Imagine running a marathon blindfolded. You can’t, and you probably shouldn’t. That’s precisely what managing a business without tracking your expenses is like.

Whether you’re a freelancer, small business owner, or an industry leader, tracking expenses is the foundation of financial stability.

This guide will help you dive deep into expense tracking–what it is, why it’s critical for businesses, and how to do it effectively. We’ll break down concepts into digestible chunks and give you actionable tips to control your finances.

What is Expense Tracking?

Expense tracking is the process of recording, categorizing, and analyzing your business’s spending. Think of it like a financial GPS–it shows where your money is coming from and where it’s going.

Some Key Features of Expense Tracking

- Recording Transactions: Logging every penny spent on business-related activities.

- Categorizing Expenses: Grouping transactions (e.g., office supplies, marketing, travel).

- Analyzing Trends: Identifying patterns and optimizing budgets.

What Are the Different Kinds of Business Expenses?

Business expenses can be tricky to categorize, but grouping them helps in analysis and reporting. Here’s a breakdown:

1. Fixed vs Variable Expenses

- Fixed Expenses: Consistent costs like rent, salaries, or insurance.

- Variable Expenses: Fluctuate with activity, like utilities or raw materials.

2. Operating vs. Capital Expenses

- Operational Expenses: Day-to-day costs like supplies or marketing.

- Capital Expenses: Long-term investments like machinery or property.

3. Direct vs. Indirect Costs

- Direct Costs: Linked directly to production, like materials.

- Indirect Costs: Overhead costs, like office maintenance or electricity.

Why is Expense Tracking Important for Businesses?

Expense tracking isn’t just about knowing how much you’re spending–it’s about that knowledge to improve your business. Here’s why it’s a game-changer:

1. Financial Transparency

Knowing where your money goes ensures there are no surprises at the end of the month. For instance, tracking your marketing spend might reveal you’re spending 30% more on ads than planned.

2. Budget Management

Expense tracking helps set and stick to budgets. For example, if your monthly utility budget is $500 and your tracker shows you’ve hit $450 by mid-month, you can adjust accordingly.

3. Tax Compliance

Accurate records ensure you don’t miss out on tax deductions. For instance, keeping receipts for business travel means you can deduct airfare and accommodation from taxable income.

4. Fraud Prevention

Regular reviews of expenses can catch fraudulent activity. Imagine spotting unauthorized charges on a company card–early detection prevents bigger losses.

5. Better Decision-Making

You can identify areas to cut costs or reinvest by analyzing expense data. For example, if your expense report shows minimal ROI from a particular vendor, it may be time to negotiate or switch.

How to Keep Track of Business Expenses?

Expense tracking can seem daunting, especially if you’re juggling multiple roles in your business. But it doesn’t have to be painful!

By following these tried-and-tested methods, you can create an efficient system that keeps track of your finances organized and stress-free.

Let’s break it down step-by-step:

1. Open a Business Bank Account

Mixing personal and business finances is like organizing a puzzle with pieces from two different sets–it’s messy and frustrating. Having a dedicated business bank account simplifies expense tracking and has several benefits:

- Clearer Financial Records: Separate accounts make it easy to identify personal and business-related expenses. For example, that $50 lunch could be a client meeting or a weekend brunch–having a separate account clears up the ambiguity.

- Tax Efficiency: When tax season rolls around, a business account simplifies the process of identifying deductible expenses. Imagine handing over a clean bank statement to your accountant instead of sifting through a tangled web of transactions.

- Professional Image: Clients and vendors take you more seriously when you operate with a business account. Sending an invoice with “Your Business Name” instead of your personal name exudes professionalism and credibility.

Some additional perks of a business bank account:

- Limited Liability: Protects your personal assets by clearly separating business liabilities.

- Ease of Delegation: Allows employees to handle day-to-day banking without compromising personal accounts.

- Access to Credit: Builds a business credit history, which is crucial for securing loans.

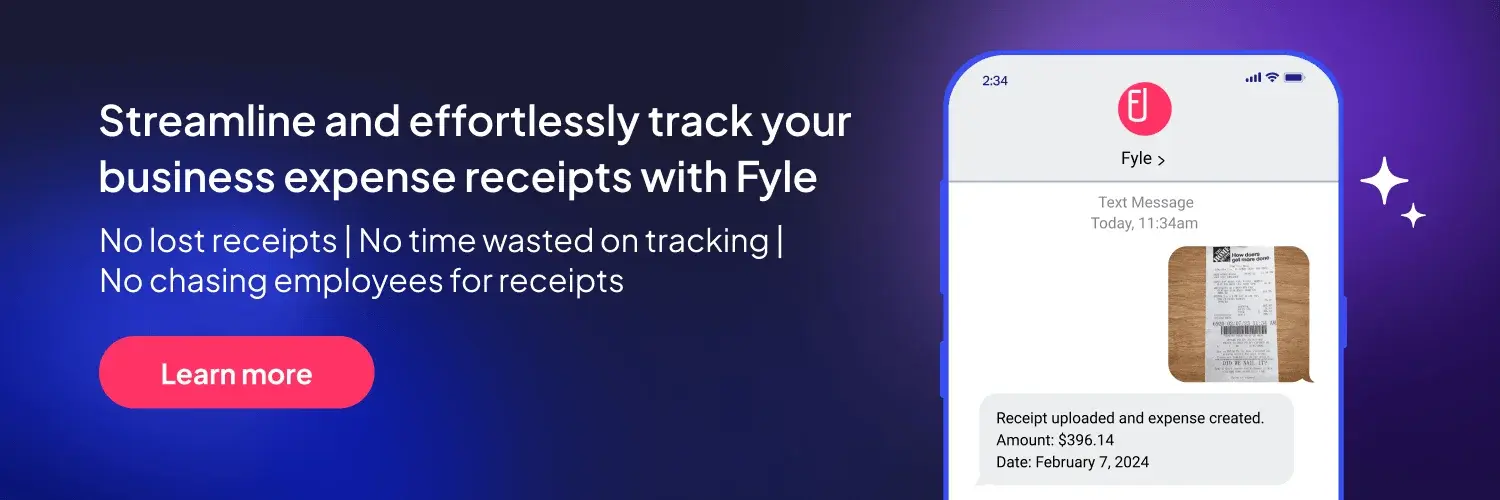

2. Track Your Receipts Regularly

Receipts may seem like small pieces of paper (or emails you never open), but they are the cornerstone of expense tracking. Here’s how to ensure your receipts are always accounted for:

- Go Digital: Physical receipts are easily lost or damaged. Using an app like Sage Expense Management can let you submit receipts via text messages, ensuring they are right where you need them.

- Organise by Category: Group receipts into categories like travel, marketing, or office supplies. This makes it easier to match receipts to corresponding expenses.

- Automate the Process: Use an expense management app that allows you to upload receipts on the go, automatically extracting key details like date, amount, and merchant and categorizing them.

Why do Receipts Matter?

- Tax Compliance: Receipts are evidence for deductions during tax filing or audits, ensuring your claims are accurate and substantiated.

- Cash Flow Management: Tracking receipts helps you monitor where the money goes, ensuring that expenses stay within budget and do not exceed your income.

- Fraud Prevention: Organized receipt management keeps employees accountable for reimbursable expenses, reducing the risk of fraudulent claims.

3. Monitor Travel Expenses

Business travel can be a significant expense, so tracking it accurately is crucial. Here’s how to streamline the process:

- Set Clear Policies: Establish rules for what counts as reimbursable (e.g., flights, accommodation, meals) and set spending limits.

- Automate Expense Submission: Use tools that let employees log travel expenses in real time. For example, when linked to company cards, an app can automatically log ride-hailing receipts or hotel bills.

- Future-Proof Travel Management: Consider software that integrates travel workflows, such as pre-approval systems for trip bookings and automatic reconciliation after the trip.

Example:

Imagine you have a sales team constantly on the road. One member submits a handwritten list of expenses at the end of the month, while another uses an app that logs every expense as it happens. Which method would you trust during tax filing or an audit?

4. Review Expenses Periodically

No matter how organized your tracking system is, reviewing expenses regularly is vital to ensure everything is accurate and up-to-date. Set time aside for monthly or quarterly reviews to:

- Identify Overspending: Spot areas where costs balloon and reallocate budgets if necessary.

- Spot Errors or Fraud: Regular reviews can reveal duplicate entries, unauthorized charges, or suspicious spending.

- Adjust Budgets: Use insights from reviews to fine-tune your financial strategy. For instance, if marketing expenses consistently exceed budget, you may need to rethink your campaigns or allocate more funds.

How Sage Expense Management (formerly Fyle) Can Help

Expense tracking often feels like a never-ending chore–chasing receipts, manually entering data, and trying to make sense of it all. That’s where Sage Expense Management steps in, turning what was once a tedious process into a seamless, automated experience.

Here’s how Sage Expense Management can revolutionize the way you manage your business expenses:

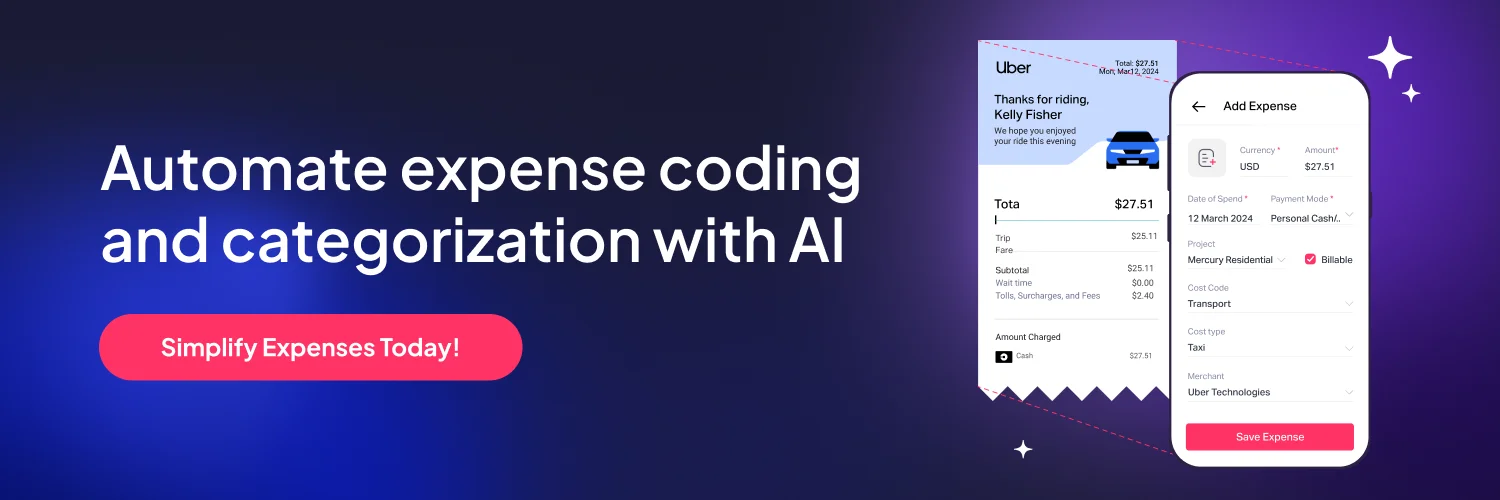

1. Automated Receipt Submission and Credit Card Reconciliation

Forget the past when you had to manually enter receipts into spreadsheets or dig through email archives for missing proof of purchase. Sage Expense Management simplifies the process with real-time tracking:

- Snap and Submit: Simply take a photo of a receipt with your phone and text it to Sage Expense Management. The system instantly creates, codes, and submits the expense.

- Real-Time Credit Card Feeds: Sage Expense Management directly integrates with credit card networks like Visa and Mastercard to give you real-time text notifications for all business credit card transactions. Employees can submit receipts via text, and they’re automatically matched.

What It Means for You: No more waiting for month-end statements or chasing employees for receipts. You can see every transaction in real-time, keeping you always up-to-date.

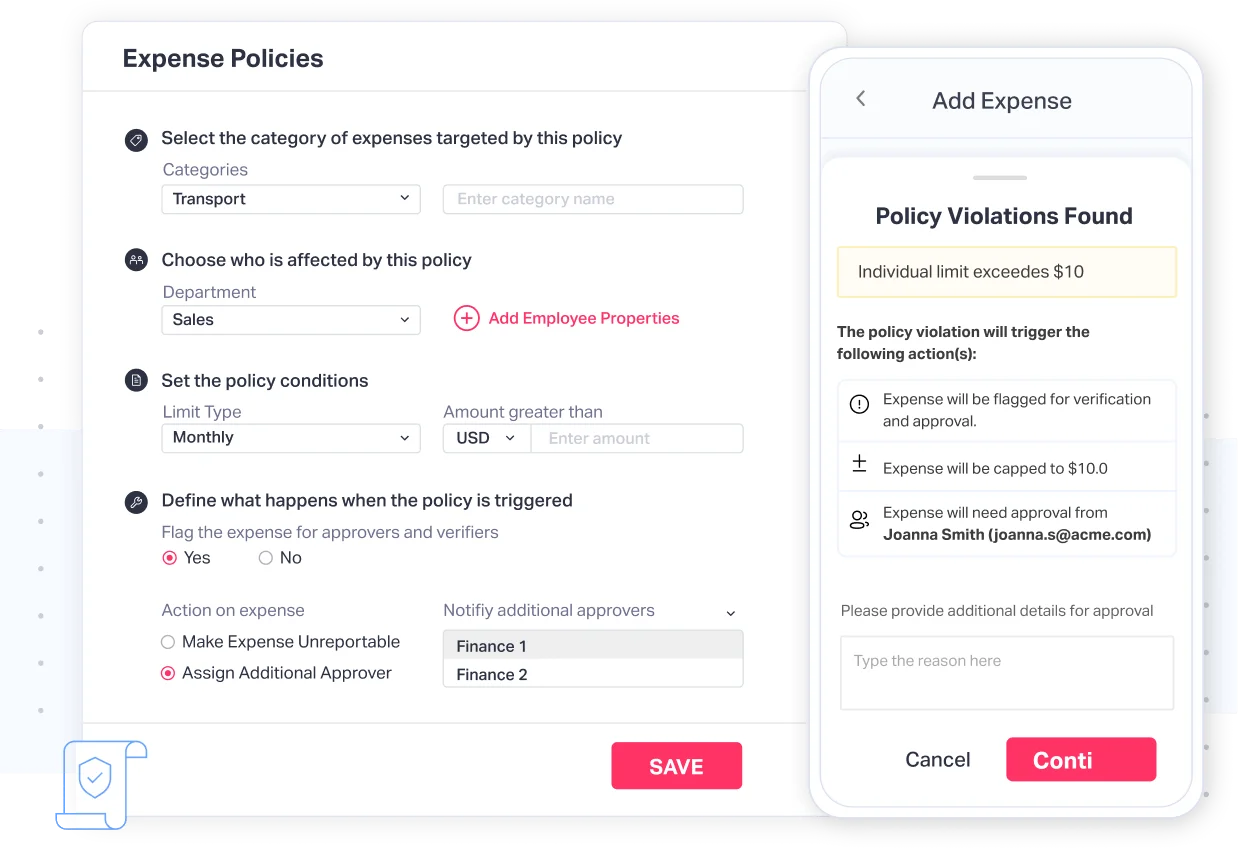

2. Automated Compliance

Maintaining compliance with company policies and tax regulations can be overwhelming, especially for growing businesses. Sage Expense Management ensures compliance is built into your expense management:

- Policy Enforcement: Expenses are checked against your organization’s policies at the time of submission. This prevents non-compliant expenses from sneaking through the cracks.

- Duplicate Detection: Sage Expense Management automatically flags duplicate expense reports, saving you from overpaying reimbursements or misreporting during audits.

- Fraud Prevention: Suspicious activity, such as unusually high expenses or altered receipts, is automatically detected, giving you peace of mind.

What It Means for You: With Sage Expense Management, compliance isn’t an afterthought—it’s seamlessly integrated into the process, reducing the risk of costly errors or penalties.

3. Instant AI-Powered Spend Insights

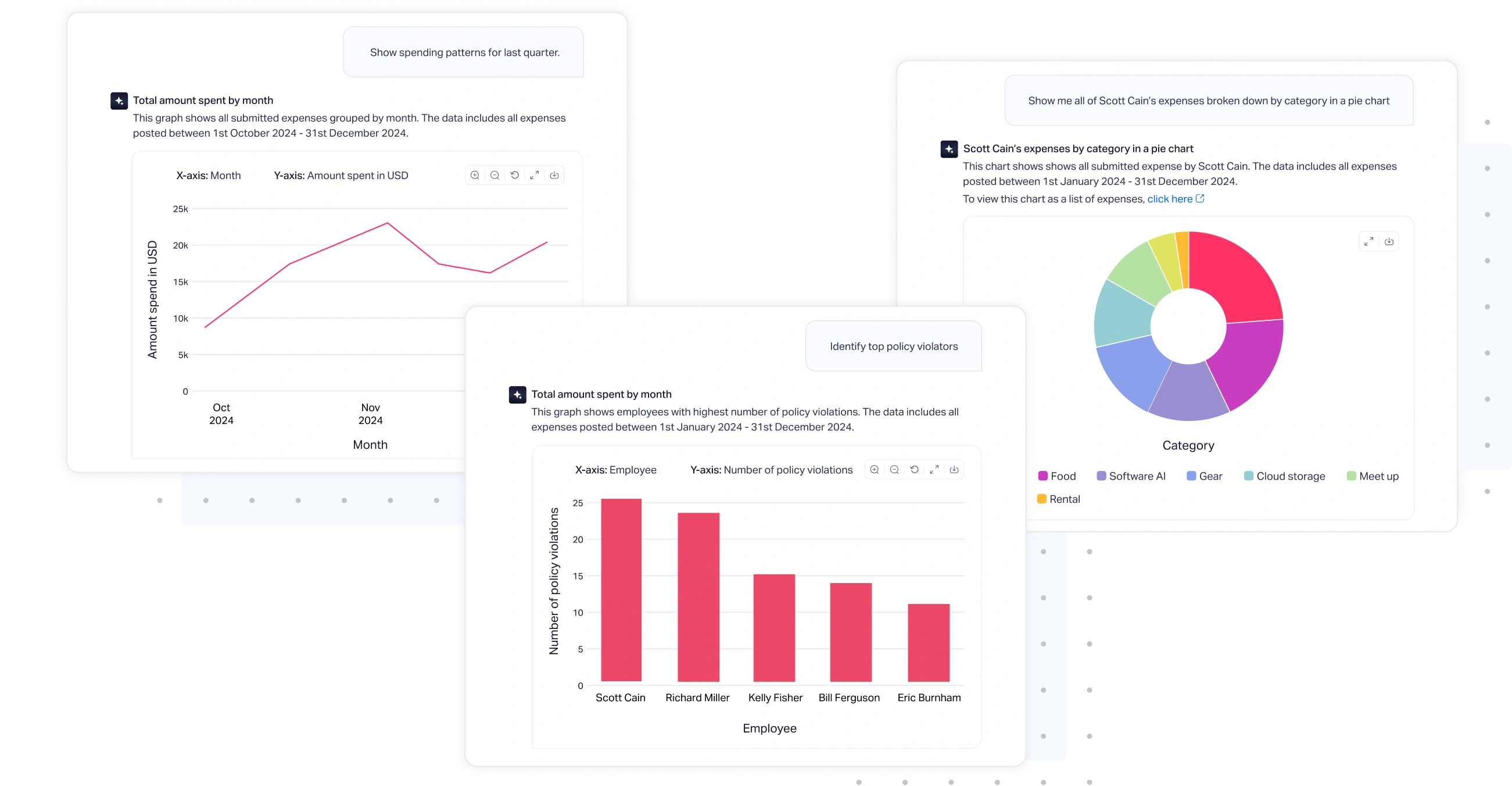

Tracking expenses is only half the battle; making sense of the data with AI is where the real value lies. Sage Expense Management's CoPilot provides deep, AI-driven insights into your business’s spending:

- Centralized AI Insights: Gain an instant, AI-powered overview of all expenses, categorized by employee, project, department, or merchant, simply by asking CoPilot.

- Detailed AI Analysis: Break down spending patterns with intelligent insights to identify areas for cost optimization. For example, you can quickly spot overspending in travel or underutilized vendor contracts through conversational queries.

- Custom AI-Assisted Reports: Generate and export reports tailored to your needs, such as expense summaries for specific projects or departments, with guidance from CoPilot.

What It Means for You: Sage Expense Management empowers you to make data-driven decisions about budgets, resources, and cost-saving opportunities—all from a single interface.

4. Seamless Integrations

Managing expenses is never an isolated task—it must sync with your overall accounting workflow. Sage Expense Management integrates effortlessly with popular accounting tools to make this happen:

- QuickBooks Online and Desktop: Connects with QuickBooks for two-way data syncing, ensuring expenses are automatically reflected in your accounting system.

- Xero and Sage Intacct: Imports and exports data to and from these platforms, streamlining bookkeeping tasks.

- Custom Integrations: With customizable integrations, you can configure to fit your unique business needs, whether connecting with ERP systems or HR platforms.

What It Means for You: Say goodbye to manual data entry and hello to a fully automated, error-free accounting process.

FAQs Around Expense Tracking

Do I Need Physical Receipts for Taxes?

No! The IRS and most tax authorities accept digital receipts as long as they’re legible and include essential details (date, amount, vendor).

How Often Should I Review My Expenses?

Monthly reviews work for most businesses, but weekly reviews are ideal for high-volume transactions.

How to Track Expenses in Excel?

Here’s a step-by-step guide to effectively use Excel for tracking expenses:

1. Create a Tracker

Set up a spreadsheet with columns such as Date, Category, Amount, and Notes. These fields will help you organize and categorize your expenses efficiently.

2. Input Transactions

Log all expenses regularly, ideally on a daily or weekly basis. This practice prevents backlog and ensures your records stay up to date.

3. Use Formulas

Leverage Excel’s built-in formulas to automate calculations. For example, use the SUM function to total your expenses or IF functions for conditional logic like flagging high spending.

4. Visualize Trends

Create charts in Excel, such as pie charts or bar graphs, to analyze spending patterns and identify areas where you can cut costs.

While Excel is a great starting point for expense tracking, its manual nature can become time-consuming and prone to errors as your business grows. Upgrading to an automated expense tracking tool like Sage Expense Management can save time and reduce mistakes.

What is the Best Expense Tracking App?

The answer might sound biased, but Sage Expense Management truly stands out as the ideal choice for small and medium-sized businesses. Here’s why we’re confident in saying this:

- Effortless Receipt Scanning: It makes receipt management a breeze. With just a snap, receipts are digitized, categorized, and linked to transactions. It removes the need for manual data entry, a common pain point for businesses.

- Powerful Analytics: Get in-depth reports and dashboards that go beyond basic tracking. Businesses can analyze spending trends, uncover cost-saving opportunities, and make data-driven financial decisions.

- Seamless Integrations: Sage Expense Management works harmoniously with popular accounting tools like QuickBooks, Xero, and Sage Intacct. This ensures expense data is automatically synced, streamlining your accounting workflows and eliminating redundancies.

- Real-Time Tracking and Compliance: From real-time expense tracking to built-in compliance features like policy enforcement and duplicate detection, Sage Expense Management has all the essentials to simplify expense management. It prevents errors and ensures every transaction aligns with your business policies.

Why Sage Expense Management (formerly Fyle)?

It’s not just about the features—it’s about how they come together to create a hassle-free experience for SMBs. Sage Expense Management addresses the specific challenges faced by growing businesses:

- It saves time by automating repetitive tasks.

- It reduces errors, ensuring accurate records.

- It simplifies financial processes, making it easy for teams of any size to adopt.

Sage Expense Management combines all the tools and efficiency an SMB needs to manage expenses seamlessly. It’s not just an app—it’s a solution designed with the needs of growing businesses in mind.

.webp)