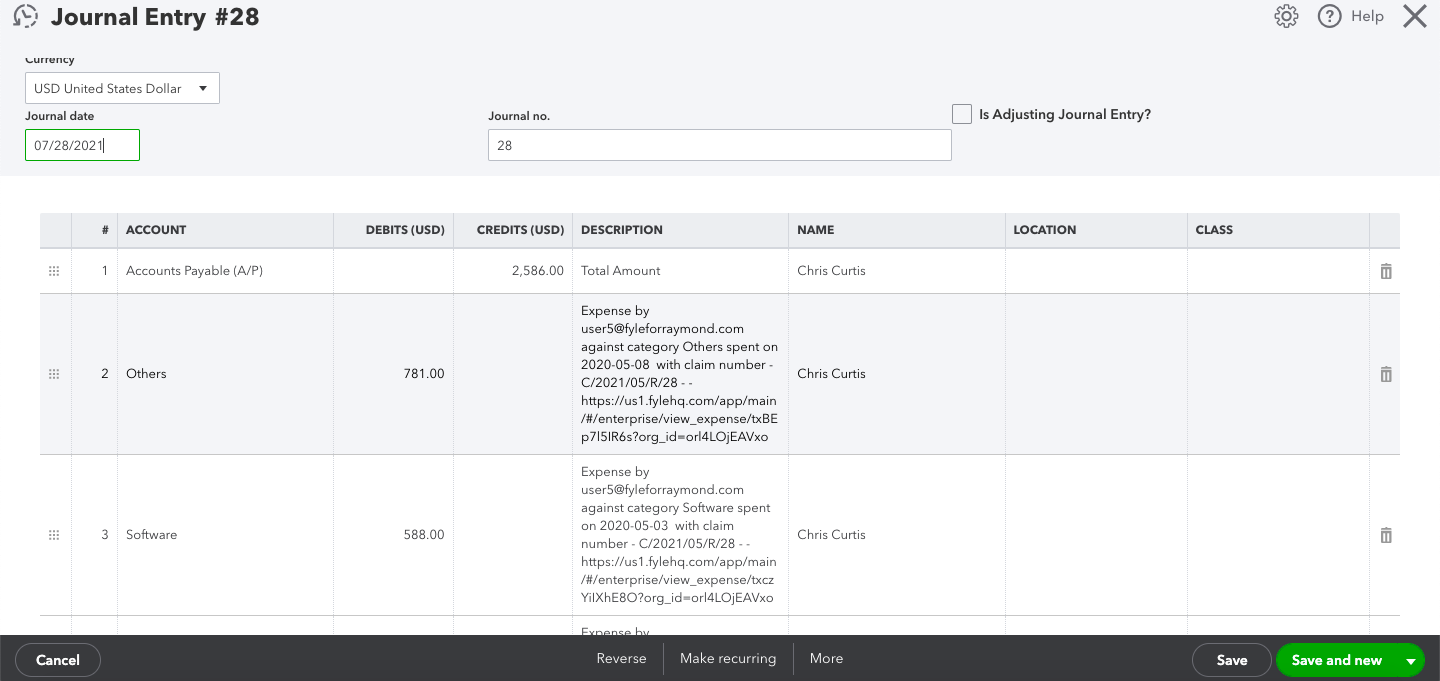

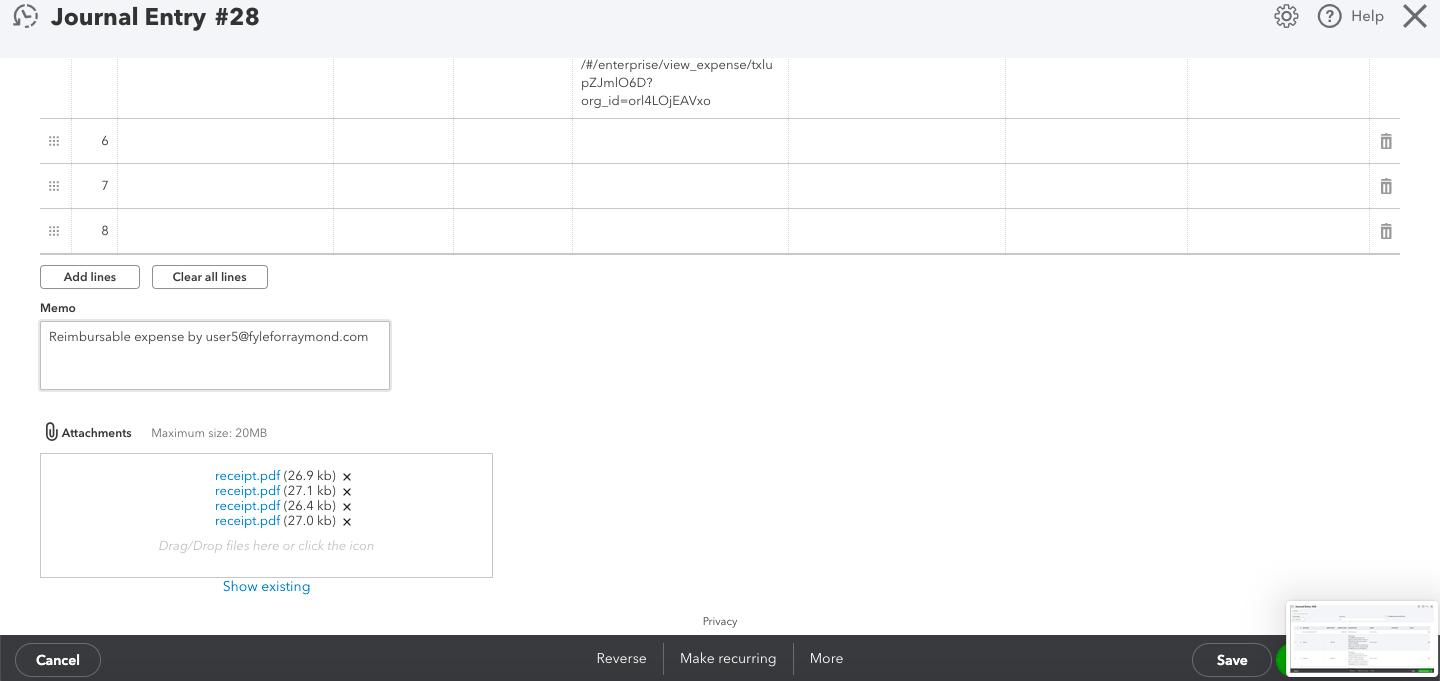

Viewing expenses in QBO

All exported expenses can be seen in your QBO account. You can view the account payable that the expenses belong to and the details of each expense.

The receipts for all the expenses are attached below, so you have complete insight into the expense information.

Automated Import/Export

If you want to automate this process even further, you can even set up a cadence to import and export data at regular intervals. Once you set the frequency, the app will automatically pull all expenses in the selected stage from Fyle (depending on your expense group configurations), and export them into QBO. All you have to do is review the exported expenses in QBO and process the payment.

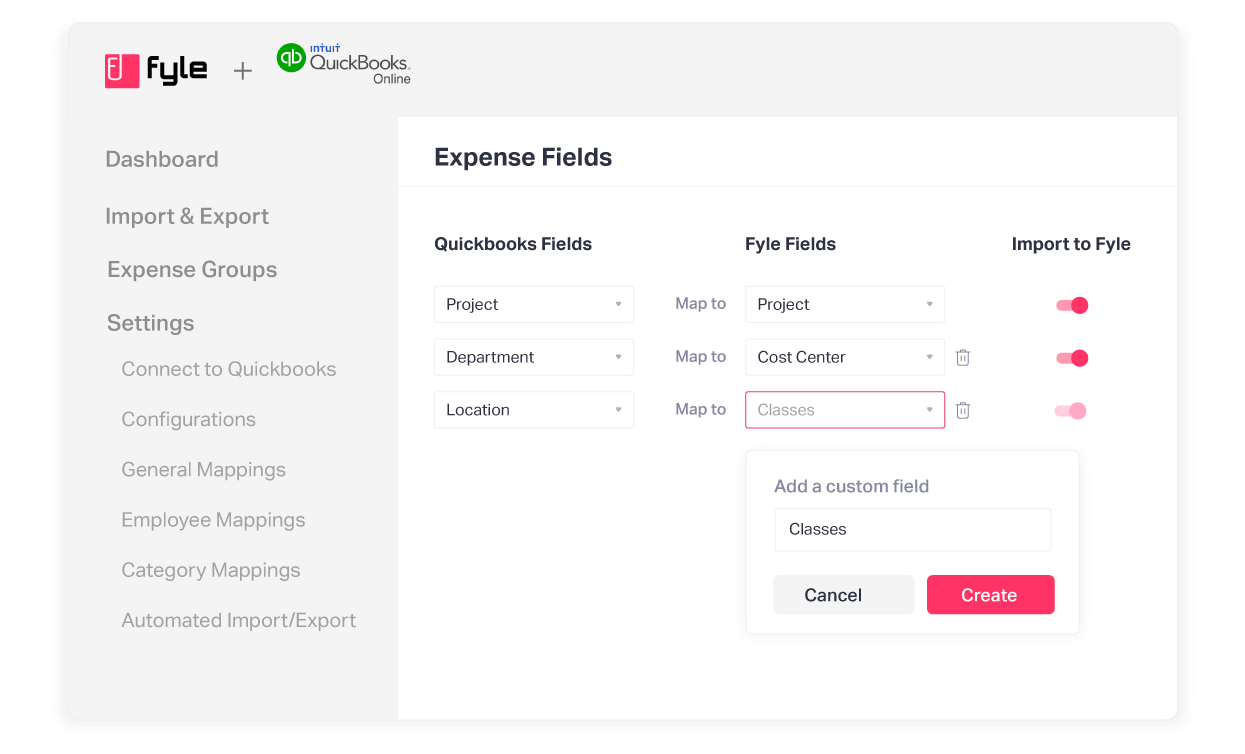

Importing all your other expense fields into Fyle

Fyle’s integration with QBO allows you to import system and custom fields like Departments, Classes, Locations etc., that they have in QBO to Fyle. So for instance, Projects in QBO can be mapped to Projects in Fyle. If a relevant custom field does not exist in Fyle, you can quickly create a new custom Type field from within the integration, without leaving the app.

With this feature, whenever you add new custom fields or update existing fields in QBO, it will automatically be imported or updated in Fyle. All field values are also automatically synced, giving you a truly seamless integration. The imported data will be available to your employees to select in the expense form.

A self-serve integration that you can rely on

As Finance, you can ensure your team has a seamless accounting experience with the QBO-Fyle integration. The 100% secure, two-way data flow ensures that all your information is updated in both the systems parallely, without any manual intervention. See how Fyle works; schedule a demo with us today!