In today’s fast-paced business world, keeping track of your company’s expenses is crucial. Not only does it help in understanding where the money is going, but it also enables better financial planning, budgeting, and overall decision-making.

This is where expense analysis comes into play. Whether you run a small business or a large organization, knowing how to effectively analyze your business expenses can save you time, money, and resources.

What Is Expense Analysis?

Expense analysis is the process of reviewing and evaluating the costs incurred by a business over a certain period. It involves breaking down expenses into categories, identifying spending trends, and pinpointing areas where costs can be reduced or better managed.

For instance, imagine you run a small retail store. By conducting an expense analysis, you may find that a large portion of your budget is going toward shipping costs. With that insight, you can explore alternatives like renegotiating shipping contracts or finding more affordable suppliers.

Key Components Of An Expense Analysis

Some key components of an expense analysis include:

- Categorization of Expenses: Breaking down costs into categories like operational, fixed, and variable expenses.

- Trend Analysis: Identifying patterns in spending to help forecast and manage future expenses.

- Comparison with Benchmarks: Comparing expenses to industry averages or internal benchmarks to assess if spending is excessive.

Why Is Expense Analysis Important for Your Business?

Expense analysis helps businesses stay on top of their financial health. By understanding where your money is going, you can make informed decisions about cost-cutting, budgeting, and improving operational efficiency.

How Does Expense Analysis Impact Cash Flow And Profitability?

Regular expense analysis ensures that cash flow is stable and profitability is maximized. By pinpointing areas where costs can be reduced, businesses can prevent cash shortages and ensure they have enough working capital to meet their needs.

What Are The Risks Of Not Conducting Regular Expense Analysis?

Some risks of not conducting regular expense analysis are:

- Overspending in certain areas, leading to unnecessary depletion of resources.

- Missed opportunities for cost-saving measures.

- Cash flow issues that can harm day-to-day operations.

What Business Expenses Should You Track?

Tracking the right expenses is crucial for accurate analysis. Common categories include:

- Fixed Expenses: Costs that remain constant over time, such as rent, salaries, and insurance.

- Variable Expenses: Necessary costs to keep the business running, including maintenance and office supplies.

- Non-Operating Expenses: These include interest on loans and legal fees, which aren’t directly tied to core business operations.

Which Expenses Are Tax-Deductible?

Expenses like office supplies, travel costs, employee benefits, and certain operational expenses can typically be deducted from taxable income, depending on tax regulations.

Also Read:

How to Analyze Your Business Expenses?

- Gather Data: Collect all your expense records, such as invoices, receipts, and bank statements.

- Categorize Expenses: Break them down into categories like operational, fixed, or variable costs.

- Look for Patterns: Analyze trends and fluctuations. Are certain expenses rising over time? Are there periods of higher spending?

- Compare to Budget: See if actual expenses match your projected budget and adjust accordingly.

Too much work? See how Sage Expense Management's CoPilot can automate the entire process!

How to Perform an Expense Analysis On Your Income Statement?

The income statement (or profit and loss statement) is a crucial tool for expense analysis. Here’s how to approach it:

- Revenue vs. Expenses: Start by comparing total revenue to total expenses. Are you spending more than you’re earning?

- Identifying Key Ratios: Calculate ratios like the expense ratio (total expenses divided by total revenue) to understand what percentage of income is being consumed by expenses.

- Monitor Changes: Compare expenses over different periods to highlight trends, such as rising costs in specific areas.

What Metrics Should You Focus On When Analyzing Expenses?

Expense Ratio

The expense ratio shows how much of your revenue is consumed by expenses. A higher expense ratio could signal the need to cut costs or increase revenue.

Expense Ratio = (Total Expenses / Total Revenue) x 100

Cost-per-Unit

Cost-per-unit helps businesses that produce goods assess how efficiently they’re operating. This metric tells you the average cost to produce a single product unit.

Cost Per Unit = Total Production Costs / Number of Units Produced

Comparing Expenses to Industry Averages

To determine whether your expenses align with industry standards, compare your expense ratios and cost-per-unit calculations to industry benchmarks.

There’s no specific formula here, but the process involves gathering industry data and calculating your metrics (like the expense ratio and cost-per-unit), then comparing them to those of similar companies. If your expenses are significantly higher, it may signal inefficiencies or missed cost-saving opportunities.

How Does an Expense Analysis Help Businesses?

Expense analysis helps businesses in multiple ways, such as:

- Contributing to Better Decision-Making: By identifying which areas are consuming the most resources, businesses can make informed decisions about where to cut costs or allocate more funds.

- Reduce Wasteful Spending: Regular analysis can highlight unnecessary or redundant expenses that can be trimmed.

- Improving Profitability: By controlling expenses, businesses can increase their profit margins without growing revenue.

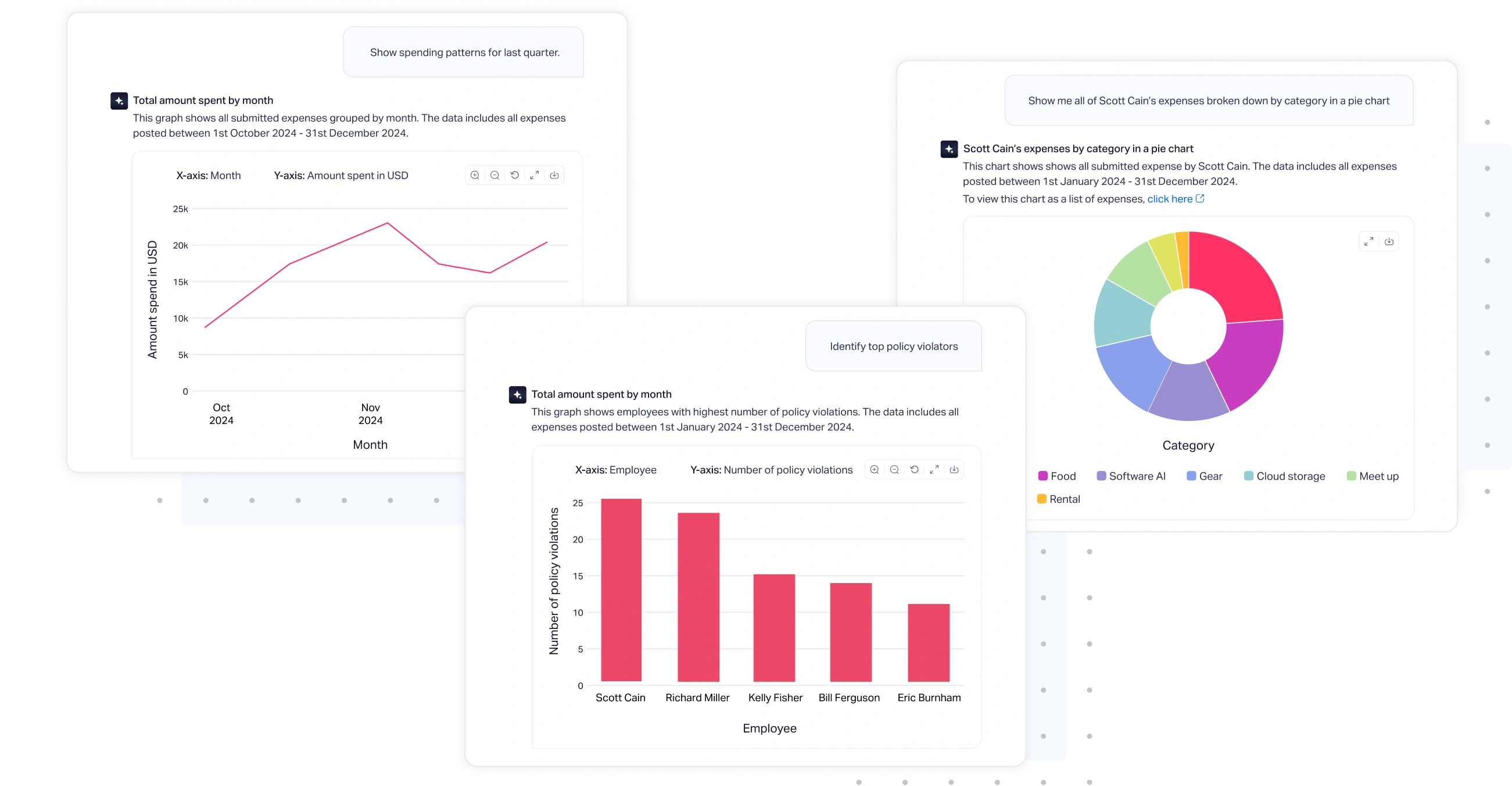

How Sage Expense Management's CoPilot Automates Expense Analysis

Sage Expense Management's CoPilot offers a powerful, AI-driven solution for businesses looking to automate and optimize their expense analysis process. Here’s how it helps:

- Instant AI Insights from Real-Time Spend Data: It directly integrates with credit card networks like Visa and Mastercard, so CoPilot provides instant analysis of transactions as they are logged, giving you immediate insights.

- AI-Enhanced Detailed Spend Breakdown: Sage Expense Management CoPilot allows you to analyze expenses based on various factors like merchant, department, and project, using simple conversational queries to see exactly where money is going with AI-driven analysis.

- Advanced AI-Powered Reporting: CoPilot goes beyond basic tracking, offering intelligent insights to guide your decision-making. Compare spending patterns over different periods, understand which areas are driving up costs, and take action accordingly, all through natural language questions.

- AI-Driven Risk Management: CoPilot helps you stay on top of policy violators and big spenders, flagging violations before they become costly problems with AI-powered alerts and analysis.

- AI-Assisted Budget Control: Real-time budget data allows you to track spending against allocated budgets, helping you forecast and maintain control over expenses with intelligent insights and recommendations from CoPilot.

In Conclusion

Expense analysis is a crucial practice for any business looking to manage its finances effectively. By regularly reviewing and optimizing your expenses, you can gain better control over your cash flow, make informed decisions, and improve overall profitability.

With tools like Sage Expense Management, automating and simplifying this process is easier than ever, allowing you to focus on what really matters: growing your business.