Expense fraud is a serious issue for businesses, with surveys reporting numerous employees admitting to submitting false expense claims.

In fact, the Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of their revenue to expense fraud annually, with a median loss of $145,000 per incident. The longer fraud goes undetected, the greater the financial damage to a business.

In light of these facts, tackling the problem of employee expense fraud should be a priority for any business looking to streamline its processes and reduce costs.

This blog covers everything you need to know to get started on your journey to eliminating expense fraud from your company.

What is Expense Fraud?

Expense fraud, also called expense fiddling or expense reimbursement scheme, refers to the falsification or manipulation of expenses to receive reimbursement or to avoid paying out of pocket. It is considered unethical and illegal in many businesses as it is a form of financial fraud.

Economic conditions in 2024 have only heightened the risk of fraud. With inflation and higher interest rates squeezing household budgets, financial stress among employees is increasing.

According to the Federal Reserve Bank of New York, U.S. credit card debt grew to over $1.13 trillion in Q4 2023, an increase of over $50 billion. This rising debt burden increases the risk of employees turning to expense fraud for financial relief.

Common Types of Expense Fraud

Mischaracterized Expenses

Personal expenses, such as meals or mileage, are submitted as business expenses.

Fictitious Expenses

Employees submit false receipts or invoices to support claims.

Overstated Expenses

Employees inflate the costs of legitimate expenses, such as hotel stays or meals, in their reports.

Duplicate Submissions

Submitting the same receipt multiple times for reimbursement.

Misuse of Company Funds

Using a company credit card for personal purchases.

Mileage Falsification

Employees overstate the distance traveled or the mode of transportation used.

It's worth noting that these examples of grave misconduct are considered illegal. Employees should always follow the company's expense policy and guidelines to avoid repercussions.

Why do Employees Commit Expense Fraud?

Employees may commit expense fraud for many reasons, including financial gain, personal gain, or a lack of understanding of company policies and procedures.

- Financial gain: Some employees commit fraud for personal financial benefit. The rising debt levels and financial pressures in 2024, as seen with over $1.13 trillion in U.S. credit card debt, exacerbate this issue. Employees under financial stress are more likely to attempt fraudulent activities to alleviate their personal financial burdens.

- Lack of understanding: Some employees may not fully understand company policies and procedures for expense claims. They may make mistakes or submit inaccurate expenses without realizing it.

- Pressure and Stress: Some employees may feel pressure to meet targets or quotas and may falsify expenses to make it appear that they have met them.

- Apathy or Disengagement: Some employees may feel apathetic towards the company and engage in expense fraud as a form of passive rebellion or disregard for the rules.

Always remember that these reasons are not excuses for committing employee expense fraud; it is not justifiable at all.

Impact of Expense Fraud on Businesses

Expense fraud can have severe financial and reputational consequences for businesses. According to ACFE, about 20% of expense fraud cases result in a $1 million loss.

Moreover, expense fraud can damage employee morale and erode trust within the company, while the public disclosure of such issues can lead to a decline in stock value.

Additionally, in 2023, Oversight reported a 50% increase in expense reimbursement and purchase card violations, reflecting a troubling trend as economic conditions worsened.

Also read:

6 Ways Businesses Can Prevent Expense Fraud

As a business, you can prevent expense fraud in your organization by practicing the following:

Create a Clear and Comprehensive Expense Policy

Having a well-defined expense policy is the first step to preventing fraud. A policy that clearly outlines what qualifies as a reimbursable expense, documentation requirements, and approval processes can reduce the risk of fraud. Regularly update the policy to reflect changes in business needs or compliance regulations and ensure it’s easily accessible to all employees.

Regular Employee Training

Regular training to employees on the company’s expense policies ensures they know what constitutes acceptable expense submissions. This training should highlight the consequences of submitting fraudulent claims and demonstrate how to submit accurate expense reports.

Conduct Regular Expense Audit

Regular expense audits can effectively prevent employee expense fraud by identifying discrepancies or misconduct patterns. Here are some steps for conducting a regular expense audit:

- Develop an audit plan: Create a plan that outlines the scope of the audit, the specific areas of focus, and the schedule for conducting the audit.

- Gather and review expense reports: Collect all expense reports for a specific period and review them for compliance with the company's expense policy. Look for any red flags: missing or incomplete documentation, duplicate expenses, or excessive or unreasonable expenses.

- Verify expense documentation: Verify that all expenses have proper documentation, such as original receipts, invoices, and detailed descriptions. Check that the documentation complies with the company's policy.

- Perform data analysis: Use data analysis techniques like trend analysis and statistical sampling to identify patterns or irregularities that may indicate expense fraud.

- Communicate findings and recommendations: Prepare a report of the audit findings and recommendations for improvement and communicate it to the appropriate parties, such as management and/or the board of directors.

- Follow-up: Follow up on any recommendations made during the audit and ensure that any issues identified are resolved.

- Schedule and plan for future audits: schedule the next audit based on the findings of the current audit and plan for it accordingly.

As with the company policy, the expense audit process should align with the company's culture and values. In addition, the audit process must be confidential and impartial to ensure the integrity of the findings.

Establish Guidelines for Processing Erring Employees

Establishing guidelines for processing employees who commit expense fraud is vital in preventing and addressing misconduct. Below are some steps for establishing the guidelines to prevent employee expense fraud:

- Clearly define expense fraud: Clearly define employee expense fraud in the company's expense policy, including examples of misconduct such as falsifying expenses, inflating expenses, or misclassifying expenses.

- Establish disciplinary action: Establish clear and consistent disciplinary action for employees who commit expense fraud. This should include a range of penalties based on the severity of the misconduct, such as verbal or written warnings, suspension, demotion, or termination. Having clear and well-communicated disciplinary action for violators of the expense policy can help deter employees from committing expense fraud and create a culture of compliance.

- Communicate the guidelines: Communicate the guidelines to all employees through regular training and education and by making the expense policy readily available to all employees.

- Have a reporting mechanism: Establish a mechanism for employees to report any suspected expense fraud, such as a hotline or an email address, and ensure it's easily accessible and well-communicated.

- Conduct investigations: Have a process for conducting investigations into any reports of employee expense fraud, and ensure that investigations are conducted confidentially and impartially.

- Have a post-investigation process: Establish a process for handling the outcome of investigations, including disciplinary action and measures to prevent a recurrence.

- Review and update: Regularly review and update the guidelines to ensure they remain relevant and effective.

Remember that these guidelines should be consistent with legal and regulatory requirements. The main goal is to create a culture of compliance and integrity within the organization.

Implement Strong Internal Controls

Internal controls, such as requiring multi-level approvals for large expenses, can help prevent fraudulent claims. Additionally, setting clear consequences for those caught committing fraud will deter other employees from following suit.

Also Read:

Regularly Review Credit Card and Mileage Logs

For businesses that provide employees with company credit cards or travel reimbursement, regularly reviewing these expenses can reveal any anomalies. Compare credit card statements to submitted reports and ensure that mileage logs are accurate and reasonable based on travel.

Also Read:

How Sage Expense Management (Formerly Fyle)Can Help Prevent Expense Fraud

An expense management software like Sage Expense Management can play a powerful role in preventing employee expense fraud by automating the reporting and reimbursement process, making falsifying or manipulating expenses near impossible. It helps businesses ensures greater compliance and accuracy while streamlining their expense management processes. Here’s how:

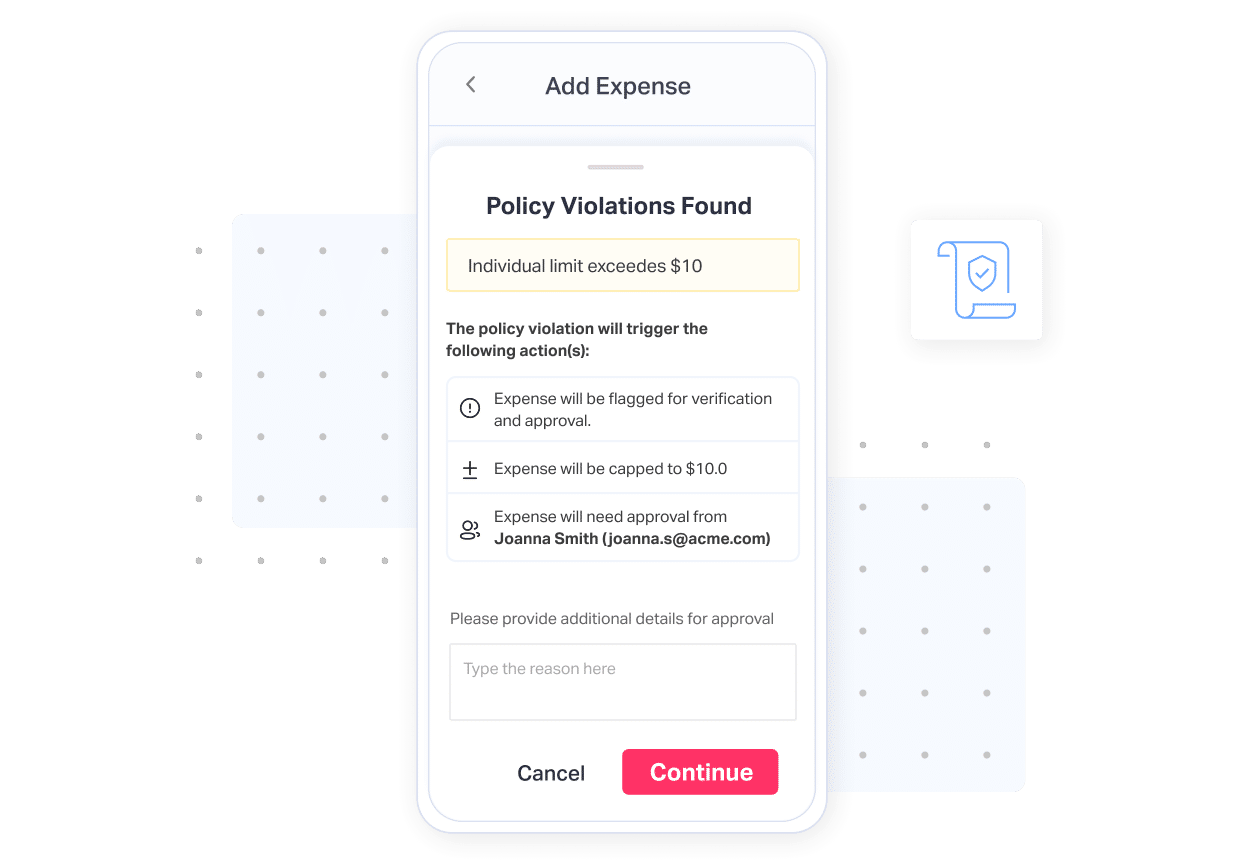

- Automated expense reporting: It allows employees to submit expenses electronically, ensuring that every submission is immediately checked for compliance with company policies. This real-time compliance check ensures that potential violations are caught before expenses are submitted.

- Electronic receipt capture: Employees can capture and submit receipts electronically, reducing the chances of receipt falsification or manipulation. A centralized cloud system stores all receipts in one place, making it easier for finance teams to access them during audits and preventing employees from submitting the same receipt multiple times.

- AI-Driven Data Analysis and Instant Monitoring: CoPilot can enable you to identify patterns or anomalies in company-wide spending that may indicate fraudulent activity, with AI-driven analysis. Additionally, instant monitoring systems notify management of any suspicious activity or policy violations as soon as they occur, delivered through CoPilot's intelligent alerts.

- Approval workflows: Custom approval workflows can be set up based on the size or nature of the expense, ensuring that expenses are reviewed and approved by managers or supervisors with the appropriate level of authority. Flagged expenses that violate company policies are sent to specific finance team members for further review.

- Integration with other systems: It integrates with other systems, such as accounting, ERP, or scheduling apps, ensuring data consistency and accuracy across the organization.

- Advanced security features: To safeguard sensitive financial data, Sage Expense Management includes encryption, multi-factor authentication, and access controls, minimizing the risk of unauthorized access to expense reports and sensitive company information.

- Detailed audit trails: Digital audit trails document all actions taken on an expense report, from submission to approval. This feature ensures that finance teams can track every interaction with an expense, giving them full visibility before any expenses are approved.

ACFE Checklist: Assessing Expense Fraud Prevention Effectiveness (Bonus)

The Association of Certified Fraud Examiners (ACFE) devised a checklist of questions in their 2018 report that organizations can use to assess the effectiveness of their fraud prevention measures. Consider the following questions to evaluate how well your company can prevent fraud:

- Has ongoing anti-fraud training been provided to all employees?

- Does your organization have an effective fraud reporting mechanism?

- Are fraud detection mechanisms communicated regularly to increase employees’ perception of detection?

- Has top management established a tone of honesty and integrity?

- Are random fraud risk assessments conducted to identify company vulnerabilities?

- Do internal auditors have the freedom and resources to act independently of senior management?

- Does HR conduct thorough background checks, including civil, criminal, and credit checks?

- Are employee support programs in place to assist with addiction or emotional health issues?

- Do you conduct regular, anonymous surveys to assess employee morale?

Implementing this checklist as part of your organization's fraud prevention framework will help ensure expense fraud does not become ingrained in the company culture. While technology can assist in detection, these human-centered strategies play a crucial role in fostering transparency and discouraging fraud.