The expense recognition principle is a fundamental concept in accounting that ensures expenses are recorded in the same period aas revenue they help to generate. This principle aligns with the accrual basis of accounting, making it essential for accurate financial reporting.

By understanding how to recognise expenses appropriately, businesses can maintain consistency and clarity in their financial statement, which is crucial for decision-making, tax-reporting, and stakeholder communication.

What Is the Expense Recognition Principle?

The expense recognition principle, also known as the matching principle, requires that businesses record expenses in the same period as the related revenue. This principle contrasts with the cash basis of accounting, where expenses are only recorded when cash is paid.

By adhering to this principle, companies achieve a clearer picture of their financial health and profitability for each accounting period.

For example, if a business incurs an advertising expenses in january that results in increased sales in March, under the expense recognition principle, the expense is recorded in March to match it with the revenue it helped generate.

How the Expense Recognition Principle Helps Accrual Accounting

Accrual accounting relies on the matching principle to present a more accurate financial picture. Instead of only recording when cash changes hands, accrual accounting records when transactions are earned or incurred. This approach provides greater clarity on business performance and cash flow.

Some key points around Accrual Accounting

- Aligns revenue and expenses for accurate financial reports.

- Helps businesses manage cash flow better by revealing obligations and income.

- Enables comparison of income and expenses to track profitability.

Cash Accounting vs. Accrual Accounting

The two primary accounting methods, cash and accrual, differ in their treatment of income and expenses. Here’s a breakdown of each:

How Does the Expense Recognition Principle Work?

To follow the expense recognition principle, a business should:

- Identify the Expense–Understand the cost incurred.

- Match with Revenue–Link the expense to the revenue it helped generate.

- Record in the Same Period–Ensure both are documented within the same timeframe.

This method is particularly useful for ensuring accuracy when dealing with long-term expenses, such as depreciation or prepaid expenses.

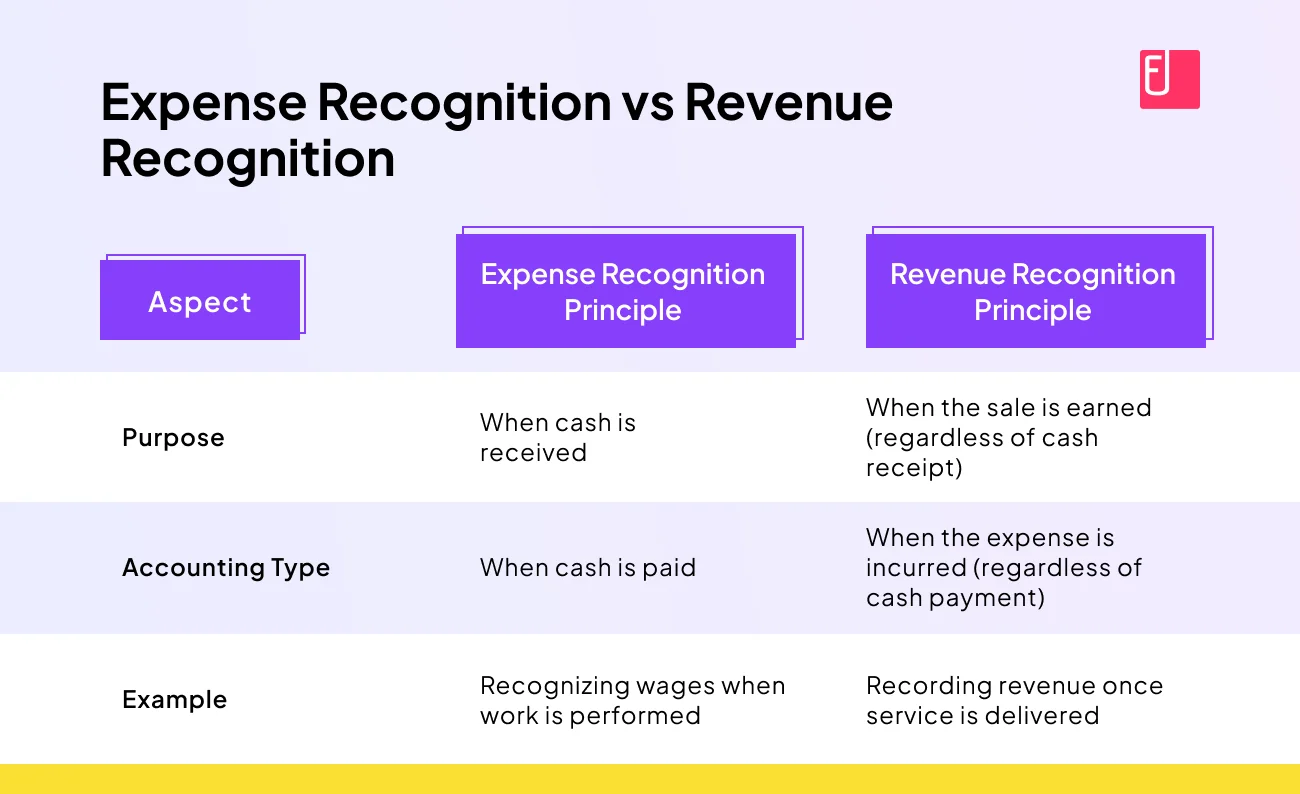

Expense Recognition Principle vs Revenue Rccognition

While the expense recognition principle deals with expenses, the revenue recognition principle governs when to record revenue. Both are essential for accurate financial reporting, as they work together to represent a company’s performance in a given period.

Challenges in Expense Recognition

While expense recognition aims to make financial reporting simple, it can be complex, especially for companies dealing with multi-period projects or those that rely on various forms of financing.

Here are some common challenges:

Complexity of Transactions

Transactions involving multiple activities or components can be difficult to allocate to a single period. For instance, a construction project may involve various phases, each with unique costs and revenue implications.

Breaking down each phase’s expenses and matching them to their respective revenue requires careful planning and coordination between finance and project management teams. Complex transactions often require segmentation of costs, making it challenging to recognize each expense accurately.

Long-Term Obligations

Some expenses relate to obligations that extend over many yeats, such as warranties, service agreements, or lease payments. These long-term obligations need to be recorded in a way that accurately reflects their impact over time.

For example, if a business offers a 5-year warranty on a product, the expense related to that warranty must be spread over the five years. Additionally, if deferred payments or credits are involved, they must be carefully tracked to avoid prematurely recognizing expenses.

Handling such obligations often requires businesses to use detailed schedules and amortization processes.

Estimations and Judgements

Businesses often have to make estimations, especially for expenses that are incertain or involve future obligations, such as expected costs for warranty claims or potential liabilities.

Estimation can introduce subjectivity, leading to inconsistencies if the criteria for these estimates are not standardized. Moreover, market fluctuations, economic uncertainity, and changing customer behvaiour can influence estimates, sometimes requiring adjustments that impact financial reports.

This reliance on judgment makes it crucial for businesses to have clear, documented policies for making estimates to ensure that expenses are recognized consistently.

Foreign Currency and Exchange Rate Variability

For companies dealing with international expenses, foregin currency fluctuations can complicate expense recognition. Changes in exchange rates between the time an obligation is incurred and when it is paid can lead to variances in expense recognition.

This complexity necessitates monitoring exchange rates and possibly using hedging techniques to mitigate exchange rate risk.

Correctly applying the expense recognition principle in these situations requires a robust process for converting expenses to the company’s functional currency and recognizing any gains or losses due to exchange rate changes.

Revenue and Expense Misalignment in Seasonal Businesses

Seasonal businesses face unique challenges, as they may incur significant costs in low-revenue periods to prepare for high-revenue seasons.

For example, a business that primarily earns revenue during the holiday season may need to start advertising and procuring inventory months in advance. Recognizing these expenses in periods with limited revenue can misinterpret financial performance.

These businesses must strategically match expenses with anticipated seasonal revenue, often using accruals or prepaid expense accounts to balance financial reports.

How to Overcome These Challenges and Ensure Expense Compliance

Effectively applying the expense recognition principle requires strategies that reduce errors and maintain compliance. Here are some best practices:

Utilize Automated Solutions

Automated accounting or expense solutions like Sage Expense Management or Quicbooks can streamline expense recognition by tracking expenses accurately and applying rule-based categorization.

Software can automate complex calculations, such as prorating long-term obligations over multiple periods, which significantly reduces the risk of human error.

These systems can also generate financial reports and provide detailed insights into expense allocations, making it easier for accountants to review and validate compliance with the expense recognition principle.

Regular Audits

Periodic audits, either internal or external, help ensure that expenses are consistently applied and recorded according to accounting standards. Audits review financial records, test for accuracy, and verify that expenses align with revenues, helping identify discrepancies or misclassifications.

Regular audits also provide an opportunity to adjust or refine expense recognition prociesses based on audit findings, ensuring that procedures align with GAAP or other relevant standards.

Additionally, audits offer assurance to stakeholders that financial statements reflect a true picture of the business’s financial health.

Clear Documentation and Standard Operating Procedures (SOPs)

Well-documented procedures are essential for consistent expense recognition. Every expense should have a corresponding entry and documentation that explains its purpose, timing, and relation to revenue.

Standard Operating Procedurers (SOPs) provide guidelines on how expenses are categorized, estimated, and matched with revenue, reducing variability and subjective judgement.

SOPs should include step-by-step instructions for handling different types of expense and establish rules of making estimates, particularly in areas like depreciation and warranties.

Documentation also helps during audits, as auditors can trace each expense to its source and verify its accuracy.

Implement Multi-Level Approval Processes

Multi-level approval processes can prevent misclassification and ensure that only relevant expenses are recognized in each period. For example, a second-level manager’s review can catch misclassified expenses that may otherwise go unnoticed.

Approval workflows also ensure that expenditures undergo multiple reviews before they are recorded, which helps prevent errors and fraudulent entries.

Many accounting systems allow for configurable workflows that route expenses through multiple approvals, providing checks and balances before they are recognized in financial reports.

Ongoing Training for Finance Teams

Proper training on accounting standards and principles, including the expense recognition principle, can significantly improve compliance and consistency.

Training should include updates on relevant accounting standards, software training, and case studies to illustrate complex scenarios. Well-trained staff are better equipped to handle subjective judgments and estimate-based expenses, which reduces inconsistencies and errors in financial reporting.

Examples of Expense Recognition

To understand how the expense recognition principle works in practice, let’s look at several expense categories, and how they align with revenue:

Salaries and Wages

Salaries and wages should be recognized in the period the employees perform the work, not necessarily when the payment is made.

For instance, if employees complete work in December but are paid in January, the related expense should still be recorded in December. This matching ensures that labor costs accurately reflect the period they contributed to production or services.

Utilities

Utility expenses should be recorded in the month the utilities are used, even if payment occurs later. For example, January’s electricity bill, paid in February, should still be recognized as an expense for January.

By matching utilities with the month they are consumed, the business shows a clearer picture of monthly operating costs.

Depreciation Expenses

Depreciation spreads the cost of a long-term asset, such as a building or equipment, over its useful life.

For instance, if a $100,000 machine is expected to last 10 years, an annual depreciation expense of $10,000 would be recorded each year. This expense allocation aligns with the revenue the machine generates over time, reflecting the gradual wearing out of the asset.

Depreciation is particularly important for businesses with substantial investments in equipment or real estate, as it balances initial asset costs over many periods.

Marketing and Advertising

Marketing expenses should be recognized based on the period they influence. For example, if a business runs an advertising campaign in December but expects increased sales in January and February, the cost could be allocated over those months.

Alternatively, if the campaign’s impact canot be directly linked to future sales, the entire expense might be recognized in December.

Advertising costs are often discretionary, so applying the expense recognition principle helps business evaluate the ROI of their marketing strategies more accurately.

Rent Expenses

Rent expenses are typically recognized in the month of occupancy.

For example, if a business pays rent for March in February, the expense should be recorded in March when the property is actually used. This ensures that rent costs are allocated to the period in which the business benefits from the space, providing a realistic view of operational expenses.

Some businesses prepay several months of rent; in such cases, the rent expense would be recorded monthly over the prepaid period rather than all at once.

Insurance Premiums

Insurance premiums are often paid in advance, but the expense should be recognized over the period the insurance coverage applies.

For instance, a company might pay an annual premium in January for coverage extending through December. Rather than recording the entire expense in January, the business would allocate one-twelfth of the premium each month.

This ensures that the insurance cost reflects its actual benefit across the coverage period, aligning expenses with the relevant accounting periods.

When Should I use the Expense Recognition Principle?

The expense recognition principle is essential for any business using accrual accounting and aiming for GAAP compliance. It’s particularly valuable for companies needing:

- Transparent Financial Reports: Stakeholders and investors require accurate financial insights to make decisions.

- Precise Financial Analysis: Matching revenue and expenses provides a true view of a business’s profitability.

- GAAP Compliance: Publicly traded and large corporations are generally required to use accrual accounting.

Even for smaller businesses, using the expense recognition principle can provide better clarity and support growth through accurate reporting.

How Sage Expense Management (formerly Fyle) Can Simplify Expense Reporting

Sage Expense Management provides a comprehensive suite of tools designed to streamline expense management, reduce manual tracking, and ensure compliance with the expense recognition principle. Here’s how it can support your business:

Effortless Receipt Tracking

Users can submit receipts through Text, Gmail, Outlook, Slack, or directly on the mobile and web apps. Sage Expense Management extracts, codes, and tracks expense data in one place, eliminating the need for spreadsheets and reducing time spent on receipt management.

Real-Time Credit Card Expense Tracking

Users are notified of business credit card spending via text in real-time. With a quick photo submission, Sage Expense Management automatically extracts data and matches it to the right transaction, saving hours of manual work.

AI-Powered Compliance

Sage Expense Management’s AI checks if expenses align with preset business rules before submission, flagging potential fraud or duplicate entries automatically. It ensures compliance with features like automatic receipt attachment, cloud storage, and easy searchability.

Automated Approval Workflows

Managers can review and approve expenses directly through email, Slack, or the mobile app, thanks to configurable workflows.

Seamless Sync with Accounting Software

Sage Expense Management integrates with major platforms like QuickBooks Online, Xero, Sage Intacct, and NetSuite, ensuring that fully coded expense data syncs automatically.

In Conclusion

The expense recognition principle is vital for accurate financial reporting, helping businesses align expenses with revenue for a clear view of profitability. By following this principle, companies can maintain transparency, support growth, and comply with regulatory standards.

Tools like Sage Expense Management simplify this process by automating expense tracking, ensuring compliance, and integrating with accounting platforms, making it easier to follow the expense recognition principle and achieve consistent, accurate financial management.

Some Key Definitions Around Expense Recognition

What are Prepaid Expenses?

Prepaid expenses are costs paid in advance for goods or services that will be used in future periods. Common examples include prepaid insurance, rent, or subscriptions.

For instance, if a business pays $12,000 in January for a year’s rent, only $1,000 would be recognized as an expense each month, aligning with the period during which the space is used.

This ensures that prepaid expenses are systematically recognized over time rather than as a single expense upfront.

What Is Amortization?

Amortization is the process of gradually expensing the cost of an intangible asset over its useful life. Intangible assets, such as patents, copyrights, and trademarks, do not have physical substance but still hold value for a company.

For example, if a business purchases a patent for $100,000 with a useful life of 10 years, it would amortize $10,000 each year, reflecting the asset’s usage over time. This process mirrors depreciation but is specifically used for intangible assets.

What are Depreciation Expenses?

Depreciation is the allocation of a tangible asset's cost over its useful life, reflecting its gradual wear and tear.

For example, a company purchasing equipment for $50,000 with a 5-year useful life might recognize $10,000 as a depreciation expense each year.

This approach aligns with the matching principle, as the cost of the equipment is spread over the years it contributes to generating revenue. Depreciation methods can vary, with straight-line depreciation being the most straightforward and commonly used method.

What are Accured Expenses?

Accrued expenses represent costs that have been incurred but not yet paid by the end of an accounting period.

Examples include unpaid wages, utilities, or interest expenses. Suppose employees earn wages in December, but the company pays them in January. The company would record an accrued expense in December, matching the cost with the period in which the employees contributed to business operations.

Accrued expenses help ensure financial statements reflect a company’s actual obligations, even if payment is deferred.

What are Contingent Liabilities?

Contingent liabilities are potential obligations that depend on uncertain future events, such as lawsuits, environmental cleanup costs, or warranty claims. These liabilities are recorded only if it is probable that the event will occur and the amount can be reasonably estimated.

For instance, if a company is facing a lawsuit with a high likelihood of a settlement, it may record a contingent liability, thereby preparing for the financial impact.

Contingent liabilities ensure that financial statements account for risks, even when outcomes are uncertain.

What are Deferred Expenses?

Deferred expenses are costs that have been incurred but are recognized in later periods to match revenue generation.

For example, if a company pays for a two-year software license, the expense would be deferred and recognized gradually over the two years. This deferral aligns with the revenue the software contributes to over time, ensuring that expenses correspond with the periods they benefit.

Deferred expenses are common in scenarios where costs extend beyond a single accounting period.

What is the Matching Principle?

The matching principle is a cornerstone of accrual accounting, requiring that expenses be recorded in the same period as the revenue they support.

This principle ensures that financial statements provide an accurate reflection of profitability by showing the relationship between costs and revenue.

For instance, a business recognizing advertising expenses in the period they contribute to sales, rather than when the cash payment occurs, is applying the matching principle.

This principle is fundamental in preparing financial reports that comply with GAAP and provide meaningful insights into a company’s operations.