In this guide, we'll break down the crucial IRS rules, provide clear examples of what you can and can't deduct, and give you actionable tips for a seamless expense management process that saves you money and headaches.

What Are Business Expenses?

According to the IRS, business expenses are ordinary and necessary costs you pay to run your business. All businesses, from mom-and-pop stores to giant organizations, record their business expenses year-round for tax purposes.

Some examples of business expenses include payroll, rent, insurance, gas for office vehicles, office supplies, and sales commissions.

- Fixed vs. Variable Expenses: Some expenses, like your monthly rent or insurance premiums, tend to stay steady, making them fixed expenses. In contrast, costs like sales commissions or travel for business can fluctuate, classifying them as variable expenses.

- The Power of Tracking: Keeping a close eye on your expenses is about more than just staying solvent. It's about unlocking valuable insights that can reveal your true profit potential, allow you to fine-tune spending, and, most importantly, help you accurately calculate your taxable income.

It's simple: subtract your business expenses from your revenue, and that’s a key step in arriving at your organization’s net taxable income.

IRS Business Expenses Definition

The guidelines for business expenses are detailed under Section 162 of the Internal Revenue Code.

It states here that, all ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business shall be allowed as deductions. These deductions encompass the following:

- Reasonable compensation: A fair salary allowance or other compensation for services demonstrably rendered by individuals.

- Travel expenses: Costs incurred while away from the taxpayer's customary place of residence in pursuit of business, including reasonable expenditures for meals and lodging. However, such expenditures must not be deemed lavish or extravagant under the prevailing circumstances.

- Rental payments and similar charges: Rentals or other payments mandated for the continued use or possession of property employed in the trade or business, where the taxpayer does not hold or acquire title or equity in the property.

What Are Ordinary And Necessary Business Expenses?

The IRS's definition hinges on these two key terms:

- Ordinary: An ordinary expense is something that is common and accepted for other businesses in your industry. For example, paying rent for an office is an ordinary expense for a consulting firm.

- Necessary: A necessary expense doesn't mean it's absolutely essential. Instead, it signifies that the expense is appropriate and helpful for your business operations. A marketing campaign is a necessary expense because it's appropriate and helpful for attracting customers, even if the business could theoretically survive without it.

Any expense that meets this "ordinary and necessary" definition can be expensed and is therefore tax-deductible.

Some examples of ordinary and necessary expenses

- Salaries paid to employees: Ordinary (common in most businesses) and necessary (essential for operations).

- Travel expenses for business trips: Ordinary ( for businesses with employees traveling) and necessary (contributes to conducting business).

- Rent for office space: Ordinary ( for businesses needing physical space) and necessary (essential for operations).

Any expense that meets this definition of ordinary and necessary for business use can be expensed and is therefore tax-deductible.

What are Tax Deductible Business Expenses?

A tax-deductible business expense is any cost a company incurs that can be deducted from its taxable income, ultimately lowering its tax obligation. These expenses must be ordinary, necessary, and justifiable for the business's operations to qualify.

Business Expenses That Are Tax Deductible

- Advertising and Marketing: Costs associated with promoting your business and attracting customers.

- Bank Fees and Interest: Charges incurred for business-related banking activities, like loan interest.

- Business Mileage: Expenses for using your personal vehicle for business purposes, calculated by standard mileage rate or actual expenses method.

- Commissions: Payments made to sales representatives or other individuals based on their performance.

- Educational Expenses: Training and development costs for employees relevant to their job functions.

- Employee Benefits: Health insurance, retirement plans, and other employee benefits.

- Equipment Maintenance and Repair: Upkeep and repair of equipment used in your business operations.

- Furniture: Furniture costs used exclusively for business purposes in your office or workspace.

- Home Office (with specific requirements): A portion of your home expenses if you have a dedicated and regular workspace.

- Insurance: Premiums for various business insurance policies.

- Membership Dues: Fees for professional organizations or associations directly related to your business.

- Legal Fees: Costs associated with legal services for your business operations.

- Office Supplies and Equipment: Essential supplies and equipment used for daily business activities.

- Payroll: Salaries, wages, and taxes paid to employees and contractors.

- Rent or Office Lease: Payments for the space where your business operates, including rent or mortgage interest.

- Software: Costs associated with software programs used for business purposes.

- Some Business Travel Costs: Meals, lodging, and transportation expenses incurred during approved business trips.

- Utilities: Costs for utilities like electricity, water, and internet at your business location.

The kinds of expenses that can be written off will vary depending on the nature of your business. Start by reviewing IRS Publication 535, which details the deductibility of business expenses and all the other rules around tax filing.

Furthermore, the IRS also recommends distinguishing between usual business expenses and other categories, such as Cost of Goods Sold (COGS) and capital expenses, to ensure accuracy, as some expenses cannot be deducted in the year they are incurred.

Examples of Non-Deductible Business Expenses

While it may seem like almost everything is deductible, there are some clear lines drawn by the IRS. Getting this wrong can lead to serious tax trouble.

- Personal Expenses: Most personal, living, and family expenses don't qualify for tax deductions. If an expense has both business and personal aspects, you must split the cost. Only the "business portion" is tax-deductible. For example, if you use a phone 70% of the time for business and 30% for personal calls, you can only deduct 70% of the cost.

- Unethical Expenses: The IRS does not allow deductions for bribes, kickbacks, or fines for violating the law. Basically, you can't deduct the cost of doing something illegal or unethical.

- Entertainment Costs: As a general rule, entertainment expenses are non-deductible. This includes expenses for events like a concert or a sporting event, even if they have a business purpose.

- Luxury Spending: The IRS explicitly states that expenses must not be "lavish or extravagant." While you can stay at a hotel for a business trip, a wildly expensive penthouse suite would likely be deemed non-deductible.

- Political and Social Contributions: Contributions to political campaigns and fees for social clubs are generally not deductible as business expenses.

- Demolition Expenses or Losses: The cost of tearing down a structure is typically not deductible. Instead, those costs are added to the land's value on your books.

- Penalties and Fines: Fines for violating any law, such as underpaying taxes or getting a parking ticket, are non-deductible. The IRS wants you to learn your lesson, not claim it as an expense on your return.

- Interest on Income Tax: While interest on a business loan is deductible, the interest charged on your business's income tax itself is not considered a business expense—so keep that separate when filing.

- Prepayment: Tax rules don't reward early birds. Expenses like prepaid interest or insurance premiums must be deducted over the time you actually benefit from the service or asset. You cannot deduct the entire amount in the year you paid it.

Important Expense Categories for Tax Reporting

Your income statement is the primary statement used to record your expenses and determine your taxable income. It shows a picture of your organization’s revenue and expenses over a given period of time. It’s broken down into the following categories:

Cost of Goods Sold

If your business creates or buys products for resale, keeping track of your inventory's value is crucial for tax purposes. This process involves valuing your inventory at the start and end of each tax year to determine your cost of goods sold (COGS).

Consider COGS as the total cost of acquiring or making the products you sell. Certain business expenses directly related to your inventory are included in this calculation.

Remember, COGS is deducted from your total sales to reach your gross profit. So, any expense included in COGS cannot be claimed again as a separate business expense.

What goes into COGS?

Direct Costs

- Purchase price of products or raw materials (including shipping)

- Storage fees

- Direct labor costs (including employee benefits) involved in production

- Factory overhead (including certain indirect costs under specific rules)

Indirect Costs (partially included in COGS under specific rules)

- Rent, interest, taxes

- Storage, purchasing, processing, repackaging, handling

- Administrative costs

Depreciation

Depreciation is the recovery of the cost of a property over a number of years. You can deduct a part of the cost each year till you recover the full amount.

Section 179 allows you to deduct a portion of the cost of certain new business equipment in the year you purchased it instead of spreading the deduction over several years. There's a limit to how much you can deduct, but it's a great way to reduce your tax bill immediately.

Here's the catch: the deduction is capped by your taxable income from active business activities. So, this benefit may not be as impactful if your business is new or has low income.

What Kind of Property Can I Depreciate?

The kinds of property that you can depreciate typically include buildings, vehicles, furniture, machinery, and equipment. You can’t claim depreciation on any property held for personal use.

If you use property like a car for both business and personal use, you can only depreciate the business use portion. Land, on the other hand, is never depreciable, however building and certain land improvements may be.

Here’s a quick checklist to determine if you can depreciate property:

- Ownership: The equipment must be yours - rentals or leased items don't qualify.

- Business Use: It must be actively used in your business or generate income for you.

- Finite Lifespan: It needs a predictable "lifespan" - how long it's expected to function effectively.

- Long-Term Asset: It must be used for over a year to qualify for depreciation.

- Not Excluded: Check if it falls under "excepted property" (like land, some software, or short-term equipment) listed in Publication 946. These are generally ineligible for depreciation.

Gifts, Meals, and Entertainment Costs

Gifts

$25 limit. Businesses can deduct a maximum of $25 per person annually for gifts directly or indirectly provided during the tax year.

Meals

Businesses can deduct up to 50% of the cost of business meals where an employee or the taxpayer themselves is present, provided the food and beverages are not deemed lavish or extravagant. These meals can be provided to current or potential customers, clients, consultants, or other relevant business contacts.

Does the 50% limit apply to your expenses?

The 50% deduction for business meals applies to different parties depending on who pays and reimburses:

- Employees: If employees pay for business meals themselves, they can deduct 50% of the cost. If their employer reimburses the expenses, then the employer can deduct 50%.

- Self-employed: If you're self-employed (including independent contractors), you can deduct 50% of the cost of business meals directly.

What Counts As a Business Meal?

Here are some examples:

- While traveling on business: Meals eaten alone or with others during a business trip are eligible, as long as the trip itself meets business travel requirements.

- Business conferences or meetings: Meals provided at official business conventions or league meetings can be partially deducted.

Now, there are exceptions to these rules. See Exceptions to the 50% Limit for Meals (Page 17)

Entertainment

In general, entertainment expenses come under non-deductible business expenses. However, there are some exceptions to this rule:

- Employee Compensation: If you treat entertainment expenses as part of your employee's wages (reported on their W-2s), you can deduct them as compensation costs.

- Employee Events: Certain recreational activities for employees, like company picnics or holiday parties, are deductible within specific limits.

- Business Meetings and Conventions: Expenses associated with attending qualified business meetings or conventions held by exempt organizations like business leagues, chambers of commerce, or professional associations are deductible.

- Entertainment Sold to Customers: If your business directly provides entertainment as a product or service (e.g., a nightclub with a live show), the associated costs are deductible.

Important Note: These exceptions have their own rules and limitations. Always consult a tax professional to ensure your deductions comply with regulations.

How To Keep Track Business Expenses?

Staying on top of business expenses, deductible or otherwise, is crucial for your financial health. Here's a system to simplify the process:

Separate Your Finances

Open a dedicated business bank account. This creates a clear distinction between personal and business spending, making expense tracking a breeze.

Capture Receipts Electronically

Ditch the paper and snap photos of receipts using your phone. Store them securely in the cloud. While you have the receipt in hand, jot down the business purpose for the expense. Consistency is key: keep the receipt image and its explanation in the same place for easy reference.

Consolidate and Reimburse

At least once a month, compile an expense report. Include key details like purchase date, receipt (image!), purpose, expense category, and vendor. This report simplifies expense reimbursements for you.

Integrate with Accounting

Don't let expense data languish. Input it into your accounting software as soon as possible. This empowers you to make informed financial decisions based on real-time expense insights.

Gain Control of Your Cash Flow

Up-to-date expense tracking reveals your financial reality. Are you sitting on a surplus for potential investments? Or do you need to temporarily tighten spending to stay on budget?

Simplify and Share

Once you've established a system that works, document the steps and share them with your team. This fosters consistency and reduces administrative burden.

Tips For Better Expense Tracking

Managing business expenses can be a tedious task, but neglecting it can significantly impact your tax liability. Here are some strategies to streamline your expense management process:

1. Keep Detailed Records (The IRS Demands It)

It’s a simple rule of thumb: if you’re in doubt, just keep it. Receipts and other documentation of your business expenses are useful when you’re audited.

What Kind Of Records Should I Keep?

Pick any record-keeping system that works for you, as long as it clearly tracks both your income and expenses. The specific records you need for taxes depend on your industry, but they should all roll up into a clear summary of your business transactions.

The following are some of the types of records you should keep:

Gross Receipts

The income you receive from your business. Ensure you keep supporting documentation that show the amount and source of your receipts. Documents here include the following:

- Deposit information

- Cash register tapes

- Receipt books

- Invoices

- Forms 1099-MISC

Expenses

The costs you incur to carry on your business. To qualify for tax deductions, your business expenses must be supported by proper documentation. Each document must clearly show:

- Who you paid: The name and contact information of the recipient.

- How much you paid: The exact amount of the expense.

- When you paid: The date the expense was incurred.

- What you paid for: A detailed description of the item or service purchased.

- Proof of payment: Documentation that verifies the transaction, such as canceled checks or bank statements reflecting electronic transfers, cash register receipts, invoices, or credit card receipts and statements.

For more information, read IRS Small Business and Self-Employed: What Kind Of Records Should I Keep?

How Long Should I Keep Records?

The IRS states that the length of time for which a document should be kept depends on the action, expense, or event that the document records.

As a general rule, you should ensure that any record that supports an item of income, deduction, or credit shown on your tax return is kept till the period of limitations for that return runs out.

The "period of limitations" defines when you can amend your tax return to claim a refund or credit, or the IRS can assess additional tax owed.

Period of Limitations That Apply to Income Tax Returns

In most cases, hold onto documents for 3 years from the date you filed your return (or the due date, whichever is later). This covers most situations.

Exceptions

- Filed for a refund or credit? Keep records for 3 years from the filing date or 2 years from the payment date, whichever is later.

- Claimed a loss from bad debt or worthless securities? Extend your record-keeping to 7 years.

- Missed reporting more than 25% of your income? Hold onto records for 6 years.

- Didn't file a return at all? You'll need to keep your records indefinitely.

- Filed a fraudulent return? Unfortunately, you're stuck keeping those records forever too.

Employment tax records: Keep these for at least 4 years after the tax becomes due or is paid, whichever is later.

For more information, read IRS Small Business and Self-Employed: How Long Should I Keep Records?

2. Ensure Personal And Business Expenses Are Separate

Quite often, folks ask the following question:

As a sole proprietor who utilizes their business bank account for personal expenses, should I report those expenditures as business income? Additionally, can I deduct them as business expenses on my tax return?

Here’s what the IRS has to say about this:

- You can include the money used to pay personal expenses in your business income when your business earned it.

- You wouldn’t write off these expenses as business expenses as they’re not ordinary and necessary costs for carrying on your business.

- Generally, personal, living, or family expenses are not deductible.

- Keeping separate bank accounts for your business and personal finances is recommended. This ensures clear records and simplifies tracking income and expenses.

3. Monitor And Review Your Expenses Regularly

Reviewing your expenses regularly can ensure you’re ready to spot potential risks, instances of overspending, fraud, and other operational inefficiencies. Some accountants often practice double-entry bookkeeping to catch expense errors and prevent fraud.

Track Business Expenses with an Expense Management Software

Tracking business expenses is crucial for lowering your tax liability, but should you really spare time for endless paperwork and manual data entry?

At Sage Expense Management, we believe expense management is nobody’s primary job, and ideally, no one should have to spend a second managing their business expenses. Here’s how we’re trying to achieve this:

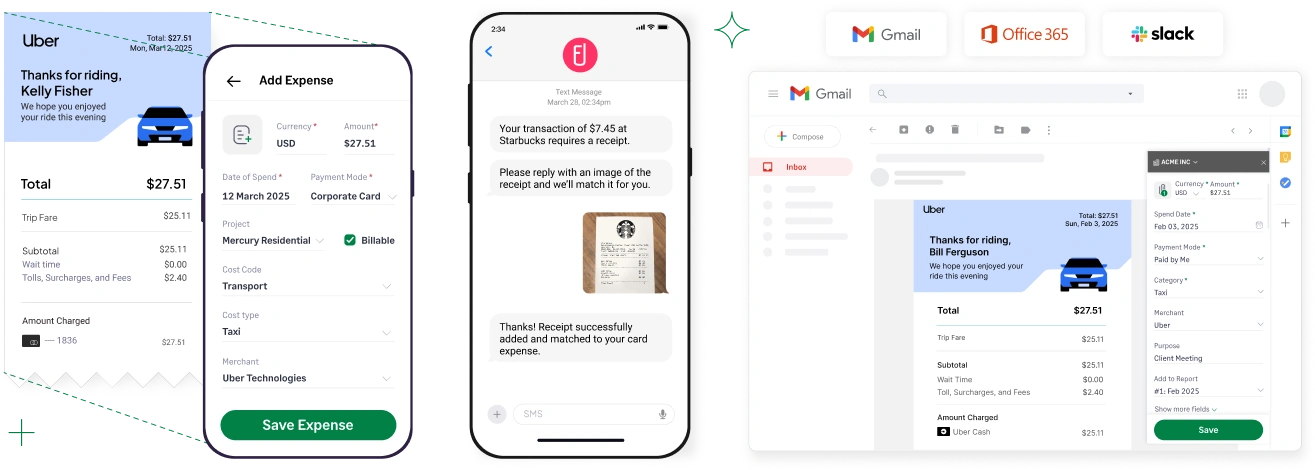

Instant Transaction Alerts and Automated Credit Card Reconciliation

Sage Expense Management integrates directly with all major credit card networks. Get instant transaction notifications each time your business card is swiped. Just click a picture of the receipt and send it to us via text message, and we will auto-match it to the correct card transaction.

Or, simply text Sage Expense Management a picture of the receipt, and it will be auto-matched when the card data flows in. This means you no longer have to wait for bank statements to arrive or chase employees for receipts.

Receipt Collection Via Other Everyday Apps

Sage Expense Management lets you submit receipts straight from your favorite apps – Slack, Gmail, Outlook, Teams, or even our mobile app. What’s more, it automatically extracts key information and automatically assigns expenses to their relevant categories.

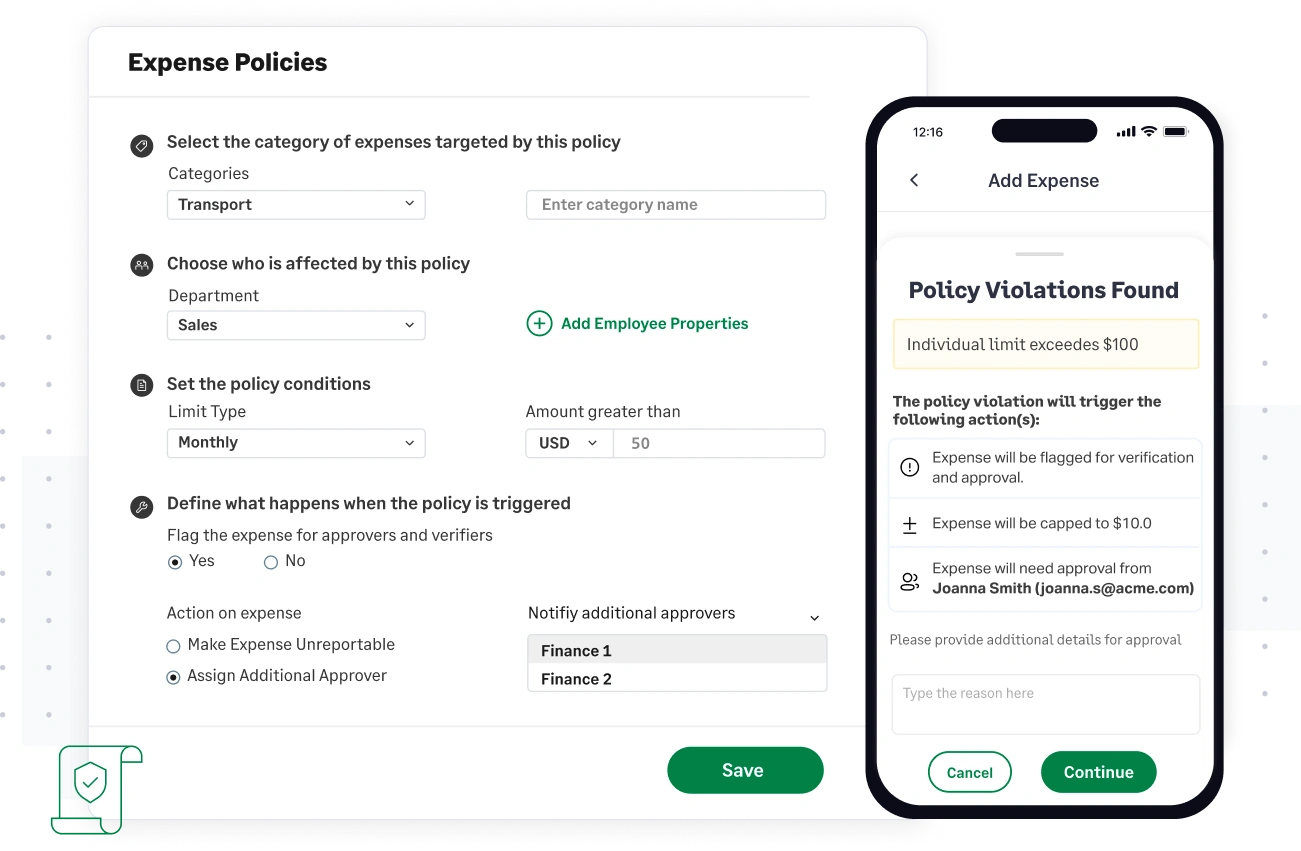

Automated Compliance

Sage Expense Management keeps your organization compliant with real-time policy checks that prevent expense violations before submission. Additionally, its duplicate detection and merge module identifies and automatically flags potential duplicates, saving time and ensuring accuracy.

In Conclusion

Navigating the ordinary and necessary landscape of business expenses can feel like a tax season obstacle course. But it needn’t be anymore.

Sage Expense Management can simplify your business expense management by automatically categorizing, capturing receipts, and flagging policy violations, ensuring your tax reporting is accurate and stress-free.

Ditch the stress, embrace the efficiency, and let Sage Expense Management be your tax season hero. Sign up today for a demo and experience the difference!

.webp)

%20-%20Main.webp)